The U.S. government has announced a 25% uniform tariff on Japanese-made products effective August 1st. If implemented, this could lead to an estimated 20% reduction in operating profits for manufacturers, potentially decreasing resources for capital investment and shareholder returns, particularly affecting sectors like automotive, construction machinery, and semiconductor manufacturing equipment. Regarding wage increases, small and medium-sized enterprises, which are still in negotiations, might adopt a wait-and-see approach due to concerns over a decline in business deals or performance. Going forward, minimising the impact on sectors highly affected by extended negotiation deadlines, such as the automotive industry, will be crucial.

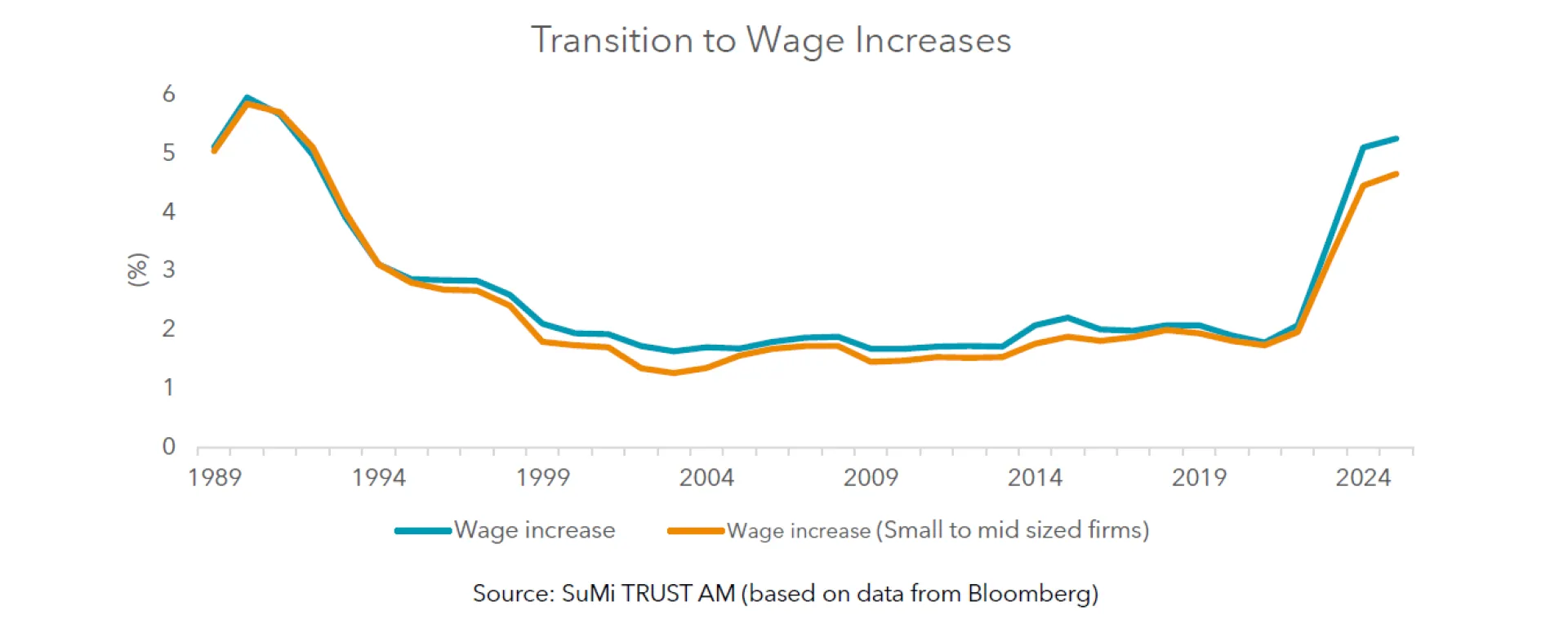

The outlook for consumer spending appears to be supported by wage hikes and government economic measures. The wage increase rate from the 2025 spring labour negotiations reached 5.25%, the highest in 34 years according to the final summary by RENGO (Japanese Trade Union Confederation), and major corporations' summer bonuses increased by 4.37% year-on-year according to Keidanren’s (Japan Business Federation) preliminary report. These effects are expected to spread after summer, and ongoing improvements in employment conditions are likely to keep consumer spending stable. Furthermore, in the buildup to the upper house elections on July 20th, parties have promised measures such as subsidies and the reduction or abolition of consumption tax, which would buoy consumer spending through increasing disposable incomes.

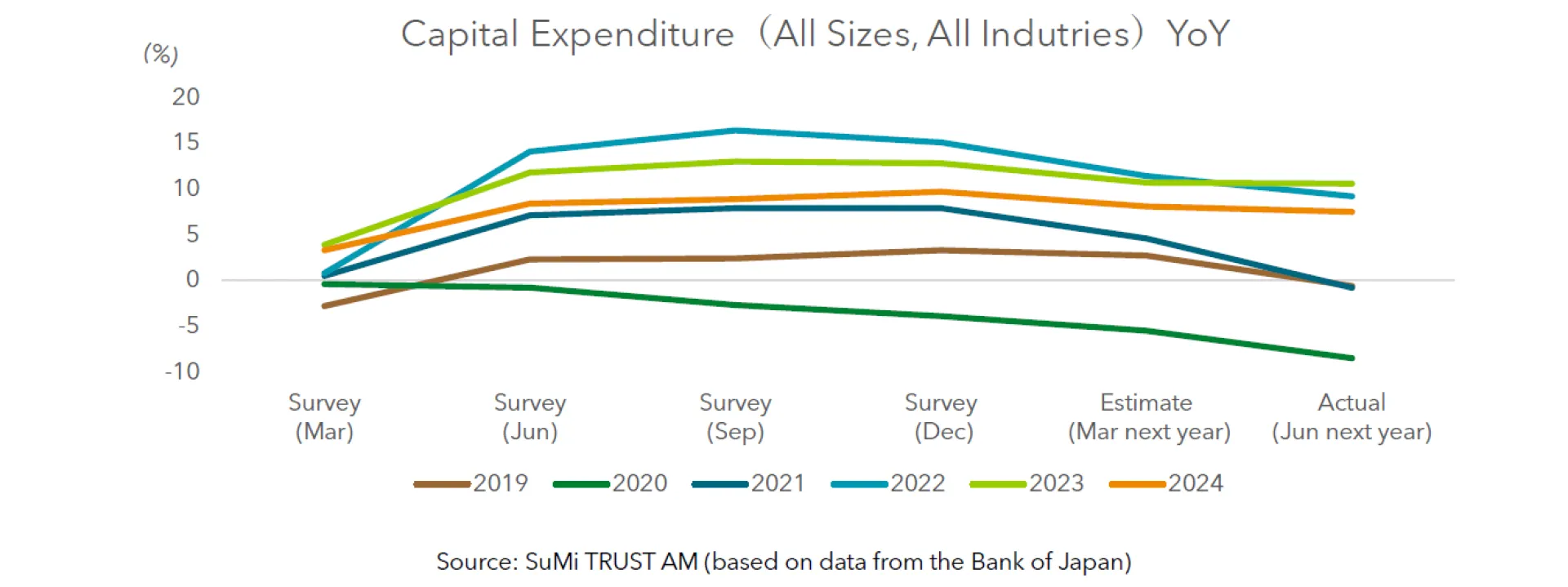

Regarding capital investment, the Bank of Japan's Tankan survey indicates steady corporate enthusiasm for investment. Planned capital expenditure for the 2025 fiscal year is forecasted to increase by approximately 6.7% year-on-year across all industries and company sizes, driven by the establishment of data centres and heightened labour shortages. Continuous investment in data centres and labour-saving technologies is expected to sustain corporate capital investment, supporting the Japanese economy. However, rising uncertainty in the domestic economy, potentially exacerbated by U.S. tariff policies, could lead to a more cautious approach to capital investment.

As for external demand, the solid U.S. economy offers some support, but there are risks of export slowdowns due to U.S. tariff policies. This could particularly impact the automotive and semiconductor-related sectors, potentially exerting downward pressure on growth rates.

II. Monetary Policy Outlook

The focus is likely to be on whether the Bank of Japan (BOJ) will implement additional interest rate hikes within the year. Currently, expectations for the BOJ to proceed with further hikes have receded, and the probability of an additional rate hike by year-end is considered low. This outlook is partly influenced by the BOJ's cautious stance amid heightened uncertainty surrounding tariff negotiations between Japan and the United States.

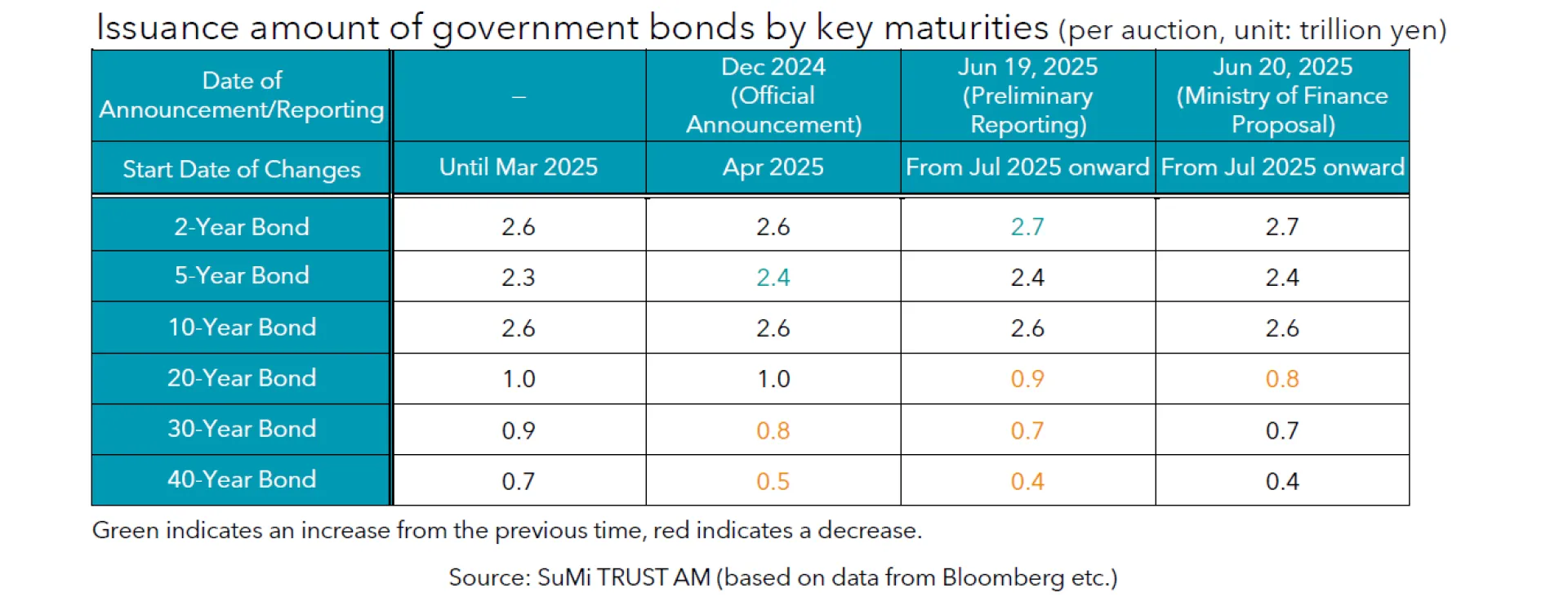

We anticipate the domestic 10-year government bond yield will fluctuate within a range of 1.25% to 1.75% by the end of 2025. The upper house elections on 20th July have political parties proposing subsidies and the reduction or abolishment of the consumption tax, which could apply upward pressure on long-term interest rates due to expansionary fiscal policies. Furthermore, the government bond issuance plan for the fiscal year 2025 was revised in June, reducing the issuance of super-long-term bonds—which had been receiving lackluster bids—and increasing short-term and retail bond issuances. Monitoring whether the supply-demand balance will be corrected as a result will be essential.

On the U.S. side, we expect the 10-year government bond yield to range from 3.50% to 4.50% by the end of 2025. There is significant attention on the number of interest rate cuts in the U.S. within the year, and we anticipate about two to three rate reductions. Key factors will include the impact of U.S. tariff policies on the U.S. Consumer Price Index (CPI) and trends in the labour market.

III. Japanese Equity Market Outlook

The Japanese stock market is expected to remain resilient, supported by corporate share buybacks, reforms to the Tokyo Stock Exchange's Price Book-Value Ratio (PBR) and Growth Market, and demand driven by NISA, despite the pressure on corporate earnings due to U.S. tariff policies.

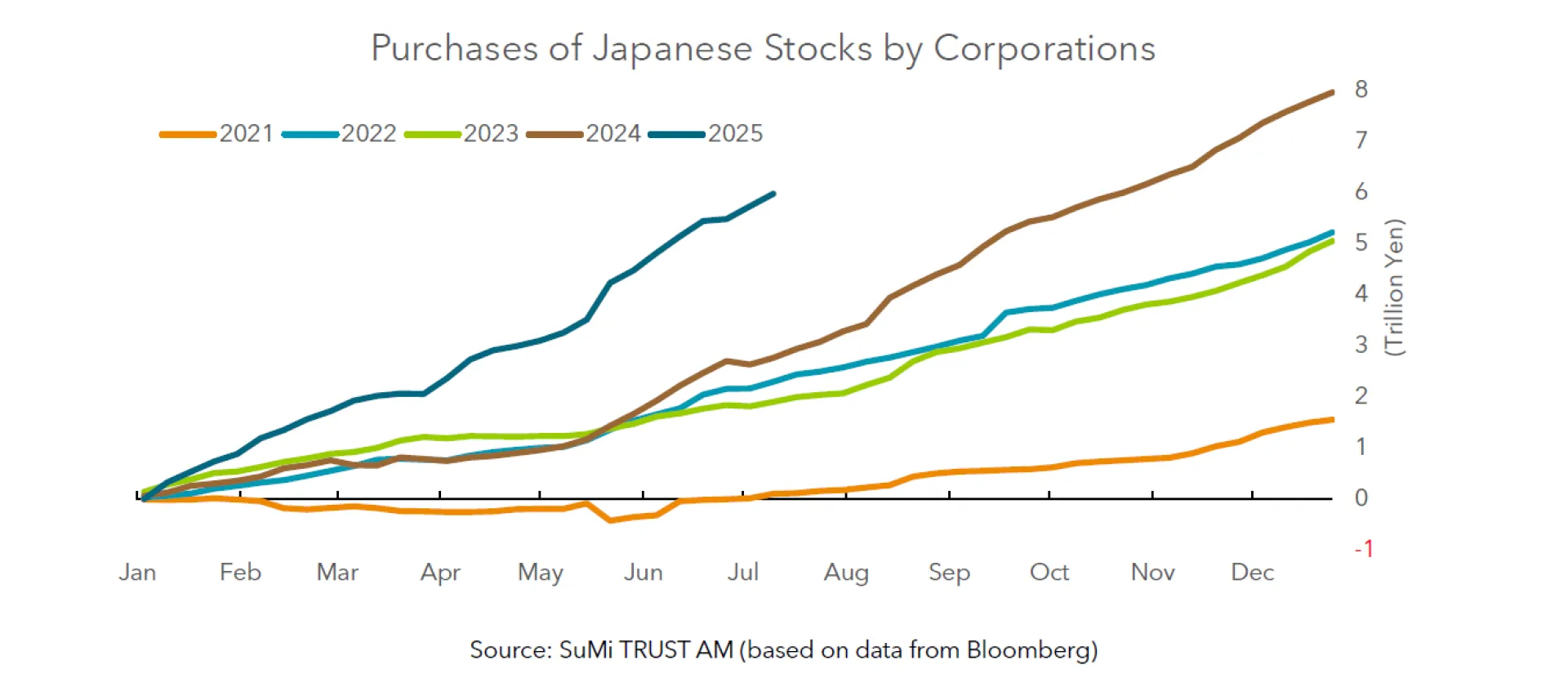

In 2025, corporate share buybacks have reached record highs, acting as a driving force for the domestic stock market. In March 2023, the Tokyo Stock Exchange requested listed companies with declining PBRs to disclose and implement improvement strategies. As a result, it is believed many companies have begun pursuing share buybacks as they have been encouraged to disclose and execute plans for capital efficiency and shareholder returns. Additionally, with continued solid corporate performance, many companies are holding surplus cash and choosing buybacks as a means of returning value to investors.

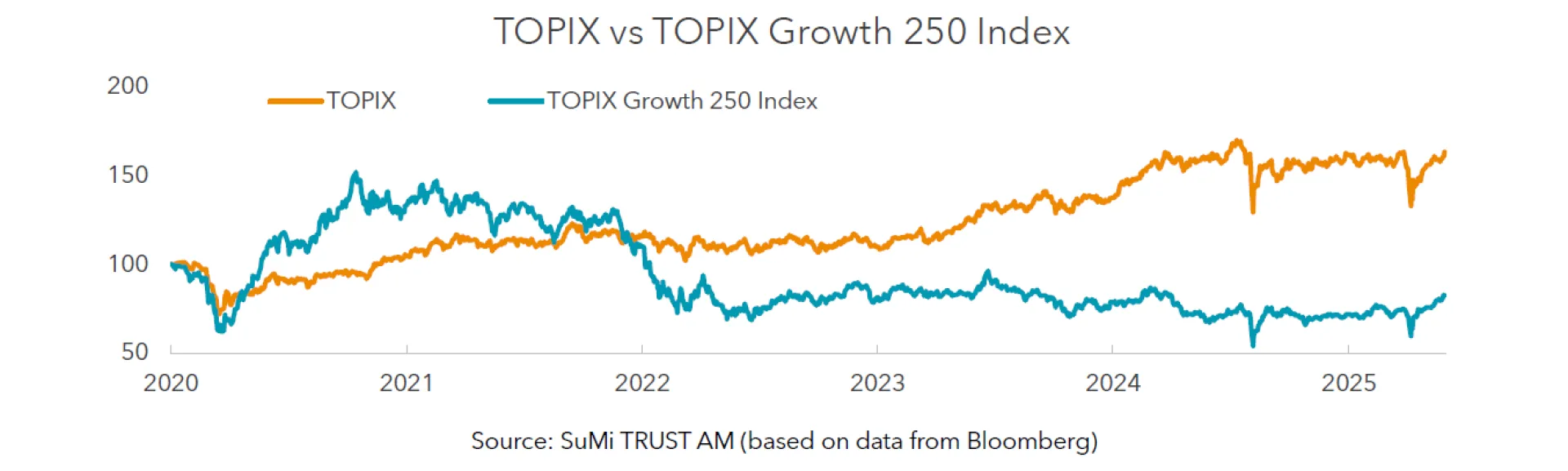

Reforms in the Growth Market are also expected to enhance market quality. On April 22nd, the Tokyo Stock Exchange held a follow-up meeting on the "Review of Market Divisions", announcing measures to ensure companies listed on the Growth Market achieve continuous high growth. The criteria for maintaining a listing have been significantly raised from a market capitalisation of 4 billion yen after 10 years to 10 billion yen after 5 years. Companies are also encouraged to analyse their growth post-listing. If growth does not meet expectations, they are required to specifically disclose the reasons and countermeasures. These measures are expected to push companies to enhance their growth potential.

On July 9th, 2025, a document titled "Future Direction of the Standard Market" was published. There is growing interest in the Standard Market among companies and investors, with efforts focusing on raising awareness of management cognisant of capital costs, stock prices and enhancing investor relations, to position it as a suitable market for companies aiming for stable growth. Consequently, it is expected that the Tokyo Stock Exchange will announce specific policies in the future, just as was done with the Growth Market.

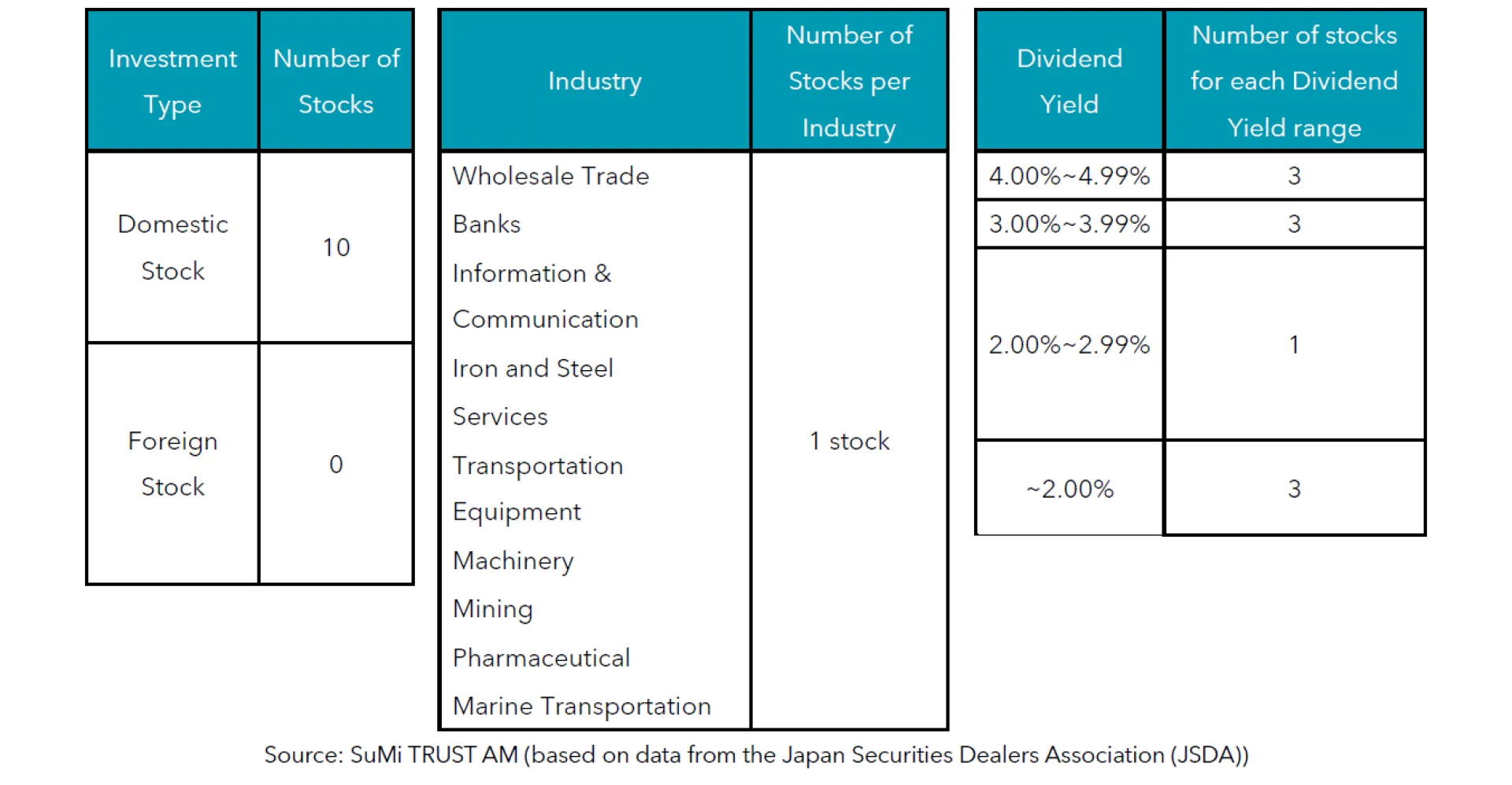

Additionally, NISA purchases of domestic stocks are expected to support the domestic stock market. According to materials from the Japan Securities Dealers Association, the NISA purchasing amount as of the end of May 2025 exceeded the previous year, with domestic stocks being the primary focus within growth investment slots, supporting the market. Of the top 10 stocks by purchase amount in the growth investment slot in May 2025 all were domestic. By industry, these included one each from the following sectors: wholesale, banking, information and communications, steel, service, transportation equipment, machinery, mining, pharmaceuticals, and marine transportation. There appears to be significant emphasis on shareholder returns and management stability, as shown by the large number of relatively high-dividend stocks.

From these factors, our forecast for the Nikkei 225's range could be as high as 43,000 yen by the end of December 2025.

IV. FX Outlook

Monetary policy trends are expected to significantly influence the exchange rate market. In Japan, attention will be focused on whether additional interest rate hikes occur within the year, while in the U.S., the number of rate cuts will be closely watched. Additionally, President Trump's previous announcement of an additional 25% tariff on Japan led to a rise in U.S. prices while also exerting a downward pressure on Japan's economy, resulting in a trend of selling yen to buy dollars. However, on 23rd July a deal was reached and the tariff set at the lower rate of 15% which should ease some of that downward pressure. Looking forward, differences in the direction of monetary policy between the Bank of Japan (BOJ) and the Federal Reserve (FRB) may lead to the appreciation of the yen due to narrowing interest rate differentials, with the dollar-yen exchange rate expected to move within a range of 130-150 yen per dollar by the end of 2025.

V. Risk Factors

One major risk factor is the slowdown of overseas economies. Concerns are arising as U.S. tariff policies may reduce export demand and increase costs in the supply chain, impacting corporate earnings. Another risk is the decline in domestic personal consumption. As the prices of commodities including food continue to rise, real wages are experiencing negative growth. Attention will focus on whether disinflation, such as that for rice retail prices, will lead to a positive turn in real wage growth. There is also concern about the impact of a rapid yen appreciation and dollar depreciation on export-oriented companies' earnings. According to a May survey by Teikoku Databank, the average exchange rate assumed by companies for fiscal year 2025 is 139.64 yen per dollar. A key point will be whether the exchange rate will remain above 140 yen amid divergent monetary policy between Japan and the U.S.

VI. About the Writers