1. Carbon neutrality efforts in other nations

As many as 120 countries around the world have already declared their goals to achieve carbon neutrality by 2050, and carbon neutrality policies are already underway, especially in Europe.

The European Green Deal policy was launched in December 2019, which aims for carbon neutrality by 2050. The intermediate goal is to reduce CO2 by at least 55% in 2030 (as compared to 1990). Breaking away from dependence on fossil fuels and reducing environmental pollution, Europe aims to be a pioneer in developing environmentally friendly technologies and supporting financial system. Europe will strive to balance economic activities with the global environment, and at the same time to create opportunities for innovations and employment. 30% of the EU’s €1.8 trillion mid-term budget for post-COVID reconstruction will be spent on Green Deals. This is so that the European Green Deal does not hinder growth of European industries or employment.

Under new President Biden, the US has rejoined the Paris Agreement and has launched a carbon-neutral policy. The US has aimed for complete decarbonization of electrical utilities by 2035 and carbon neutrality by 2050. In addition, the US has announced a plan to invest $2 trillion over four years in infrastructure projects, including clean energy, in order to achieve these targets. The state of California has announced that it will phase out the sale of gasoline-powered cars by 2035.

Chinese President Xi Jinping announced in his speech at the United Nations in September 2020, that China would reduce CO2 emissions in 2030 and complete carbon neutrality by 2060. Then in December of last year, China announced that CO2 emissions per GDP would be reduced by 65% or more by 2030 (as compared to 2005) and that consumption of non-fossil fuel within the primary energy category, will be raised from the former target of 20% to 25%. In order to achieve these targets, China has focused on fostering industries for decarbonization technologies, including electric vehicles and fuel cell vehicles, and has budgeted subsidies for new energy vehicles in 2020 at about 450 billion yen. In addition, China officially launched the National Emissions Trading System (ETS), a key to achieving decarbonization, in February 2021.

2. Japan’s Green Growth Strategy for Carbon Neutrality

Although Japan has fallen behind the rest of the world in its carbon neutrality efforts, Prime Minister Suga has set the goal of achieving carbon neutrality by 2050 as his cornerstone policy after digitization. Thus, in December 2020, Japan’s "Green Growth Strategy" was announced.

The strategy outlines energy policies and growth industries (14 areas in total: offshore wind power, fuel ammonia, hydrogen, storage batteries, carbon recycling and others) to achieve the goals, and it is estimated that there would be an annual economic impact of 90 trillion yen per annum by 2030 and about 190 trillion yen/annum by 2050. In terms of the budget, the government will take a step further in environmental investment by creating an unprecedented 2 trillion yen fund to support companies with ambitious innovative challenges, for a period of 10 years. Furthermore, on taxation, Japan will create a special case by raising the deduction limit for loss carryforwards for companies restructuring or reorganizing, and will create tax incentives for investment towards carbon neutrality, and will expand the scope of R&D taxes to encourage private investment.

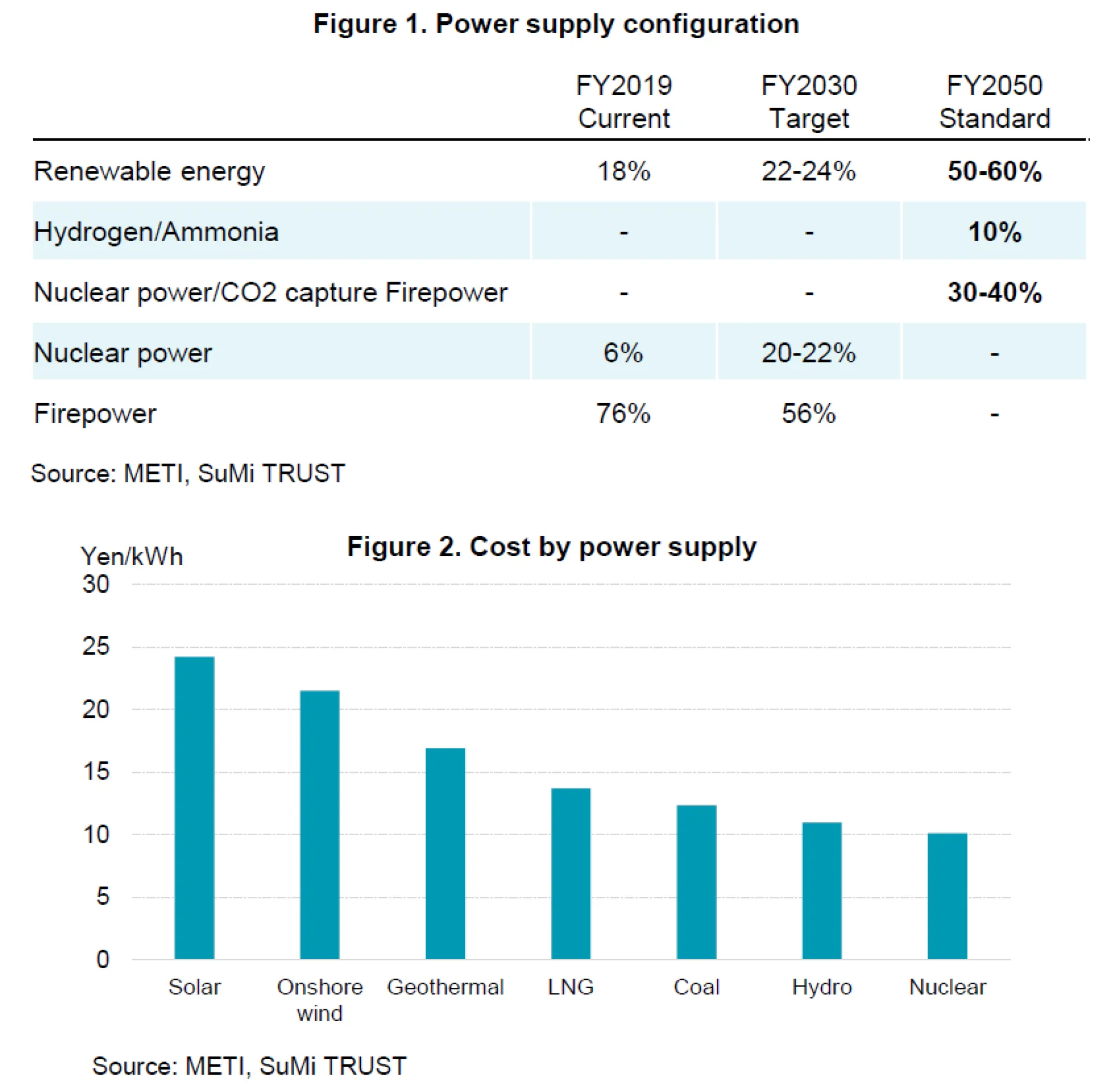

Looking specifically at the energy policy guidelines, it is said that electricity demand will increase by 30 to 50% from current levels in 2050 when carbon neutrality will be achieved. This is due to further electrification of the industrial, transportation, and household sectors. Regarding the power source composition, it will largely depend on the development of future technology, but as a guide, it is believed that renewable energy will be significantly increased from 18% in 2019 to 50-60% in 2050, and hydrogen/ammonia power generation will compose 10% of total by 2050. Nuclear and thermal power generation (on the premise that the CO2 will be collected) will constitute about 30-40% (Figure 1). On the other hand, the cost of power generation (1kWh) for renewable energy in Japan is generally higher than that of conventional power sources. Thus, the hurdles to achieve these figures are rather high economically (Figure 2). Discussions on restarting nuclear power plants still face strong dissenting public opinions due to the impact of the Fukushima nuclear accident. The government is still looking for a good balance between environmental measures and economic growth to achieve the goals.

3. Three key areas of growth

Next, I would like to focus on three major areas (offshore wind power, fuel ammonia, and hydrogen) among industries that are expected to grow.

Firstly, Japan has a policy of focusing on offshore wind power among renewable energies. In Japan, the prospects of onshore wind power are low because of the difficulty to secure enough flat land to install a large number of wind turbines, and offshore wind power is the key to expanding renewable energy. The global offshore wind market is growing mainly in Europe, and is expected to grow to 562 GW (24 times the current level) by 2040 boosted by incoming investments of over 120 trillion yen, becoming the main power source among renewable energies. Although currently Asia including Japan is falling behind in this area, it is expected that by 2030, more than 40% of the world share will be accounted for Asia. Hence we see rapid growth potential in the future. The Government of Japan aims to (1) increase the domestic energy procurement ratio to 60% by 2040, and (2) to lower the power generation cost to 8-9 yen/kWh by 2030-2035. In the future, we see construction demand for offshore wind power related facilities and demand for the development of a power grid, connecting wind power supply with areas having demand for electricity.

Regarding fuel ammonia, Japan will focus on this source of energy for its unique features: (1) It does not emit CO2 when it burns, (2) ammonia can be used together with thermal power generation, and (3) transporting ammonia by sea has already been put into practical use. The Japanese government is ultimately aiming for the transition to a hydrogen-based society. But in the interim, fuel ammonia will be the main decarbonised fuel source. If 20% of ammonia is mixed at a coal-fired power plant, this will lead to a 20% reduction in CO2 emissions. In this way, the Government of Japan aims to have 20% co-firing at thermal power generation plants by 2030, and have a co-firing rate to 50% by 2050, and develop specialised combustion technology for thermal power generation, effectively accelerating efforts toward decarbonisation. Going forward, through collaboration between ammonia producing countries (North America, Australia, Middle East) and consuming countries (Asia including Japan), Japan will build a supply chain that it can control, and ultimately reduce fuel ammonia costs (The 2030 target cost is under 20 yen/Nm3.)

Hydrogen can be used as a key carbon-neutral technology that can be used in a wide range of fields such as power generation (fuel cells), transportation (automobiles, ships), and industry (steel, chemicals). Japan is the first in the world to formulate a basic hydrogen strategy, and is technologically ahead in multiple fields. Although Japan has global hydrogen suppliers such as Iwatani Corporation (8088), Europe and South Korea have followed suit. The Government of Japan has set a maximum hydrogen procurement quantity of 3 million tons by 2030 at a cost of 30 yen/Nm3 (less than 1/3 of the current selling price) and 20 million tons by 2050 at a cost of under 30 yen/Nm3. In the future, Japan is expected to build a CO2-free supply chain of hydrogen, in which it has a competitive advantage. Furthermore, as the Japanese automobile industry struggles with EVs, it is expected to be offset by FCVs that use hydrogen for commercial vehicles, such as trucks which are used for long-distance hauling, something that EVs have not been able to accomplish.

4. Challenges for achieving carbon neutrality

In order to achieve carbon neutrality by 2050, Japan needs inexpensive energy technologies (for renewable energy, hydrogen, carbon recycling, etc.) that lead to decarbonisation as well as a strong digital infrastructure that supports its green growth strategy. For example, by increasing dependence on renewable energy in the future, it will be necessary to have an advanced digital infrastructure that efficiently adjusts the supply and demand of solar and wind power, whose output fluctuates depending on the weather. The green growth strategy and the digital infrastructure need to go hand in hand, like both sides of car wheels working in perfect harmony, and broad industry sectors needs to be involved for technological development.

In addition, strong incentives to promote decarbonisation will be needed to achieve carbon neutrality by 2050. We believe that the government should take the initiative to reinforce the framework (such as carbon taxation and emissions trading). Japan has already introduced a "global warming countermeasure tax (equivalent to a carbon emission tax)" in 2012, but the tax rate is low at 289 yen per ton of CO2 emission. According to the World Bank data, it is the fourth lowest among the 25 comparable countries, which is equivalent to 2% of the highest rate set by Sweden. At present, it is hard to say that incentives are working sufficiently toward decarbonisation, and raising the tax rate may be a consideration.

Furthermore, while achieving carbon neutrality requires a large-scale investment in renewable energy, the renewable energy levy has already been increased, and a further increase may cause a taxpayer’s revolt. Thus, we need to figure out the extent of the cost burden that society is willing to accept.

Finally, once carbon neutrality has been achieved, it is likely that the industrial structure will have changed significantly from the past. How can workers who were employed in traditional industries be successfully shifted to new industries? The President of Toyota Motor also raised this issue with the government, which has announced policy shifts to EVs and gasoline-free vehicles, saying, "If you do not come up with an appropriate electrification policy, we will not be able to maintain employment." There is also a high level of awareness on issues in the industry on maintaining competitiveness and switching to next-generation products. In the future, decarbonisation may eliminate the need for a supply chain built for gasoline-powered vehicles. As Japan has employees in a wide range of industry sectors that would be affected by the disappearance of gasoline-powered vehicles, the government and industry must work together for the smooth transformation of the industry.