Toranomon-Roppongi Area (A): An Ever-Evolving Skyline

In 1986, Mori Building[i] pioneered the redevelopment of the Toranomon-Roppongi area with the construction of the ARK Mori Building, a 37-story building that marked Japan's first large-scale urban redevelopment project led by a private company. This initiative was followed in 2003 by the unveiling of Roppongi Hills Mori Tower, a 54-story mixed-use skyscraper that has since become a prominent landmark in Tokyo. Guided by their corporate philosophy of "Create Cities, Nurture Cities," Mori Building has undertaken numerous iconic projects in central Tokyo.

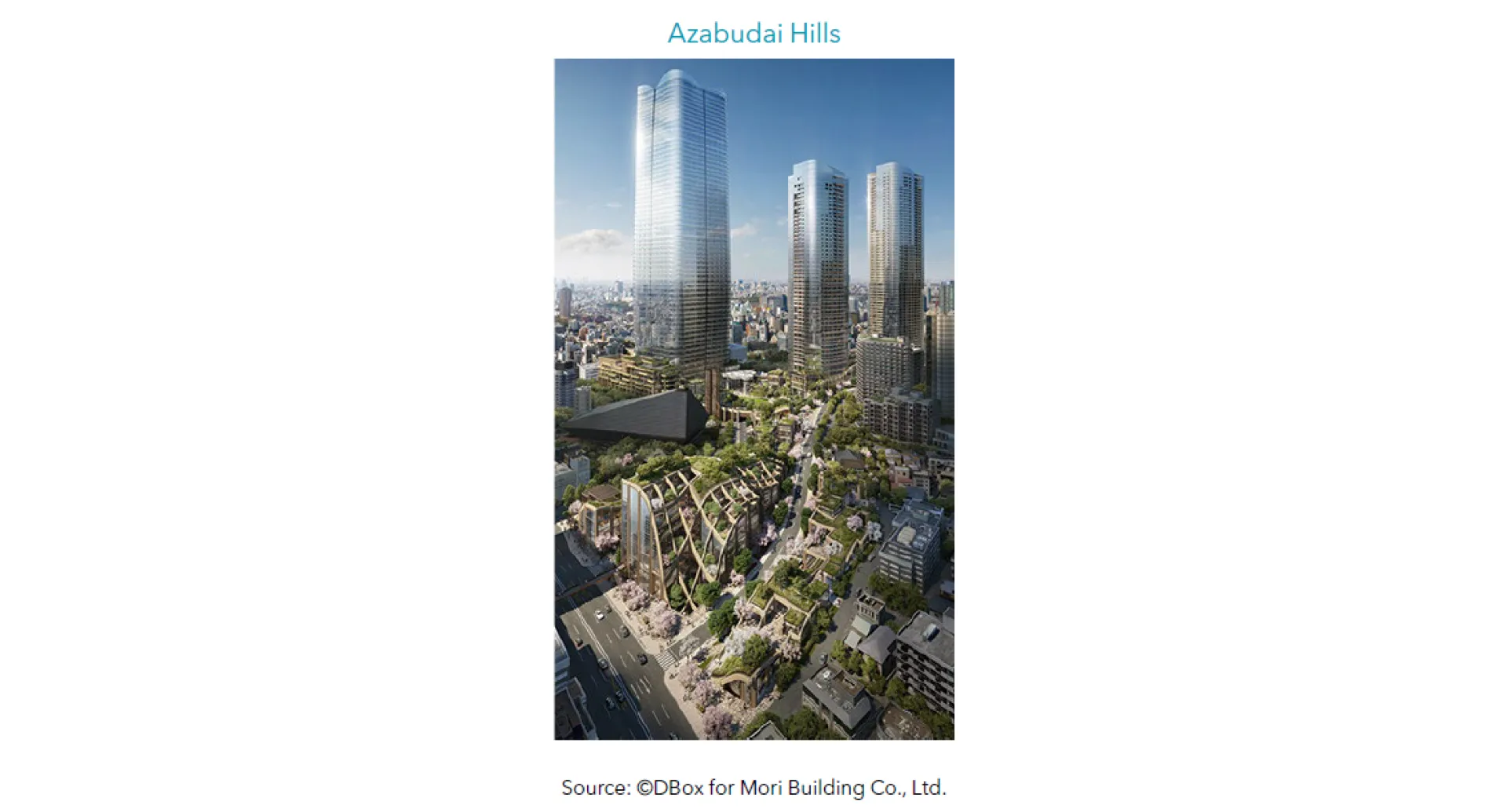

In October 2023, Mori Building continued its success with the opening of the 52-story Toranomon Hills Station Tower. This was soon followed in November 2023 by the opening of Azabudai Hills, featuring the 64-story Mori JP Tower, which, at approximately 330 meters, is the tallest building in Japan. These two mixed-use complexes, which include international luxury hotels, offices, residences, and hospitals are architectural marvels that transcend traditional concepts of design and function. Furthermore, in April of this year, Mori Building announced the launch of the Roppongi 5-chome West District Redevelopment project.[ii]

The development of the Toranomon and Roppongi areas is not solely the result of corporate efforts but also part of a government-led urban planning initiative. In April 2008, the government designated this area as a zone to enhance international financial functions. Consequently, industry associations and government-affiliated organisations, such as the Ministry of Finance and the Ministry of Economy have established new bases in the Toranomon district.

Previously, a lack of convenient transportation access posed a major issue. However, Mori Building has worked closely in collaboration with government and transport bodies to include transportation and urban planning improvements as part of its development projects, including the establishment of new subway stations, which has significantly enhanced the area's accessibility. As a result, Toranomon has emerged as a popular location for many companies looking to expand or relocate in the past five years, and the area now hosts a multitude of promising enterprises, fuelling a positive economic cycle.

Shibuya (B): A Fusion of Youthful Energy and Urban Sophistication

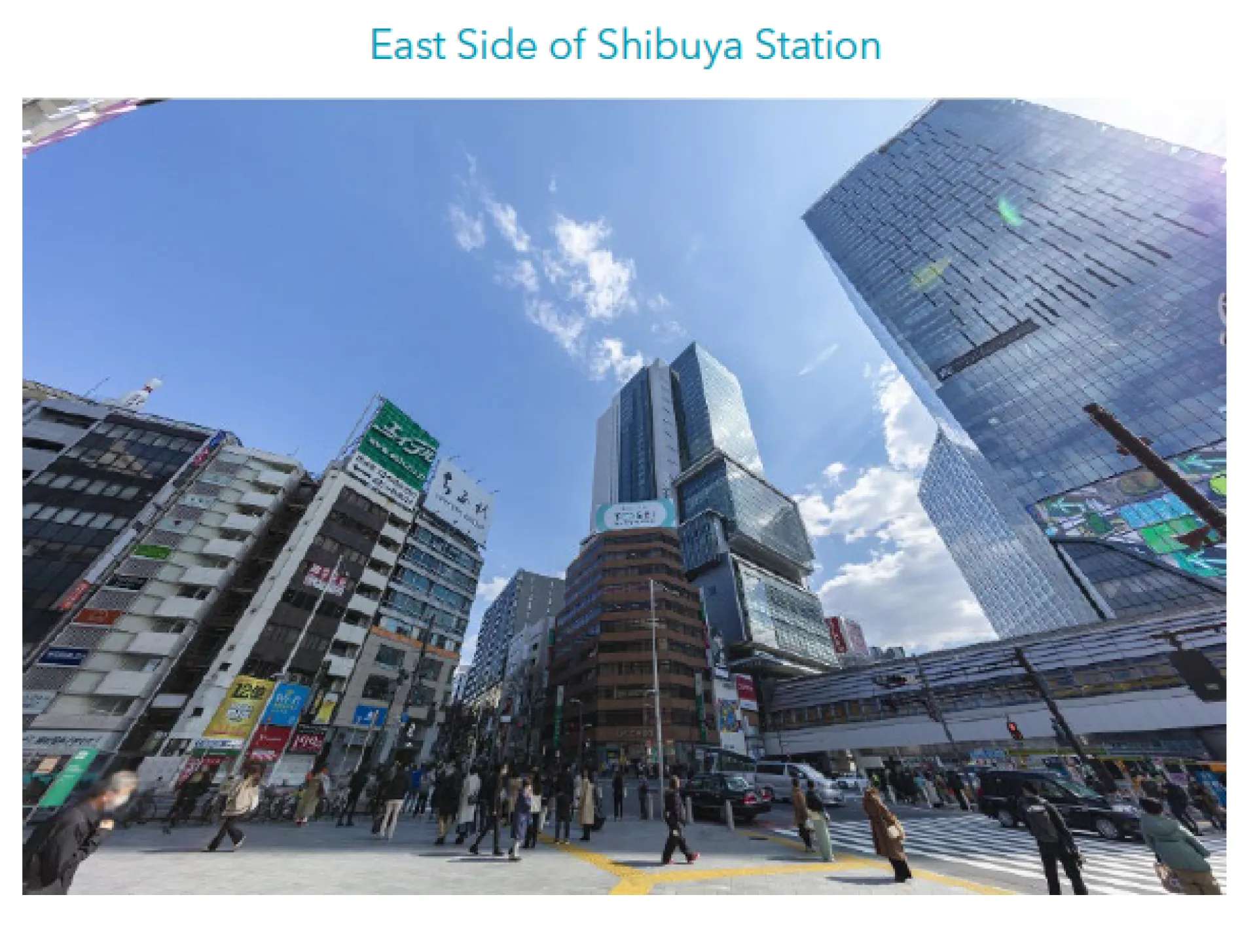

Once a bustling centre of fashion and IT in Tokyo, the area around Shibuya Station - famous for the world’s busiest pedestrian crossing, Shibuya Crossing - is undergoing a monumental redevelopment, often described as a "once-in-a-century" transformation. Initiated in 2013 and spearheaded by the Tokyu Corporation[iii], this ambitious project began with the underground relocation of the Tokyu Toyoko Line – the move of the subway line itself was a feat of engineering taking years to complete. The goal of the redevelopment project is to create an internationally recognisable appealing urban space of exceptional quality. To achieve this, there has been a significant enhancement in educational and cultural facilities, along with notable improvements in environmental quality and services. As a result, IT and entertainment-related businesses are turning their attention to Shibuya.

In the past, Shibuya struggled with a shortage of office space, but this situation has changed dramatically. Since 2012, the Tokyu Group has built approximately 347,000 square meters of rentable office space, equivalent to about 48.6 soccer fields. Along with this expansion, there has been an increase in foot traffic, with the average daily number of passengers at Shibuya Station rising by about 10% compared to before the opening of the mixed-used high rise Shibuya Hikarie development. Tokyu is building a Shibuya which combines its previous image as a town for young entrepreneurs with a new cosmopolitan and sophisticated grown-up look. Shibuya is evolving into a hybrid space that integrates diverse elements and populations which makes it an exciting choice of office location.[iv]

Major IT and entertainment-related companies such as Google, CyberZ, and GMO Media, along with numerous start-ups, are attracted to Shibuya's updated image and are once again establishing their presence here. Various events and seminars are frequently held in Shibuya, creating opportunities for entrepreneurs, investors, engineers, and designers to participate and actively exchange ideas and business information. This fosters an environment that accelerates the growth of venture companies. Besides the extremely convenient transportation, the vibrant environment for exchanging opinions is attracting IT companies back to Shibuya.

Shinagawa (C): An Emerging Hub for High-Speed Connectivity and International Exchange

Japan’s cutting-edge technology is also drawing the attention of investors and businesses to Shinagawa, located in the Minato Ward of Tokyo. The Shinagawa area is set to become the starting station for the future Linear Chuo Shinkansen. This new Shinkansen (Japanese bullet train) makes use of revolutionary Superconducting Maglev technology and will dramatically reduce travel times between major cities like Nagoya and Tokyo. By linking these cities in a journey as short as 40 minutes, the Shinkansen will offer exceptionally rapid travel across Japan, opening new opportunities for business travel. Coupled with excellent access to Haneda Airport and existing Shinkansen lines, Shinagawa is poised to become an attractive hub for foreign companies.

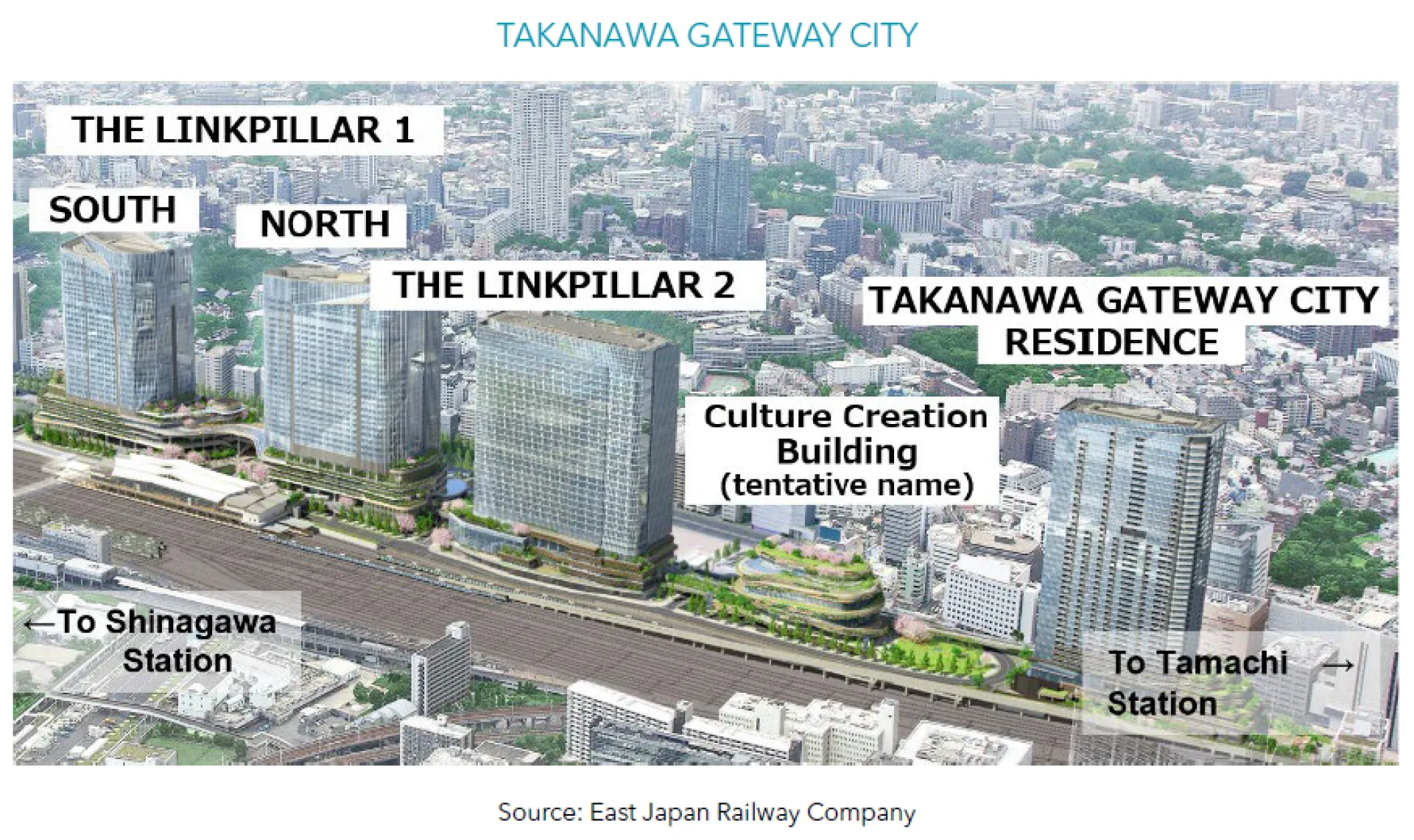

The Shinagawa area also took a significant step forward in 2020 with the opening of Takanawa Gateway Station, the first new station on the Yamanote Line—the most important train line in Tokyo—in 49 years. Furthermore, the area is home to TAKANAWA GATEWAY CITY,[v] one of Japan’s largest redevelopment projects slated for completion between late 2024 and fiscal 2025 led by East Japan Railway Company[vi]. This expansive complex will feature four buildings housing offices, luxury rental residences, hotels, and commercial facilities. Combined with the Linear Chuo Shinkansen, the redevelopment of the Shinagawa is evidence of the area’s strong potential to be a "hub for international exchange that will drive Japan's future growth”.[vii]

Concerns and Prospects for Tokyo Office Buildings

While the three areas introduced above – Toranomon-Roppongi Area, Shibuya and Shinagawa – are promising investment opportunities for foreign investors who are looking for exciting prime office real estate, we would like to cover some common concerns that we hear during our dialogue with investors interested in Japan.

One of the most common concerns among foreign investors is the oversupply of office space. Redevelopment projects have the potential to loosen the supply-demand balance. We anticipate future polarisation in the market: while prime locations with excellent access, such as proximity to multiple stations, will continue to attract businesses, properties in less favourable locations with inferior facilities may face challenges. The areas introduced in this article, for example, are all prime locations.

Another prevalent concern is the potential for interest rate hikes by the Bank of Japan (BOJ). However, for us this is not a concern as we view the BOJ's revision of its monetary policy as part of the normalisation process for the Japanese economy. Given the low absolute level of interest rates, coupled with the BOJ's cautious approach to policy adjustments, we believe that the impact on the real estate market can be somewhat mitigated if interest rates are maintained at a certain level. Therefore, it should not prevent foreign investors from viewing Japan favourably.

Additionally, there are inquiries about the impact of inflation in Japan on real estate. We interpret the positive cycle of rising prices and wages underlying Japan's mild inflation as a sign of the economy regaining health and not something to fear for real estate investors. Indeed, property owners are facing increased costs due to rising utility expenses. However, with strong corporate performance under moderate inflation, tenants will be more than able to cover rental costs. For high-quality offices in prime locations, it is possible to pass on these costs, and there have already been instances where rents have risen.

What does the future hold?

Beyond office spaces, Japanese real estate overall remains an attractive investment opportunity for foreign investors, owing to the economy's stability and high liquidity. For instance, we are observing rising rents for residential properties and increasing room rates for hotels. Additionally, real estate prices have generally maintained stable levels. Revenues from urban commercial complexes are also growing, driven by an increase in inbound tourists. Even with an increase in hybrid and remote working styles due to the pandemic the office attendance rate in Japan has remained higher compared to overseas, which should reassure investors. Therefore, we encourage fans of excellent real estate opportunities to keep an eye on the Japanese real estate market.

[i]Mori Building Co., Ltd. is a Japanese private family-owned property management firm. Since 1955, it has been managing office building leases, with its business primarily focused on Minato, Tokyo.

Mori Building Co., Ltd., As of 29 July 2024, Company Profile, https://www.mori.co.jp/en/company/profile.html

[ii]Mori Building Co., Ltd., As of 29 July 2024, Main Project, https://www.mori.co.jp/projects/

[iii]Tokyu Corporation, a public corporation focused on urban development, primarily based on its railway business. One strategic area for the company is enhancing the appeal of Greater Shibuya. This is achieved through the development and enhancement of infrastructure that integrates urban development with railway improvements.

Tokyu Corporation, As of 29 July 2024, Long-Term Management Initiative, Long-Term Management Initiative | Management Policy | Investor Information | Tokyu Corporation, Tokyu Railways

[iv]Tokyu Corporation, As of 29 July 2024, Tokyu Greater Shibuya Strategy, https://www.tokyu.co.jp/shibuya-redevelopment/210719_factbook.pdf

[v]East Japan Railway Company, As of 29 July 2024, Explanatory Materials, https://www.jreast.co.jp/e/investor/pdf/2024_presentation.pdf

[vi]East Japan Railway Company, the largest passenger railway company in Japan. It was originally a part of the government-owned Japanese National Railways (JNR) before being privatised. Today, its business includes merchandise sales, shopping centres, hotels, and other related activities.

East Japan Railway Company, As of 29 July 2024, Profile, https://www.jreast.co.jp/e/investor/ar/2001/pdf/p01_e.pdf

[vii]Bureau of Urban development Tokyo Metropolitan Government, As of 29 July 2024, Development of Shinagawa/Tamachi Station District, https://www.toshiseibi.metro.tokyo.lg.jp/seisaku/guideline2020/pdf/siryo_16.pdf