2. Future outlook: The pace of recovery is expected to slow down, although the worst is over

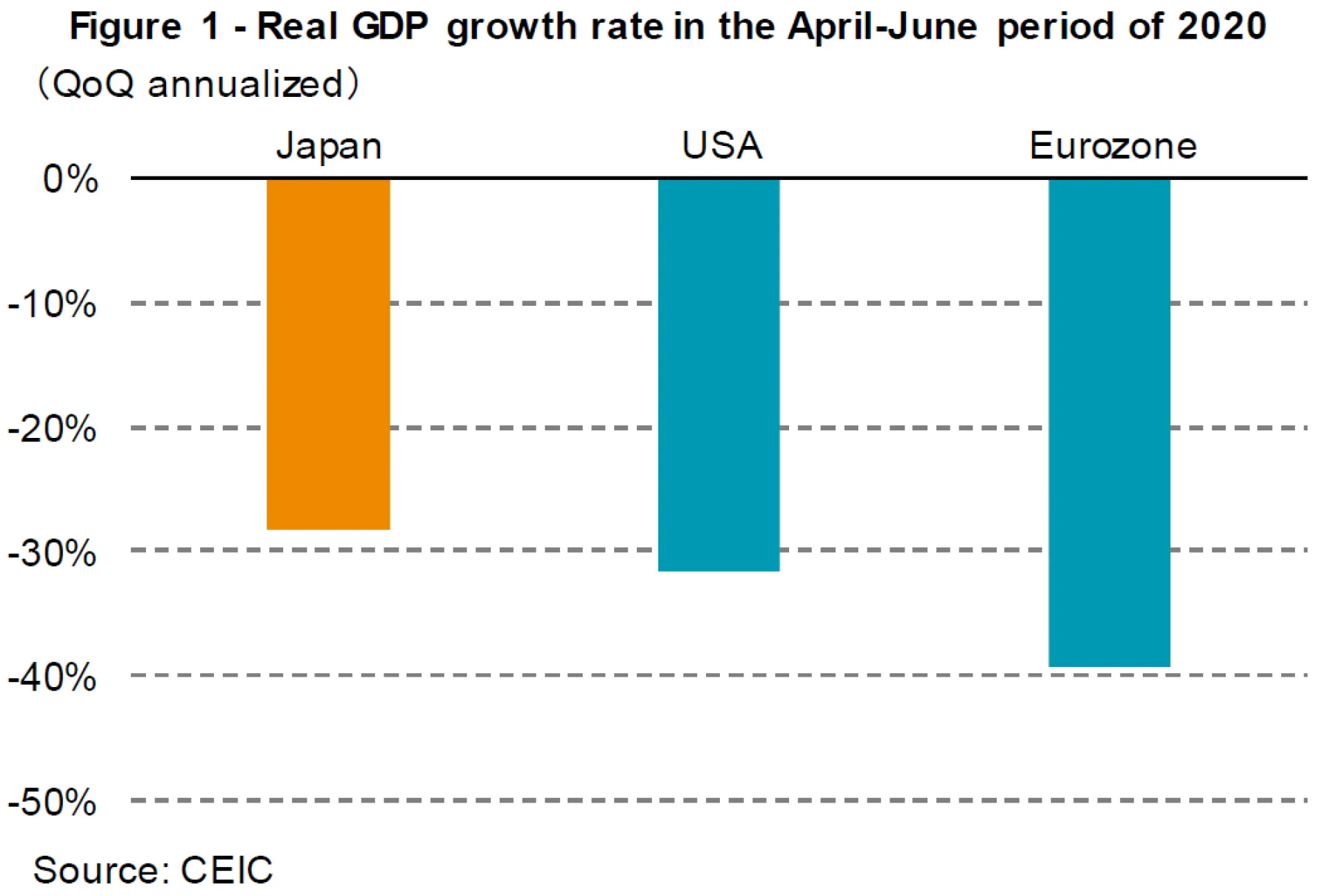

The real GDP growth rate of this economy is projected to be -5.6% in FY 2020 and +2.9% in FY 2021. It is assumed that real GDP forecast will recover gradually from October-December, after recovering about half the decline from pre-COVID-19 (end of 2019) in July-September. Recovery of real GDP to pre-COVID-19 levels will not be until the latter half of FY 2022.

It should be noted that the second emergency declaration and the lockdown seen in other countries are not included. We are out of the emergency period, when the world was inexperienced in tackling COVID-19. Going forward, employment and wages, and capex by corporations will become important in predicting the pace of recovery.

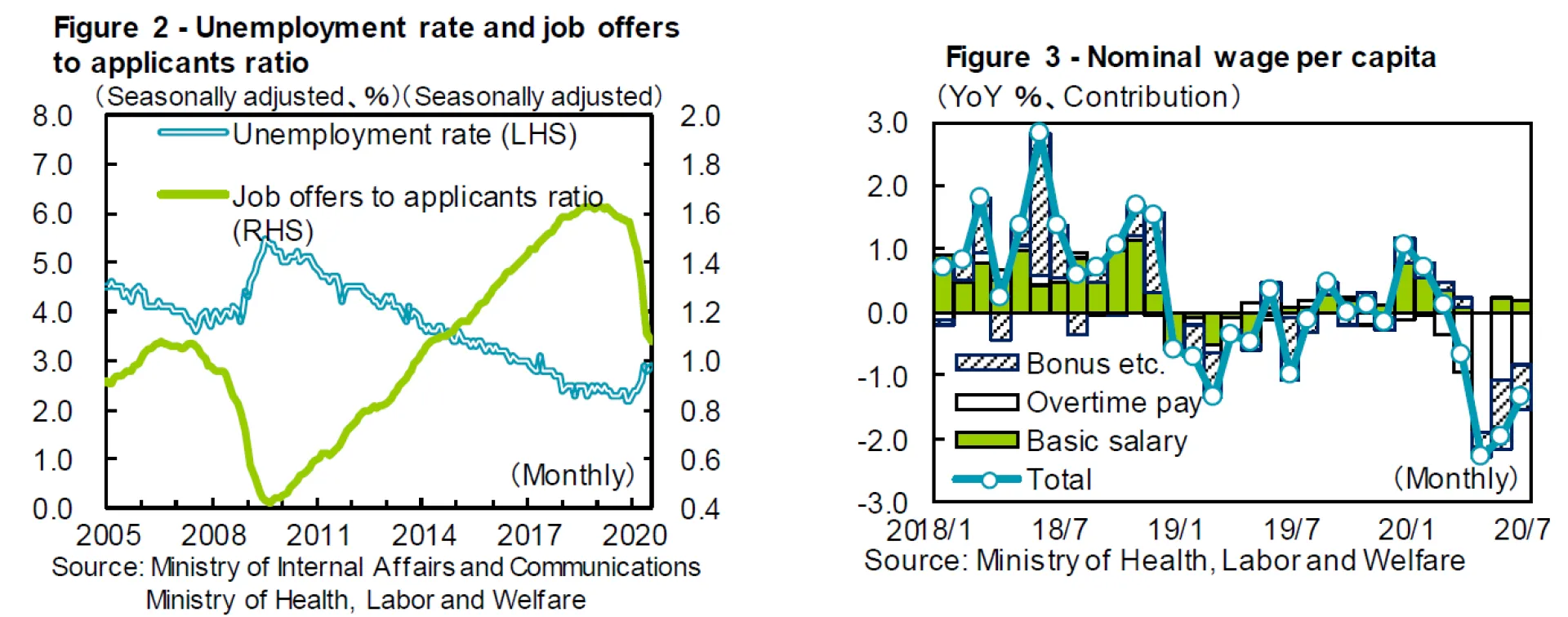

In the labor market, employment and wages, which are key to the recovery of consumption, are deteriorating. The ratio of job offers to applicants, which indicates labor supply and demand, plummeted in 2020 (Figure 2). The reason for this decrease is that companies have reduced the number of job vacancies by about 25% since the end of last year as they did not anticipate the recovery of demand. By industry, the number of job vacancies in the manufacturing industry, lifestyle-related services, entertainment, accommodation, restaurants, wholesale, retail, transportation and postal services is remarkable. As of July, the number of employees had decreased by 1.17 million since the end of last year, and it is believed that there were some who became unemployed to avoid infection risks in addition to those who were laid-off (+440,000). As it is difficult to expect a V-shaped recovery, the unemployment rate is projected to rise from 2.9% as of July (+0.6% pts YoY) to around 3.5% by the end of the year.

Nominal wages are under downward pressure against the backdrop of declining corporate earnings and labor demand (Figure 3). In April-June, the fall in overtime allowances mainly pushed down wages against the backdrop of stay-at-home policy, but it is expected that bonuses from winter 2020 onwards will deteriorate significantly reflecting poor corporate earnings. Also, in the spring labor offensive of 2020, the rate of wage increase (including the fixed portion) fell below the previous year's level. Furthermore, the minimum wage remains unchanged in 7 prefectures, with a slight increase of JPY 1 to 3 in 40 prefectures. As a result, the per capita nominal wage in 2020 is forecast to fall by 1.1% compared to the previous year.

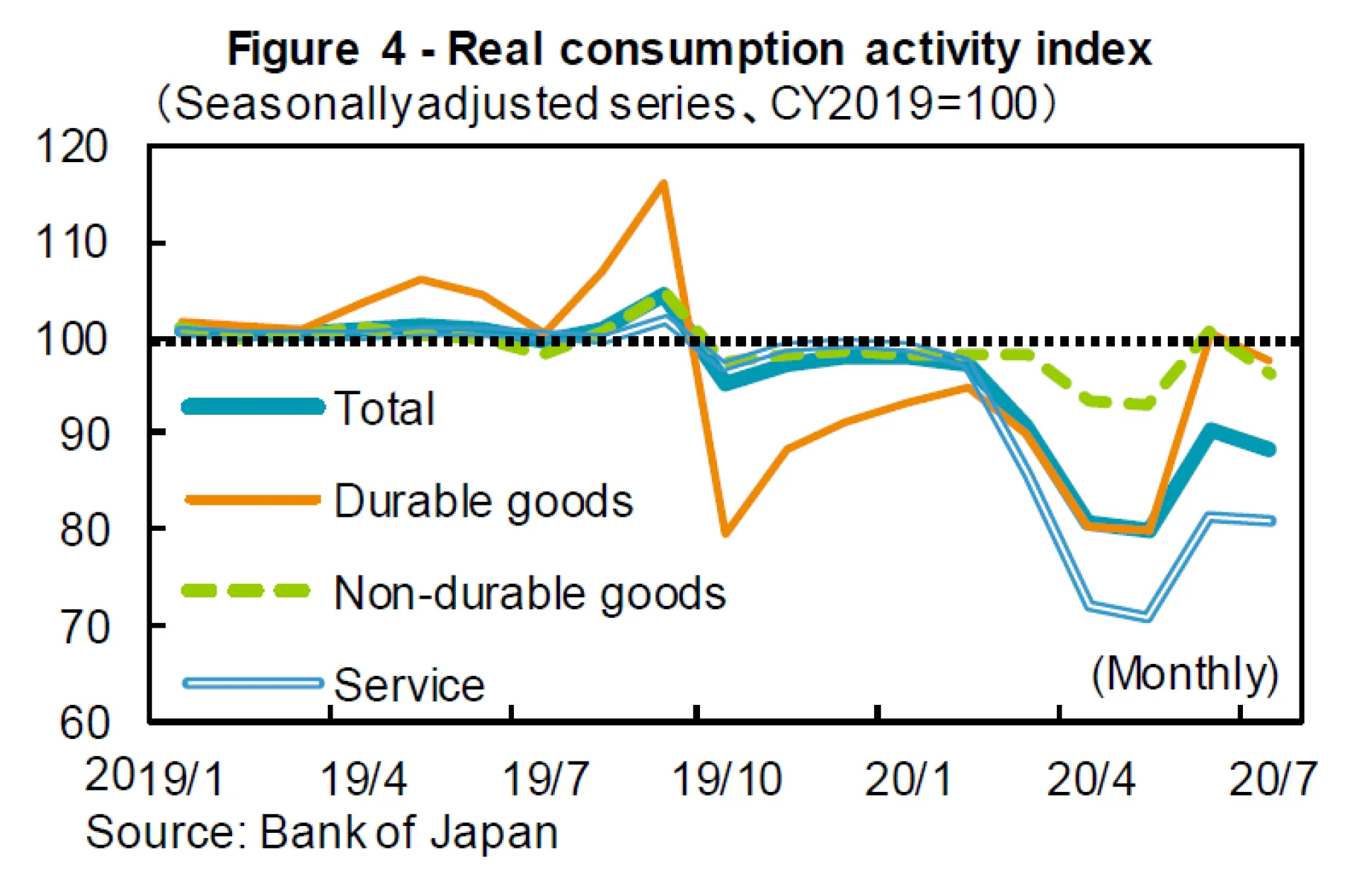

Looking at demand by item, first, personal consumption is forecasted to be -4.8% in FY 2020 and +3.3% in FY 2021. Looking at consumption as a whole under the Real Consumption Activity Index, it fell by about 20% in April-May YoY. It then bottomed out as economic activity gradually resumed. In June, the decline was less severe as it fell by 9% YoY but dipped by 12% in July YoY (Figure 4). In the July-September period, because consumption was strong until the end of June, the recovery should be larger compared to the previous quarter, but the recovery of people going out will be slower after July, due to the 2nd wave of COVID-19. As a result, the pace of recovery in consumption is expected to slow down.

The special cash payment of JPY 100,000 per citizen had a distribution rate of 98.9% as of August 28, which temporarily boosted household income and had an effect on sales of home appliances. However, the recovery in consumer sentiment has been slower since the 2nd wave began spreading in July, and employment and wages have deteriorated. Most of the special cash payments have gone into savings, and the effect of boosting consumption in FY 2020 is estimated to be around +1.1%.

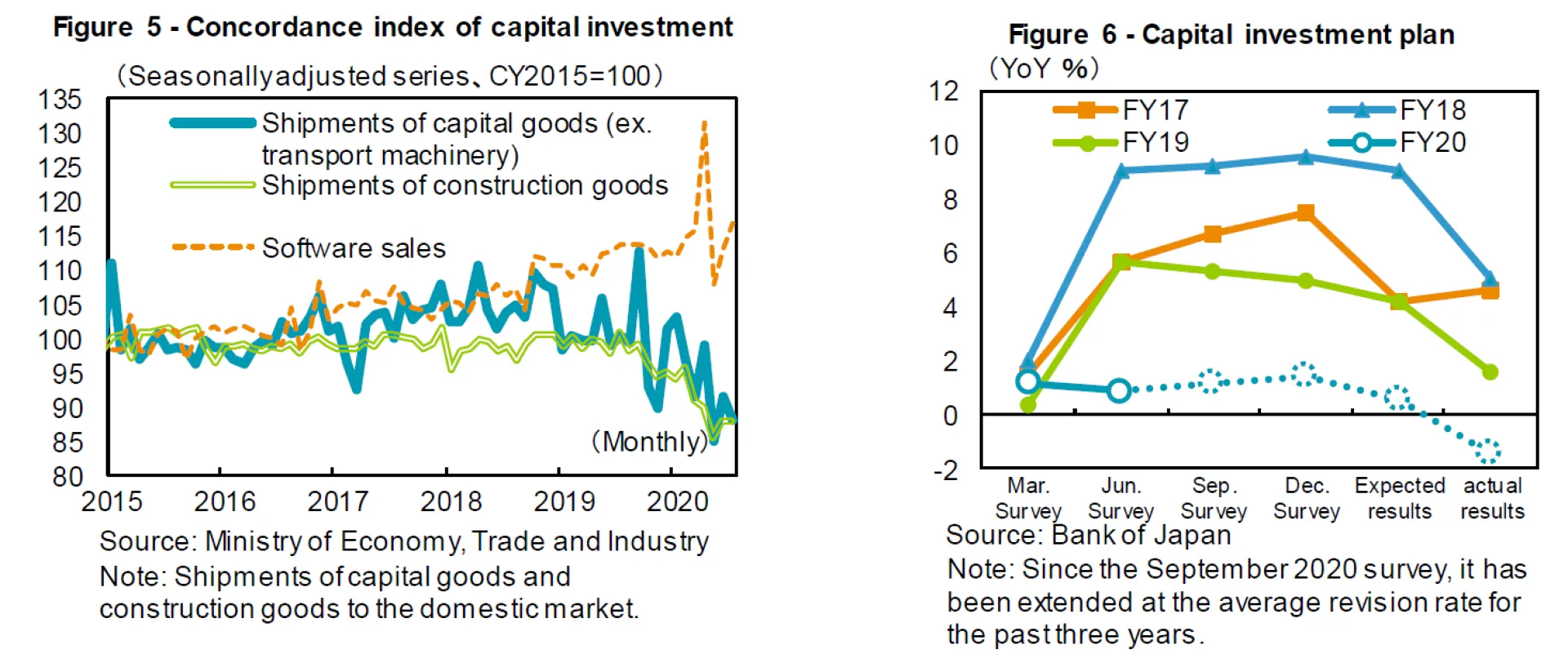

Capital investment is forecast to be -5.5% in FY 2020 and +2.1% in FY 2021. With uncertainty in the domestic and foreign demand outlook, and as the end of COVID-19 is nowhere in sight, companies cannot take steps to aggressively expand their facilities. In the April-June quarter, although software investment was firm against the backdrop of telework and digitization, shipments of capital goods (excluding transportation machinery) and construction goods, continued to decline. Thus, there are no signs of a rebound in machinery and construction investment (Figure 5). Future capital investment will continue to decline in the July- September quarter, and is expected to pick up from the October-December quarter. The Bank of Japan's Tankan's FY 2020 capital investment plan for Japanese companies is extremely low compared to a typical June survey, and based on the average revision pattern in the past, capital investment for full year FY 2020 is expected to be negative year-on-year (Figure 6).

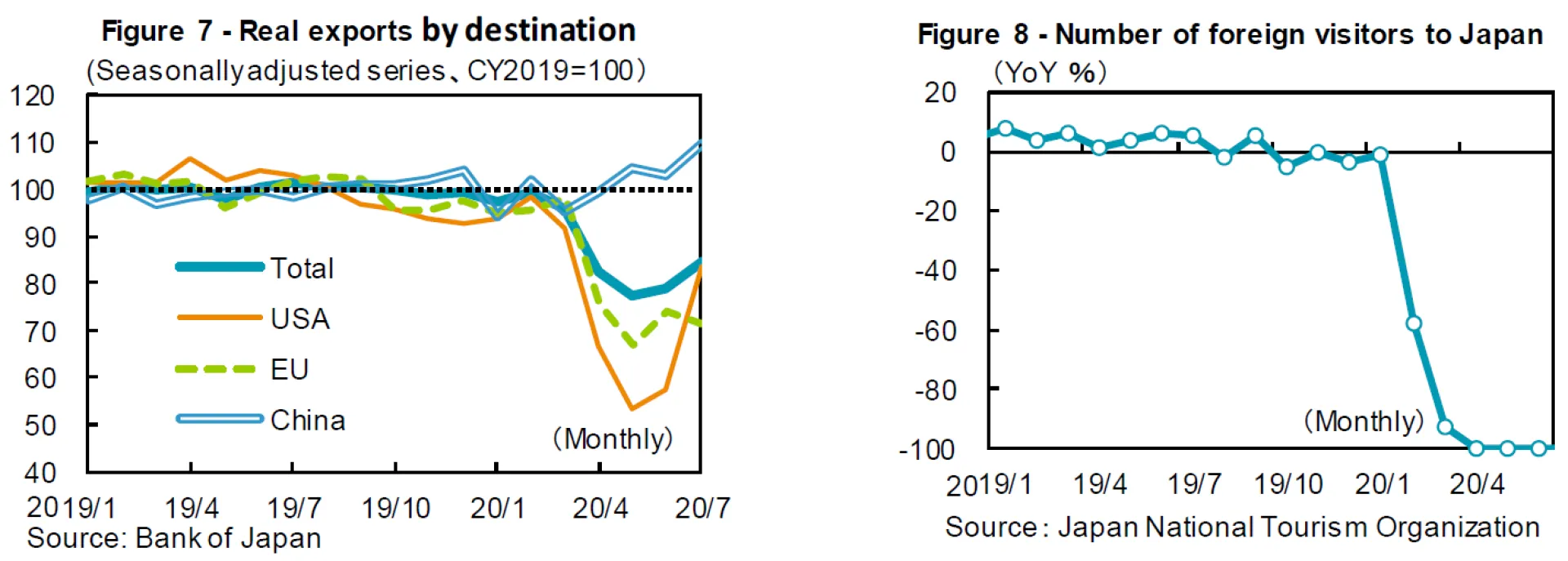

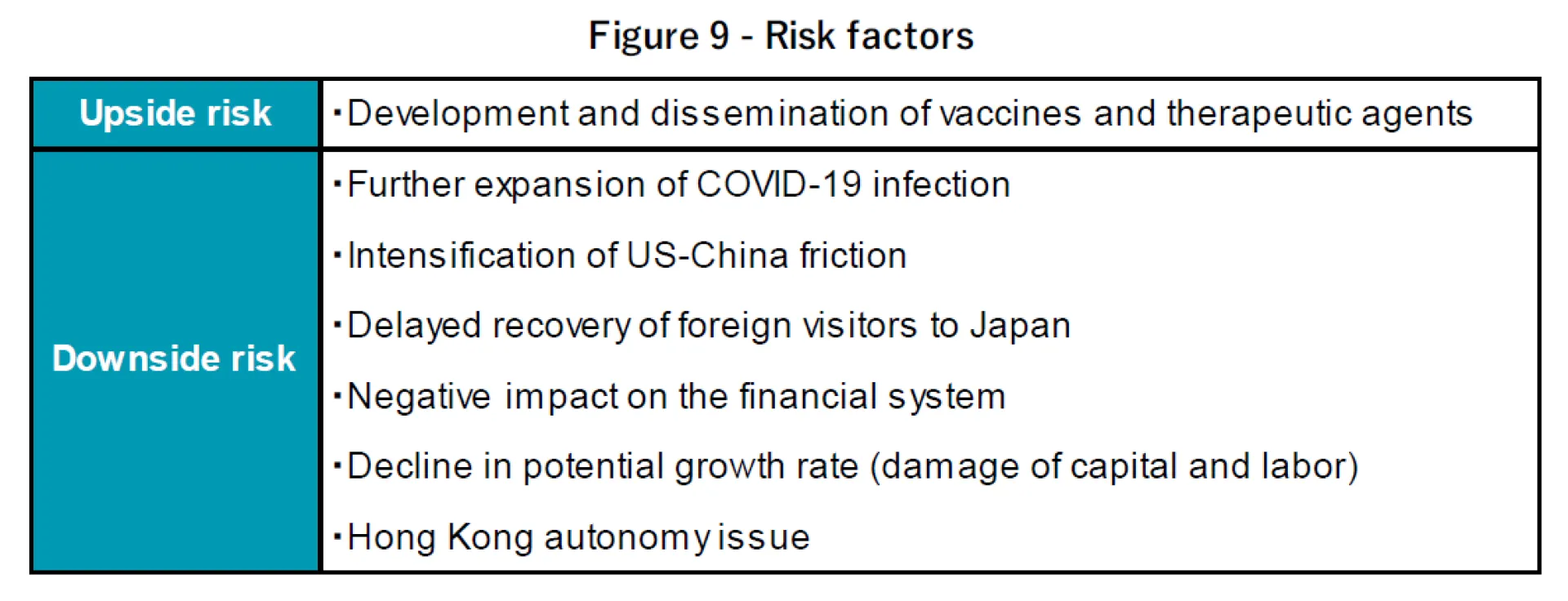

Exports are forecasted to be -16.6% YoY in FY 2020 and +8.5% YoY in FY 2021. Exports of goods fell 3 consecutive months until May amid restrictions on economic activity overseas, but increased in June and July as economic activity resumed (Figure 7). By country, exports to China, which managed to contain COVID-19 by March, exceeded the previous year's level, while exports to the US and EU remain below year-on-year levels due to weak exports of transportation equipment and general machinery. From the July-September period onward, it is expected that exports of goods will pick up as countries gradually resume economic activity. However, strict immigration restrictions and reductions in international air flights continue, including Japan, and the number of foreign visitors to Japan has almost evaporated (Figure 8). Therefore, service exports, including inbound consumption, cannot be expected to recover for the time being compared to goods exports.

3. Plenty of downside risks

With respect to the future outlook, the downside risk continues to be high (Figure 9). The 2nd wave of COVID-19 became apparent, and the recovery of people going out has slowed down. Until vaccines and therapeutic agents become widespread, infections may continue to spread and converge intermittently, hindering the resumption of economic activity. In addition, as the US presidential election approaches, President Trump's hardline stance towards China has toughened, and the US-China conflict is steadily intensifying. The target for sanctions includes Chinese-owned individual IT companies.

In addition, the conflict in Hong Kong will continue to be a risk factor. With the enforcement of the "Hong Kong National Security Law" on June 30, the international community has condemned China. It goes without saying that the United States will use it as a source of criticism against China, and countries such as Britain, Australia, Canada and New Zealand have also raised their criticism against China by suspending extradition treaties with Hong Kong. If international trade stagnates due to the conflict between Western countries and China, it will further delay the recovery of the economy deteriorated by COVID-19. If these risks become apparent, the recovery of people's outings and exports will be further delayed, and economic activity may stagnate for a long time.

4. Impact of the new Prime Minister on the economic outlook

Yoshihide Suga was nominated the new prime minister in both houses of the Diet on September 16. Prime Minister Suga has a track record of supporting the longest administration in the history of constitutional administration as Chief Cabinet Secretary of the Abe Cabinet, and it is only natural to think that his basic policy stance will continue along the line of Abenomics. Monetary policy, which is the main pillar of Abenomics, will not change significantly given that BOJ Governor Kuroda's term in office is until March 2023. The consensus is that it is necessary to continue with the accommodative monetary policy and expansive fiscal policy for the time being in order to support the economy damaged by COVID-19, and Prime Minister Suga will adopt policies in line with that consensus.

The term of office for the House of Representatives is until October 2021, and a general election must be held by that time, but it is thought that Prime Minister Suga will take measures that is widely accepted by the masses in order to gain widespread support. The new prime minister has urged telecommunications companies to reduce mobile phone charges since he was the Minister of Internal Affairs and Communications, but there is the possibility that he will strongly push for this in order to gain widespread public support. The reduction of mobile phone charges, which is said to be high internationally, may have a positive impact on the development and popularization of new services that utilize communications, and is desirable from the perspective of fostering new industries.