The Number of TOPIX Constituents will be Significantly Reduced

The Tokyo Stock Exchange Stock Price Index (TOPIX), which was launched in 1969, is widely used both in Japan and overseas as a market average benchmark for the overall Japanese market. According to the Japan Exchange Group (JPX), which owns the Tokyo Stock Exchange (TSE), TOPIX-linked assets amounted to JPY 83 trillion as of March 2023.

The JPX released its proposed TOPIX revision on June 19th [1], which was the second phase of the revision. Originally, the TOPIX index was composed of all stocks listed on the First Section of the Tokyo Stock Exchange. The index included stocks with small market capitalisation and low liquidity, and these stocks are automatically purchased and supported by investment trusts, pension funds and exchange traded funds (ETFs) that aim to track the TOPIX index through passive management, which was viewed as problematic.

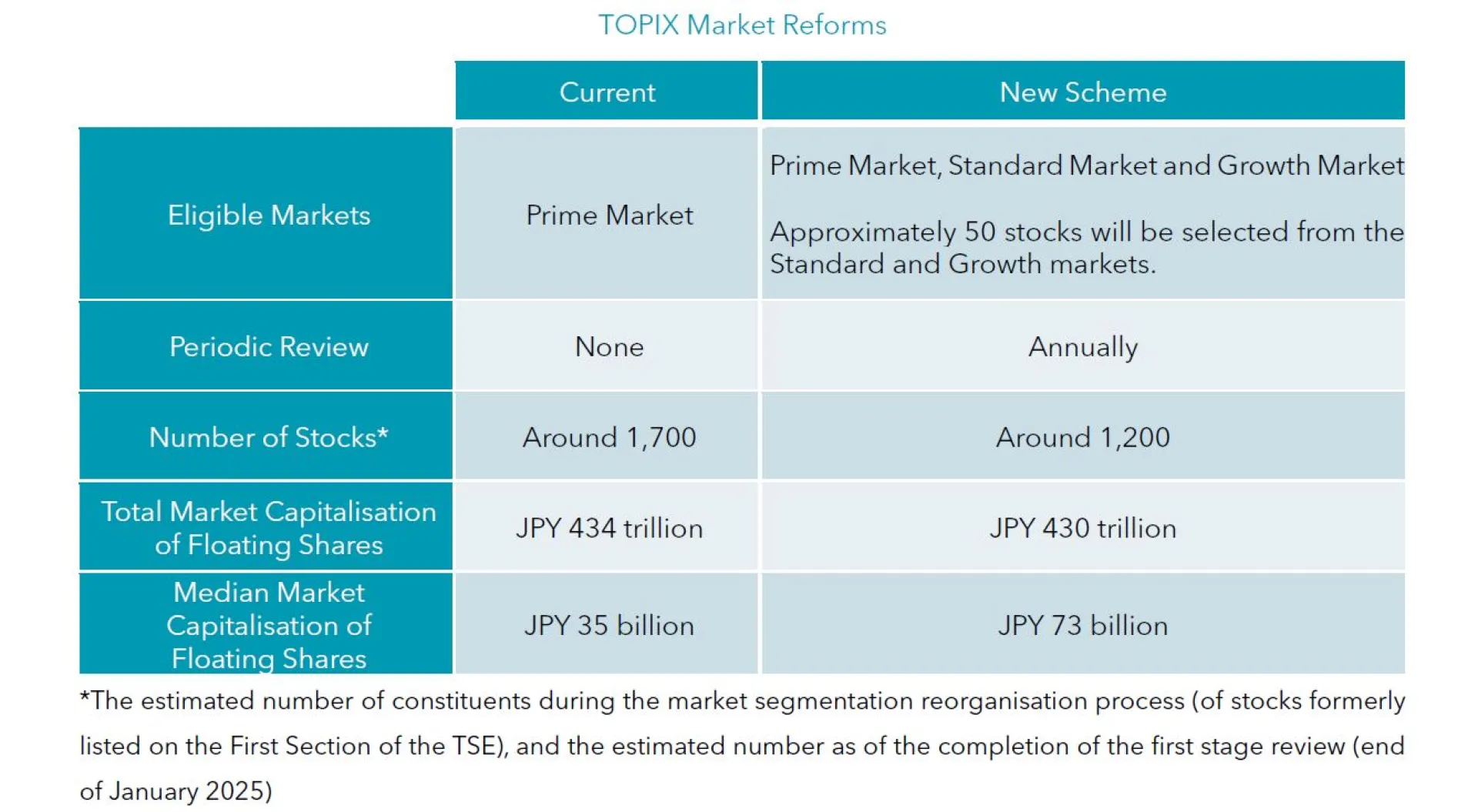

In the first phase of the revision, the calculation method was revised to enhance TOPIX’s functionality as an investable index when the TSE First Section was eliminated as part of the April 2022 TSE market reclassification. In the review, small issues with a tradable share market capitalisation [2] of under JPY 10 billion were excluded, and now their weighting in the index is being reduced in stages. By the end of January 2025, when the review is completed, the number of TOPIX constituents will be reduced from approximately 2,100 to about 1,700.

In the second phase of the revision announced last month, the index will be expanded to cover all market segments (Prime, Standard and Growth markets) to ensure continuity and improve broad coverage. In addition, to enhance the functionality of TOPIX as an investment, a reshuffling of stocks will be conducted once a year in accordance with the criteria that places even greater emphasis on liquidity. By July 2028, when this review is completed, the number of TOPIX constituents will be reduced to approximately 1,200. While the index will still hold more stocks than the S&P 500 Index and the Stoxx 600 Index, it will be easier for investors to manage.

Effects and Expectations of the TOPIX revision

The revision will require listed companies to further increase their corporate value. Until now, once a company was included in TOPIX, it was expected to be held semi-permanently by passively managed index funds and entities. But after the revision, it will be excluded from TOPIX and its shares will be sold if the price slumps. It will likely be necessary to increase market capitalisation by pursuing growth, or by increasing liquidity by unwinding cross-shareholdings, which are excluded from the JPX liquidity criteria. In addition, paving the way for companies listed on the Standard and Growth Markets (i.e. not on the Prime Market) to be included in TOPIX will provide an incentive for such emerging companies to raise their stock prices.

From another perspective, institutional investors who passively manage Japanese stocks currently exercise voting rights for over 2,000 companies. But after the revisions, they will be able to concentrate on fewer companies. Through deeper dialogue between companies and investors, a positive impact on the governance of Japanese companies can be expected.

References

[1] JPX Market Innovation & Research, Inc., 19 June 2024, ‘Overview of Revisions of TOPIX and Other Indices’, e_data1.pdf (jpx.co.jp)

[2] The tradable share market capitalisation is the total market value of shares (excluding treasury stock, shares held by management, etc.) on the market, and is calculated by multiplying the number of shares in circulation by the share price.