For example, when it comes to fashion, during the bubble period in the late 1980s, it was necessary to spend money to enjoy trendy and high-quality items. However, around the year 2000, fast fashion began to emerge, and consumers had a wider range of choices. Therefore, the notion that all good things are expensive don’t hold true anymore, and spending money became less of a symbol of high status. As a result, it seems that the value of owning expensive things has diminished.

In addition, some consumers now think that a minimalist who owns and lives on a minimum number of goods is better than a life surrounded by many goods.

(2) Innovation in information and communication technology

We can attribute the fact that consumers do not have to buy goods, to innovation in information and communication technology. According to the Ministry of Internal Affairs and Communications, the internet penetration rate of households was only 9.2% in 1997, but has reached 79.8% in 2018. In particular, the digital native generation grew up with a familiarity of the internet and SNS, with personal computers and mobile phones close at hand since their childhood. With the increase in games and communication tools that can be enjoyed for free, the consumer attitude of "I do not need to buy goods” and “I can enjoy life without spending money” is likely to be increasing.

3. Instead of buying goods, consumers have come to buy services (experience) (1) Increase in experiential consumption

The second factor behind the shift “from owing to using” is that instead of buying goods, consumers have come to buy services (experience) In other words, spending patterns have changed.

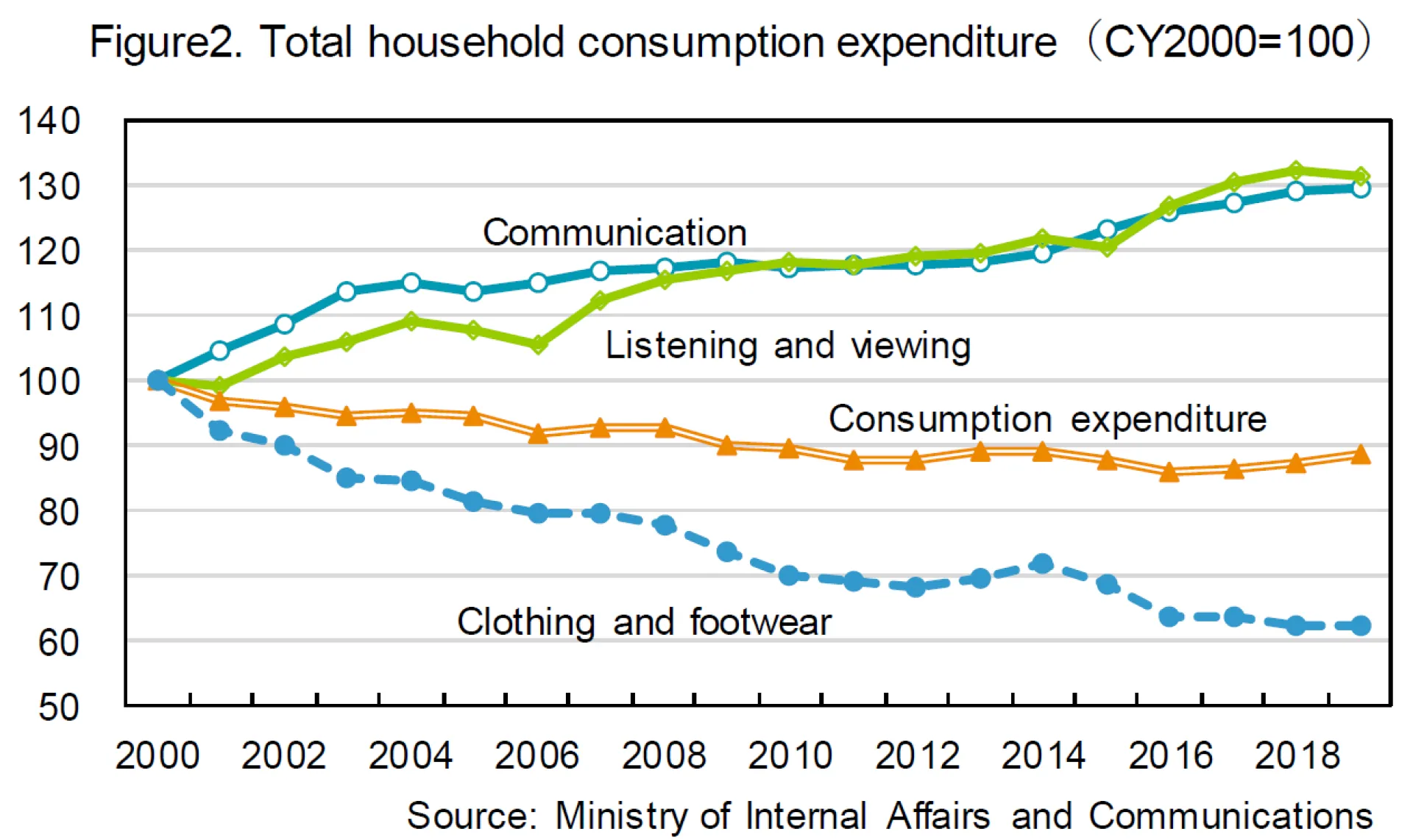

According to the Ministry of Internal Affairs and Communications, total household consumption expenditures fell to 88.8 in 2019 (Base of 100 in 2000), whilstt that of goods, "clothing and footwear," fell to 62.6(see Figure2). On the other hand, the service of “listening and viewing” rose to 131.5, and “communication” rose to 129.9.

(2) Converting goods to digital content services

With the advancement of the digitalisation of goods, consumers who use digital content services instead of owning goods are increasing. For example, at present, the subscription of music CDs, movie DVDs, and magazines by mobile terminals such as smartphones is becoming mainstream. In this case, consumption expenditure is recorded as a communication service. Subscriptions of cars, furniture, and clothing are also counted as service consumption. Also, in recent years, the spread of sharing services has accelerated the change in consumption behavior, such as "beginning to buy services" instead of goods. With the spread of intermediary services for sharing goods with many people, such as car and bicycle sharing services, the need for individuals to own goods for themselves has been reduced.

4.Conclusion - Sustained change “from owning to using”

In this commentary, we will point out two factors regarding the change in consumption “from owning to using”, 1) the need to buy things has decreased, 2) consumers have come to buy services instead of buying goods. We have looked at each situation. We believe that the “from owning to using” trend will continue.

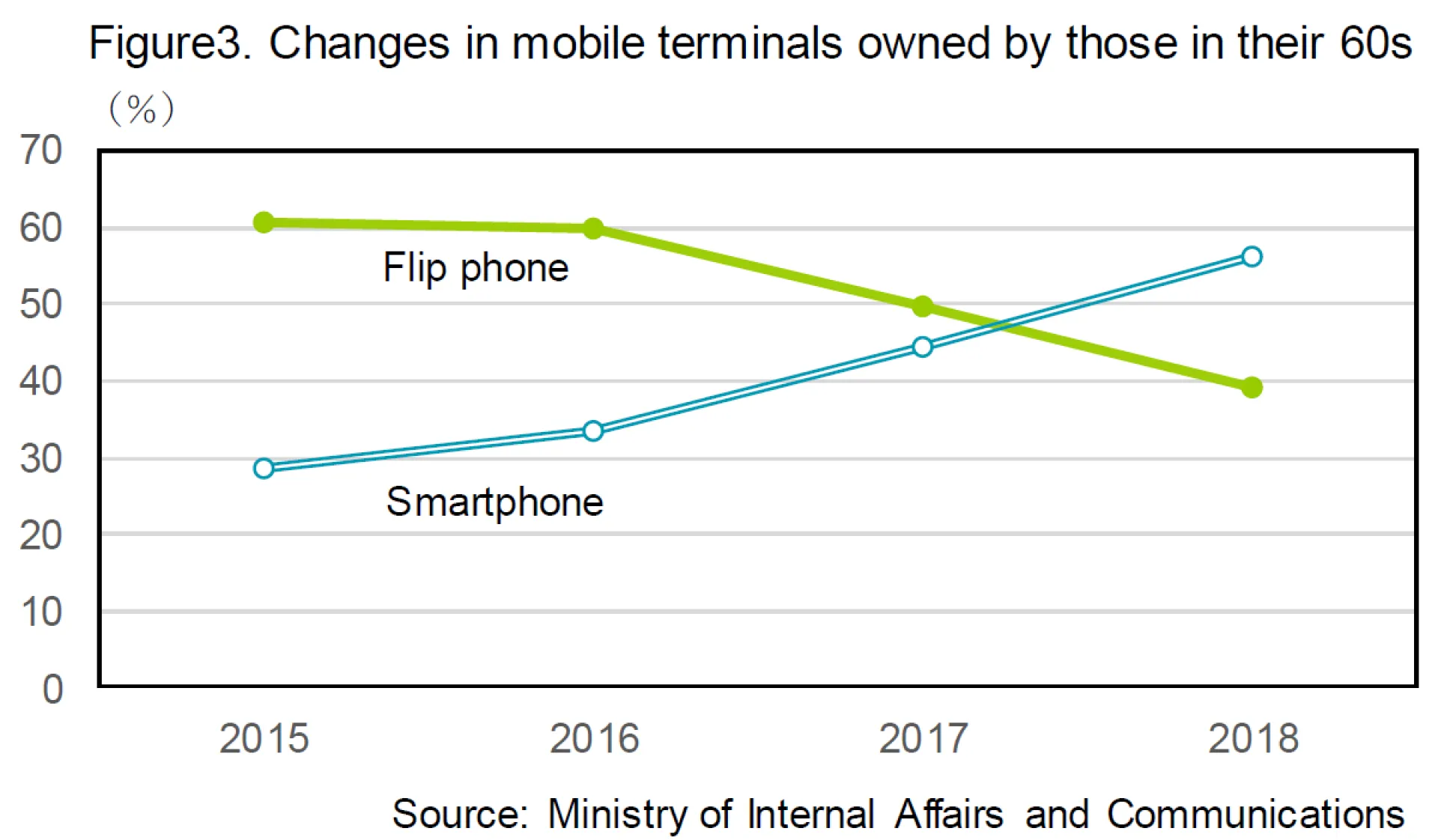

In particular, with regard to 2), we are paying attention to the trend toward the consumption of digital content services, which is seen in subscription services. At present, the use of subscriptions is thought to be mainly for the younger generation, but the use of smartphones by seniors is increasing more than the flip phone (see Figure 3), and it is expected that the use of subscriptions will also spread among seniors in the future.

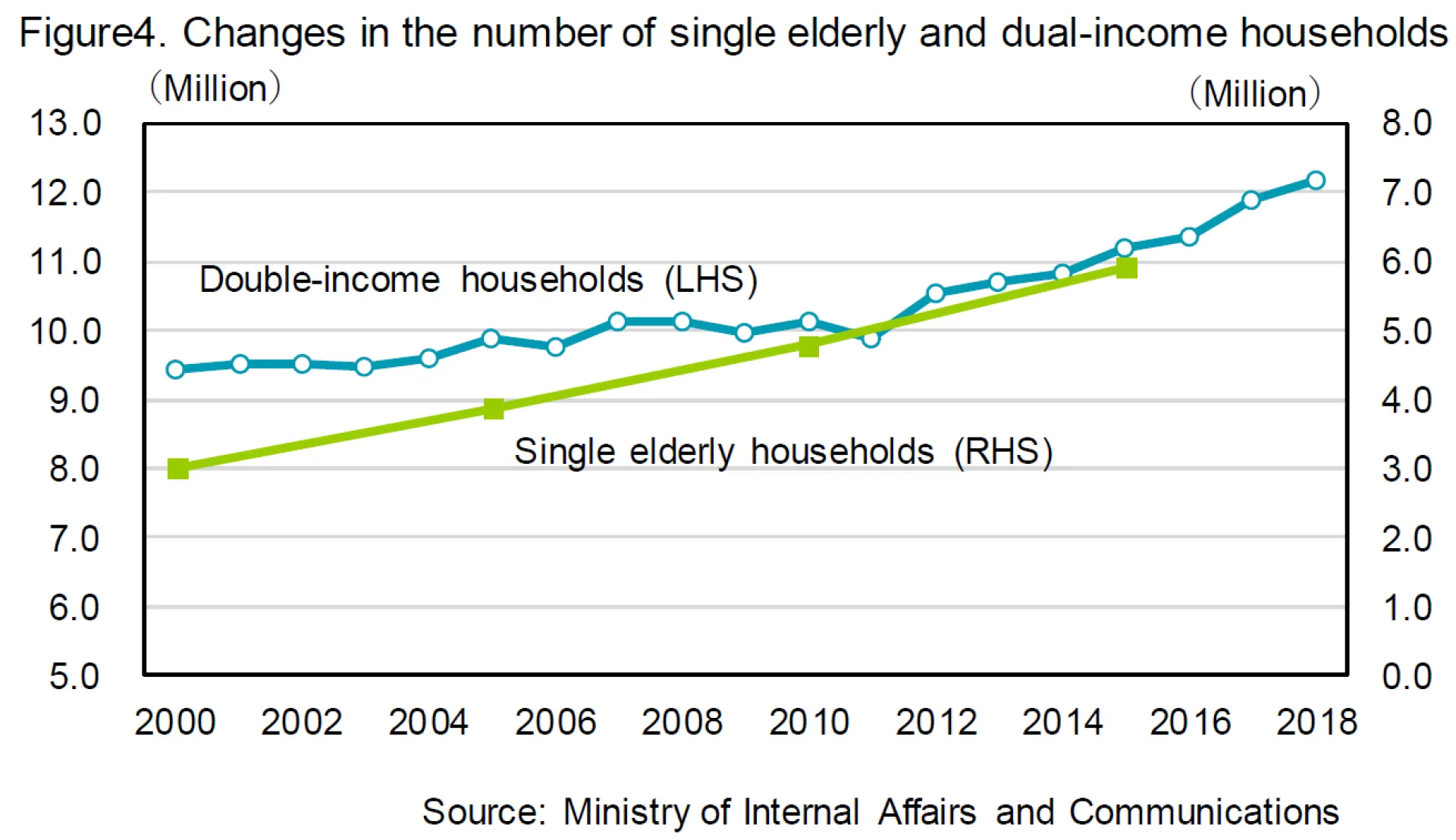

The increase in the number of households with strong demand for services has also accelerated the trend of "buying services" rather than goods. In Japan, the number of single elderly and dual-income households is increasing and is expected to continue to rise in the future (see Figure 4). In both cases, there is a shortage of workers at home, and for example, there is a strong demand for housekeeping services (including catering services) and pick-up services for children.

In this way, we believe that the change in consumption “from owing to using” will continue and penetrate not only amongst young people but also for a wide range of Japanese people.

In the following, we will introduce experiential consumption, subscription, and sharing service related stocks that we are paying attention to.

Bushiroad (7803)

As an IP (Intellectual Property) developer that acquires and develops high-quality IP, the company develops its business with the mission of "creating entertainment for a new generation". The company has been successful in launching live music activities using popular voice actors, broadcasting anime, selling the goods, and revitalizing the sluggish “New Japan Pro-Wrestling”. By continuing to develop and distribute new IP, the company is expected to expand service sales not only in Japan but also globally.

Sansan (4443)

Sansan is the largest business card management service company in Japan, with a focus on the corporate business card management service, "Sansan", and its main revenue source is subscription income. By visualizing and sharing internal network information through business card management, the company helps client companies improve labor productivity.

Its strength is the accuracy and speed of converting business card data, and 99.9% input accuracy has been achieved by combining machine and human visual observation. In addition, continuous reduction of business card data costs using AI is a barrier to entry into the business card management market.

Park24 (4666)

The company has a car sharing service called "Times Car Plus", and its competitiveness is overwhelming in Japan due to synergies with the existing parking lot business. The probability of long-term profit growth will continue to rise with the increase in vehicles compatible with car sharing. In addition, the company has announced an alliance with Toyota in collecting car share data and is expected to develop not only the sharing business but also full-scale utilization of data.