SuMi's Coffee Break Column

Japan is Short of Manpower Across Various Industries

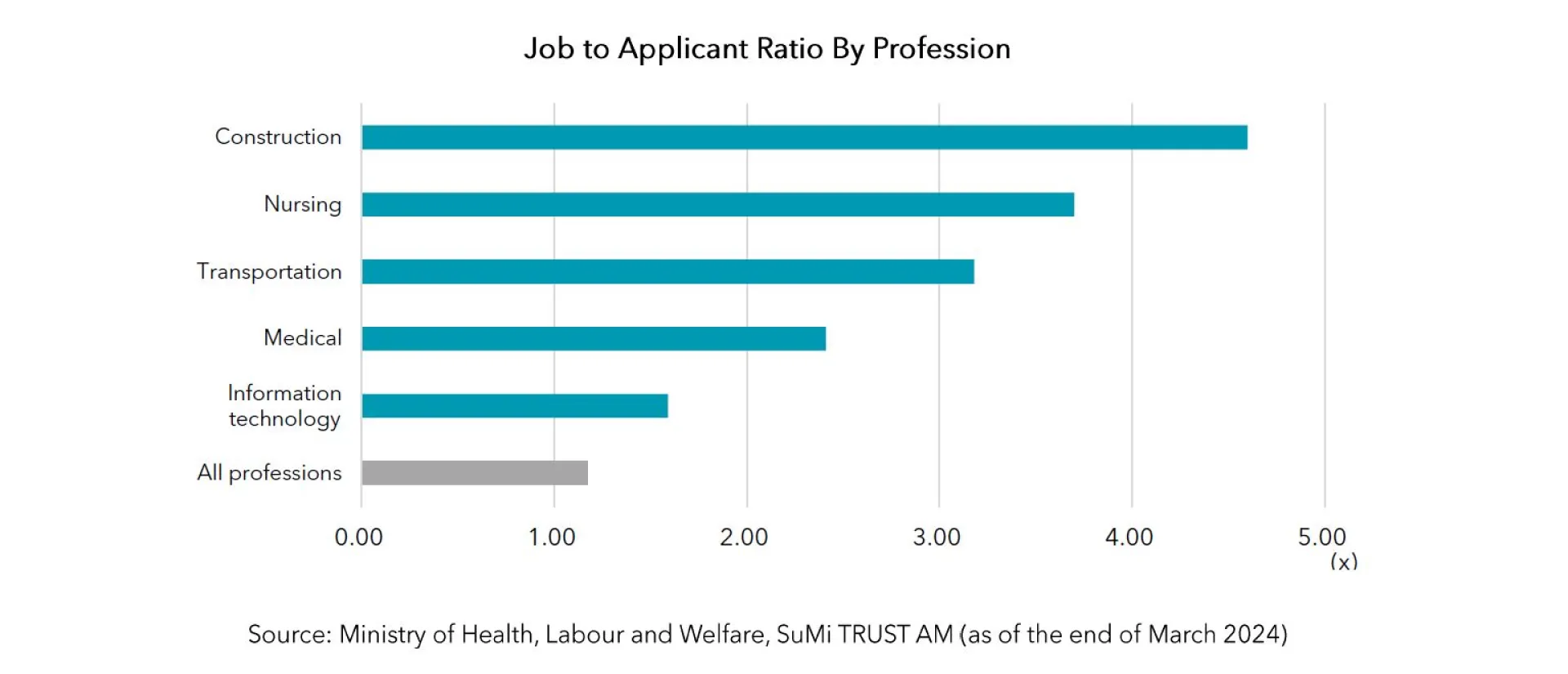

Japan's logistics industry is currently reeling from the so-called ‘2024 problem’. In April of this year, the government imposed stricter overtime limits for drivers. Due to the shortage of trucks and drivers, there is concern that deliveries may be delayed. With driver shortages now a chronic issue, some estimate that trucking capacity will fall short by 34% by the year 2030.[1] The ‘2024 problem’ is symbolic of a Japanese society plagued by labour shortages caused by a declining birth rate and ageing population. In fact, there is also a mismatch of human resources, which means that there is a skew toward shortages in different industries and occupations. Industries with particularly acute shortages include medical and nursing care, IT services, inns and hotels, construction, and logistics. These industries do not have an adequate workforce despite increasing demand due to social changes.

Society-wide Measures to Address Labour Shortages

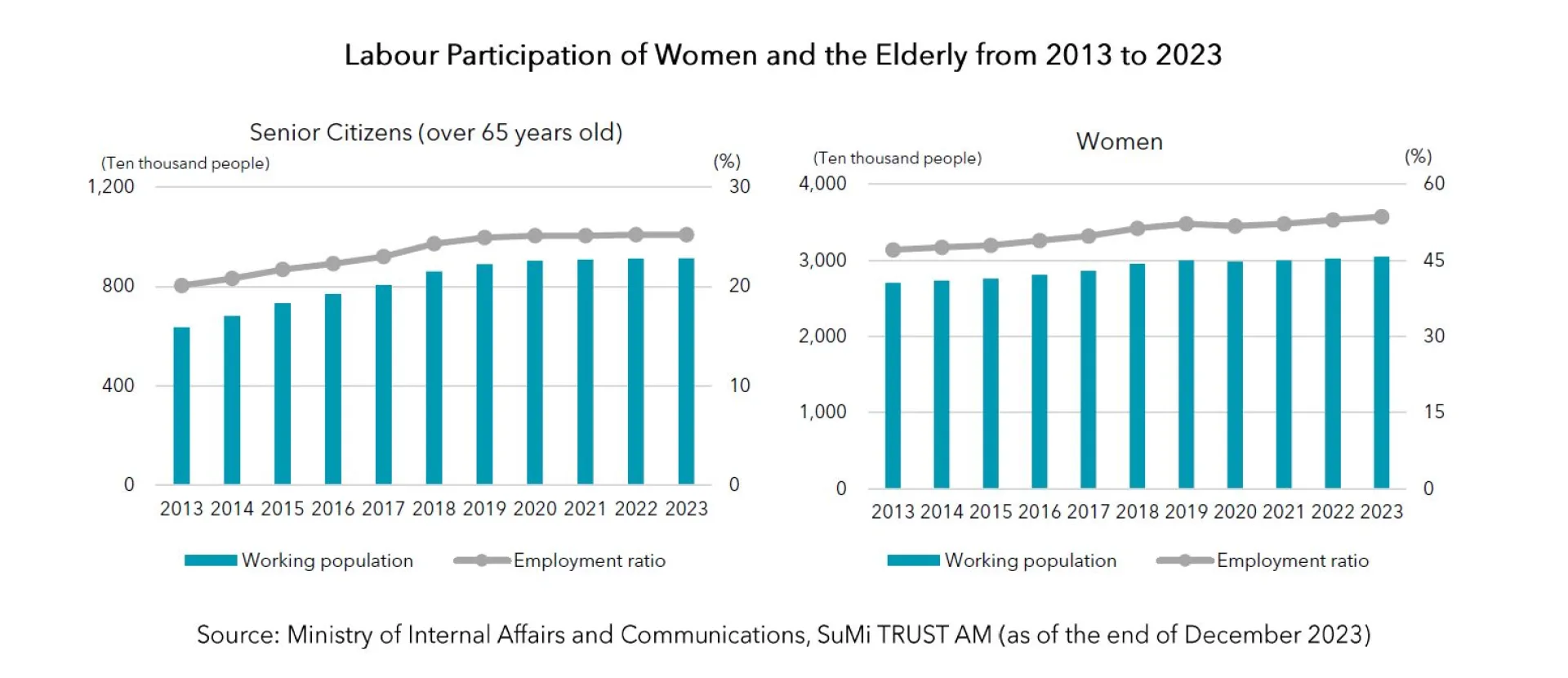

In Japan, the labour participation of women and the elderly has increased significantly over the past decade. Women who left the workforce after marriage have returned, and the elderly who had retired have re-entered the workforce to compensate for the decline in the population of younger workers. However, this trend appears to have reached a plateau.

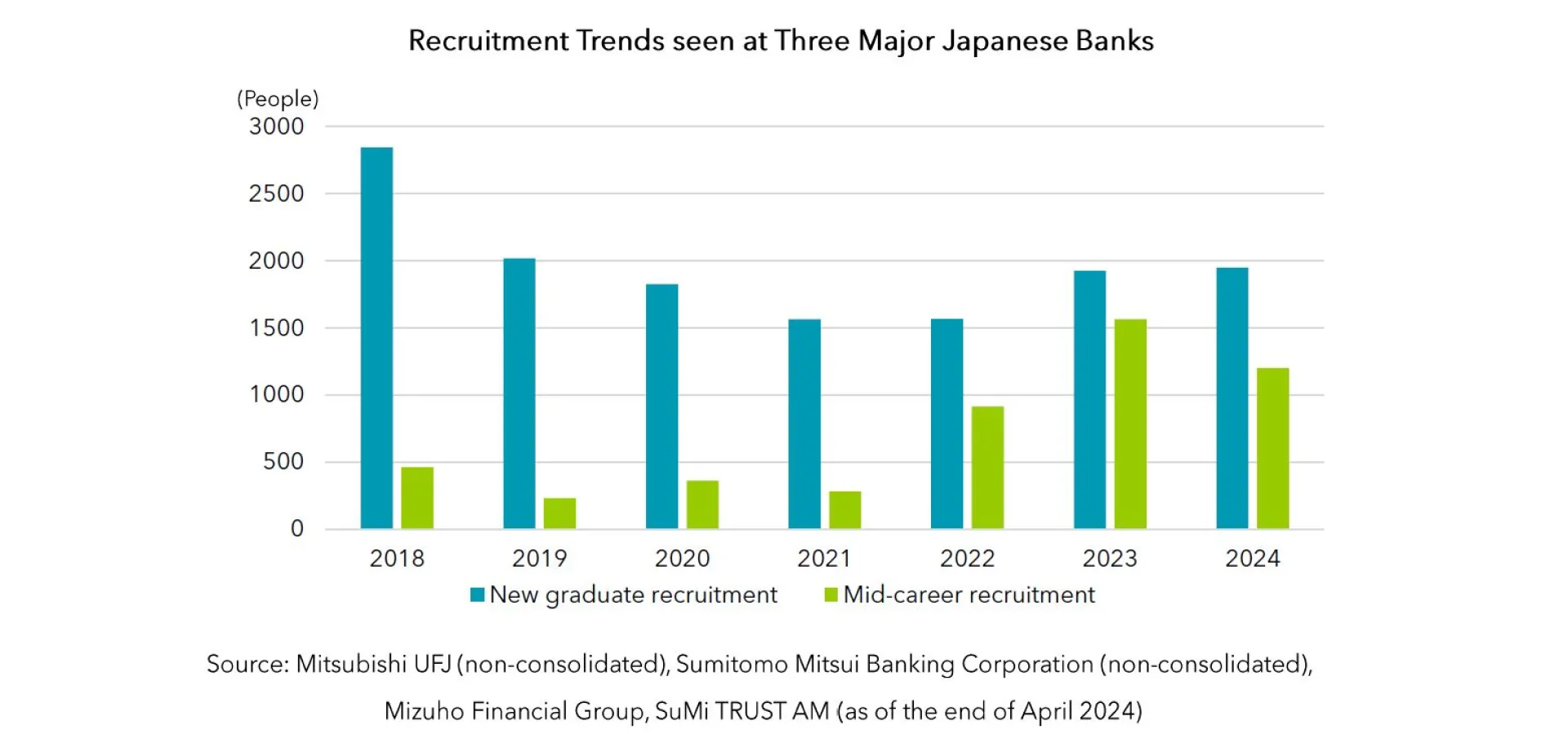

Employers have also become more flexible in their hiring practices in response to the situation. Until a decade ago, it was common for Japanese companies to hire young people fresh out of college and continue to employ them until retirement as part of the so-called ‘job for life’ employment system. Today, the values of workers are becoming more diverse. Fewer people continue to work for the same company for their entire working life than before, and human resources are becoming more fluid in Japan. I was surprised to learn this some time ago, but the hiring attitude of major banks, which are known to be conservative, has also changed considerably. Due to changes in society and competition across industries, the number of mid-career hires, who are work-ready, is now reaching the number of graduate hires.

A New Society is Emerging after the Pandemic

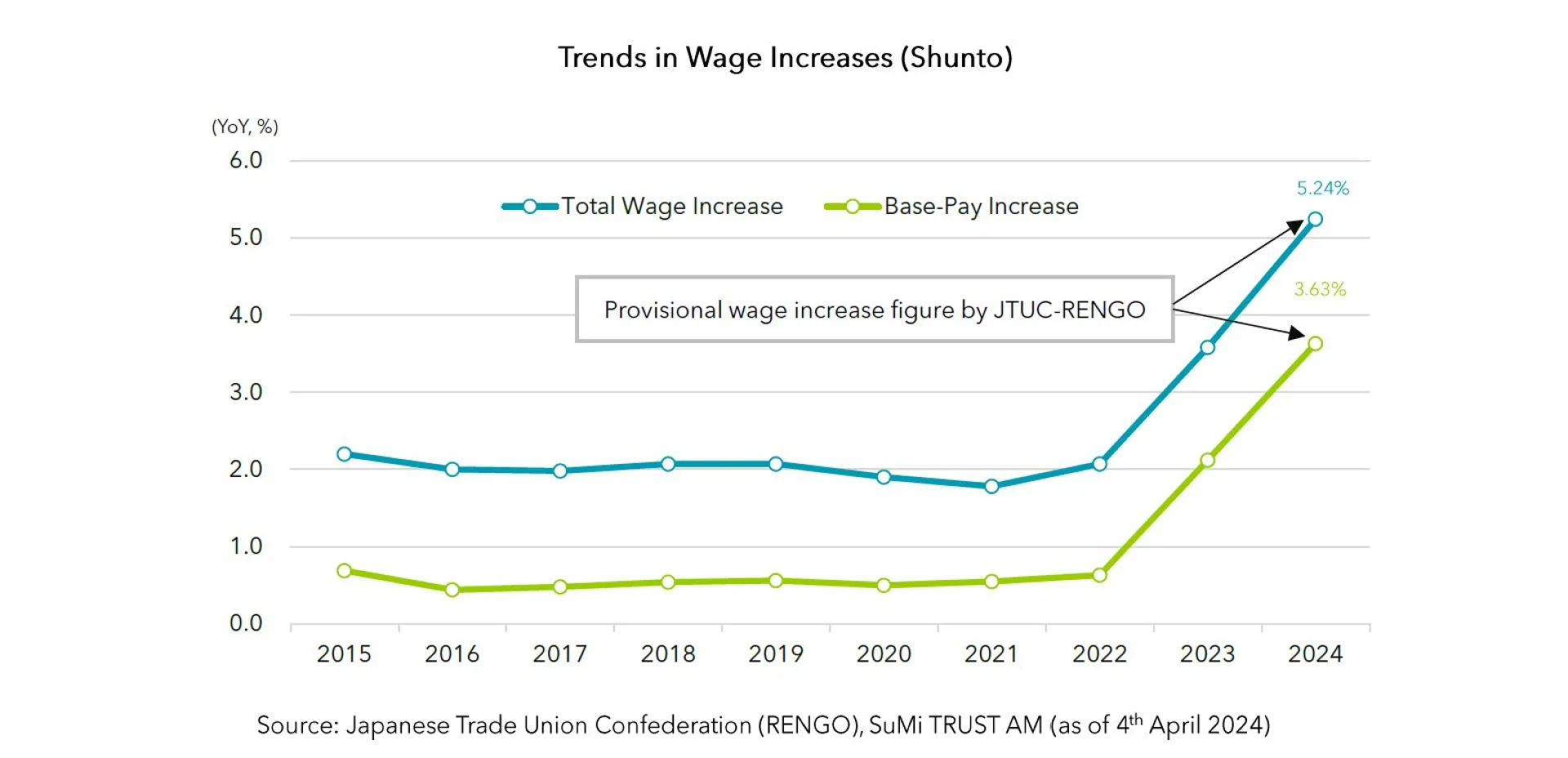

The response to the labour shortage in Japan has changed dramatically since the pandemic. The unprecedented event forced the Japanese people to fundamentally rethink the social structure they had taken for granted. Japan’s labour shortage is now recognised as an issue that must be dealt with today, and many drastic measures are being taken. Uniform wage increases were restored during last year's annual wage negotiations between labour unions and corporate management, also known as ‘Shunto’. This year’s wage increase has exceeded last year’s growth. A virtuous cycle between prices and wages is emerging in Japan, triggered by post-pandemic inflation.

Inns and hotels, which are chronically understaffed, must also change. The industry cut its workforce when demand fell during the pandemic. Even now amidst the recovery in foreign tourism, the industry still does not have enough staff. Hotel occupancy rates are still lower than before the pandemic, but hotel room rates have risen markedly. It can be said that hotels have regained their inherent added value by taking advantage of supply constraints.

If you look at restaurants in Tokyo, you will often see robots serving food. Ordering and paying by smartphone is also becoming more commonplace. This change has the potential to dramatically improve productivity in the restaurant industry, which has long been known for its low profitability.

The logistics industry is also using this sense of crisis as a springboard to try to build an efficient logistics system for the entire society through the promotion of joint delivery and modal shifts (railroads and ships).

Politics have also moved. As a measure to address labour shortages, the Japanese government has expanded the quota of foreign workers accepted into Japan this year and eased restrictions on transferring workers after their arrival to encourage them to work in the country longer.

As described above, in the wake of the pandemic, public and private entities are working on what they can do now to address labour shortages from their respective standpoints.

Ageing is a social challenge that Japan faces ahead of the rest of the world. Japanese society and businesses are still grasping to find solutions. There is no quick fix for this problem, but Japan is making incremental steps toward building a sustainable society!

References

[1] NX Logistics Research Institute and Consulting, Inc., 11 November 2022, ‘「物流の2024年問題」の影響について(2)’ [Japanese only] https://www.meti.go.jp/shingikai/mono_info_service/sustainable_logistics/pdf/003_01_00.pdf [accessed on 30/05/2024]