(1) The Global Economic Outlook

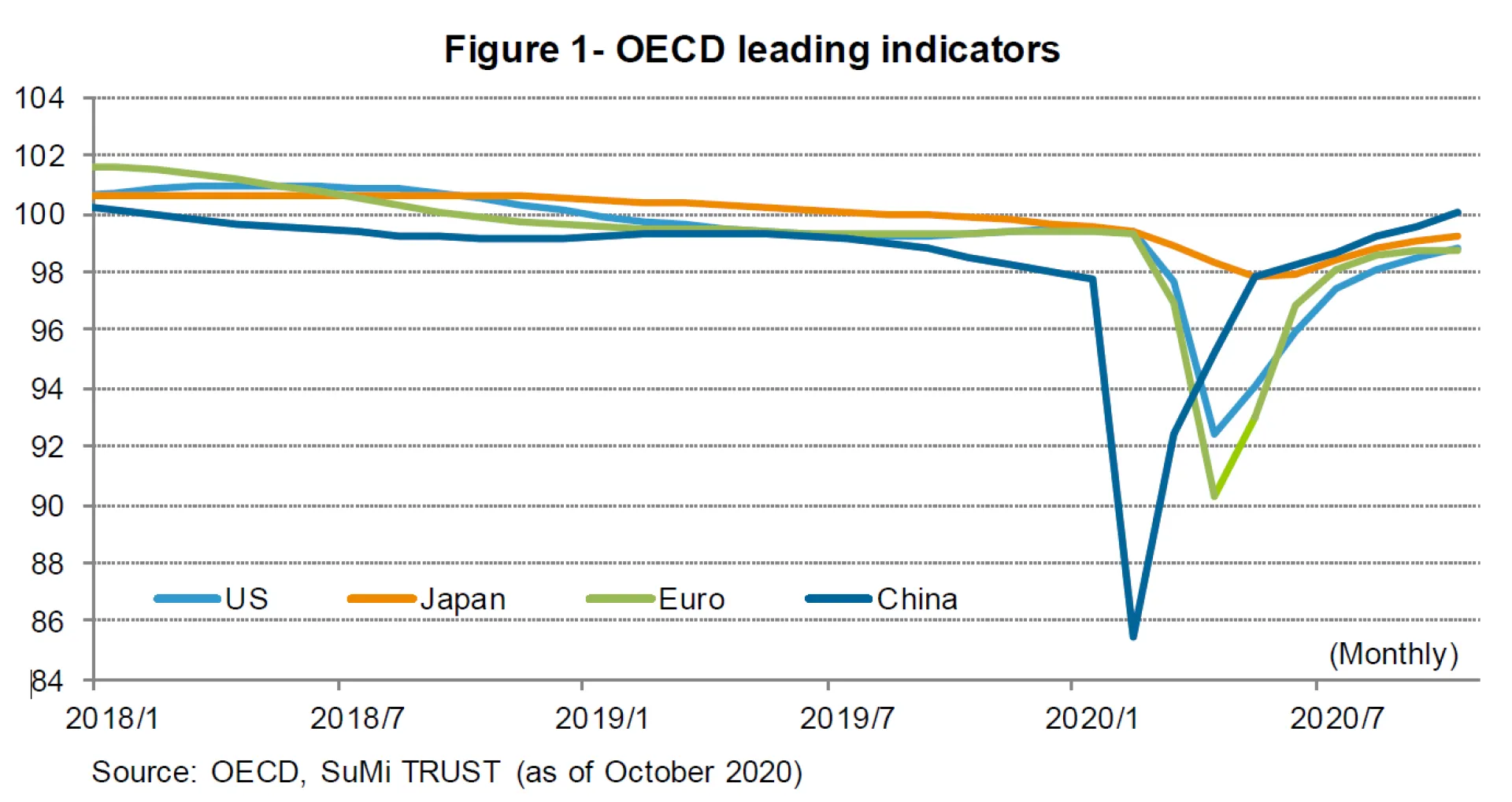

2020 has been a year of COVID-19 spreading like wildfire around the world. Whilst the global economy took a dive in the first half of the year, the second half saw a gradual easing of lockdowns and a rapid move towards the normalization of the economy. Most notable has been the recovery and leadership of the Chinese economy (Figure 1).

While the world awaits a vaccine, we believe that once announced, it will take some time for it to penetrate the masses. And while we see a further move towards normalization in 2021, social distancing and infection prevention should dampen productivity. Thus, we see at best a modest recovery in 2021 and a continuation of accommodative monetary policy and expansionary fiscal policy. Should the penetration of the vaccine goes as planned, we could see an acceleration of economic activity towards the latter half of 2021 with the service sector leading the way.

We believe that China, which has managed to control the spread of COVID-19, and other Asian nations (including Japan) will lead the global economic recovery in 2021. On the other hand, Europe, which has seen a sharp rise in cases and a further round of lockdowns, should see a lag in its recovery.

(2) Outlook for the Japanese Economy

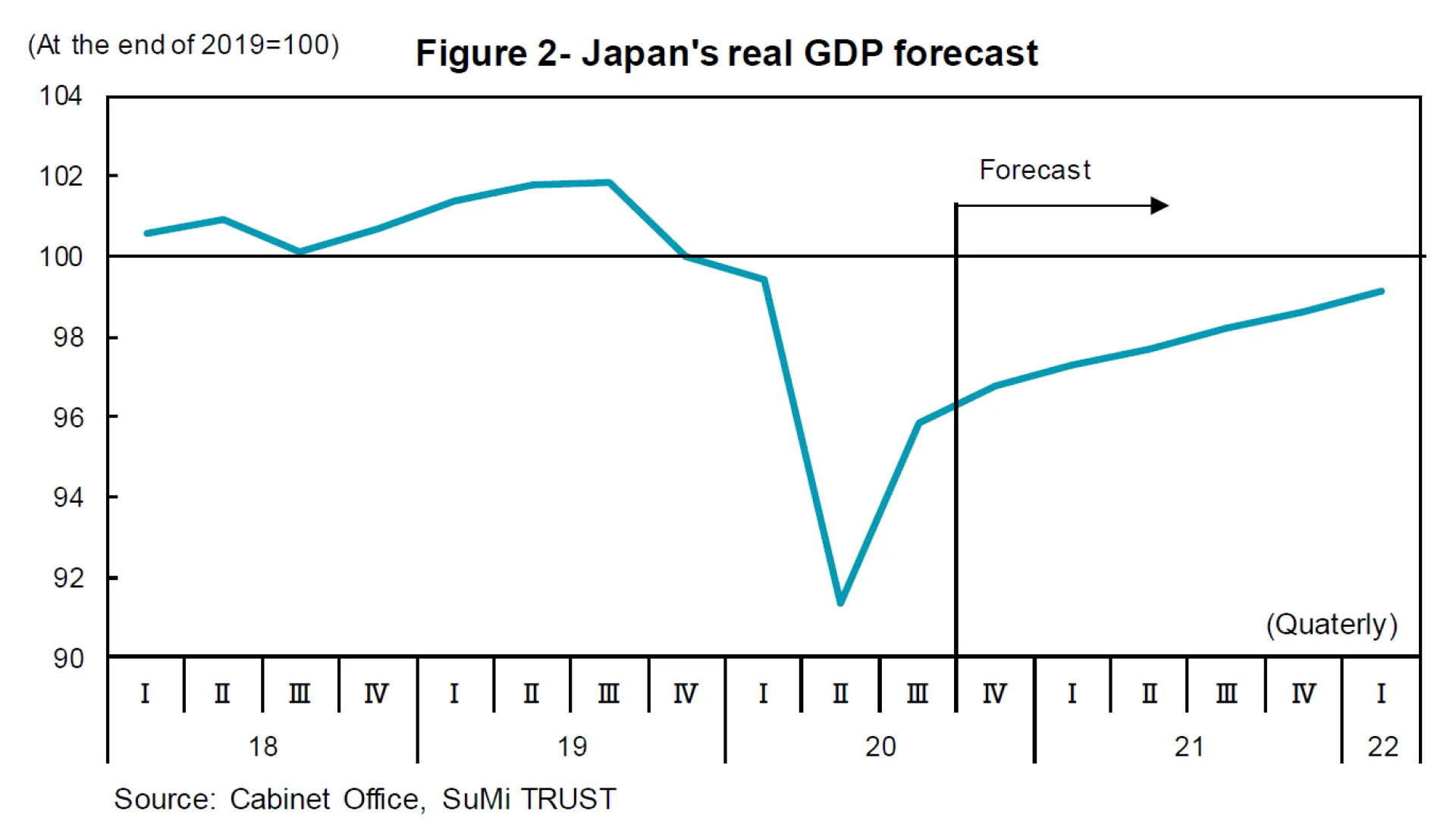

Japan’s real GDP for July-September 2020 was up 21.4% QoQ annualized, the largest increase in recorded history. However, it was a mere reaction to the previous quarter. Economic activity remains sluggish and real GDP is down 5% from the pre-COVID-19 period (i.e. end-2019)

Among segments of the economy, there have been clear winners and losers. We are starting to see an acceleration of trade in goods, but for the service sectors (particularly for those who must meet their clients face-to-face), they have yet to see their clients return. In addition, we have seen sluggish growth in capital expenditure and housing starts among the uncertainty with COVID-19.

Looking on the brighter side, we have seen some positive vaccine trial results since November and there is strong hope for new vaccine approvals. For example, Pfizer’s vaccine is reportedly 90% effective. This was followed by Moderna’s vaccine, and on November 23rd, AstraZeneca announced its vaccine which is 70% effective. While there are still logistical issues, Japan should see high penetration of an effective vaccine by the second half of 2021.

With the 3rd wave of COVID-19, Japan has had to limit “Go To Travel Campaign” (a government led scheme to support tourism and dining out) and this will no doubt slowdown the economy as we go into the first half of 2021. On the other hand, the death rate from COVID-19 has been low and medical facilities, whilst overwhelmed, have not collapsed. Thus, we believe there is little likelihood of an emergency declaration towards the winter season. Japan should manage to get through the winter months through successful virus prevention measures combined with the resumption of economic activities.

With the 2021 Tokyo Summer Olympics fast approaching, we believe that the penetration of an effective vaccine by mid-year coupled with recovery in the service sector should revive the economy. With major sporting events such as the grand slam tennis tournaments, European football games and NBA being held under limited admissions, we believe that the Tokyo Olympic Games will go ahead as scheduled albeit with a limited number of spectators. While inbound tourism demand will remain stagnant, the Olympics should symbolize Japan’s economic recovery.

We forecast Japan’s real GDP growth rate to be -5.4% for FY 2020 (or -5.2% for calendar 2020) and +3.4% for FY 2021 (+2.2% for calendar 2021) (Figure 2). With the slowdown of COVID-19, we expect to see “revenge” consumption and the reactivation of personal consumption, as well as real investments including capital expenditure and housing starts as the uncertainty clears. Meanwhile, exporters should benefit from China’s economic recovery. Accommodative monetary policy and expansionary fiscal policy should also support the Japanese economy.

(3) Outlook for Monetary and Fiscal Policies

For the time being, the negative effects of COVID-19 will continue to remain, so accommodative monetary policy and expansionary fiscal policy will remain under the Suga administration. As a supporter of Abenomics for many years, we believe that Prime Minister Suga leave policy unchanged into 2021.

With regard to monetary policy, no major changes are expected given that BOJ Governor Kuroda's term of office is until April 2023. While the Fed is committed to its zero interest rate policy and inflation above 2% (decided at an extraordinary FOMC meeting on August 27th), the Bank of Japan is also trying to curb pressure on a stronger yen through its ultra-accommodative monetary policy. As COVID-19 persists, it is highly likely that the BOJ’s funding program for SME’s will be extended at least until the end of next year. On the other hand, further lowering negative interest rates will have a detrimental effect on financial institutions, so it is unlikely to be implemented unless the yen strengthens to below 100 yen.

Regarding fiscal policy, we should see a budget of over 100 trillion yen (the largest ever) for FY 2021. The budget will include counter COVID-19 measures, a budget for digitalization which Prime Minister Suga has been focusing on, a budget for reinforcing information and communication system infrastructure with a view to a post-5G era, and robust infrastructure to counter intensifying and frequent natural disasters.

(4) Outlook for the Japanese Stock Market

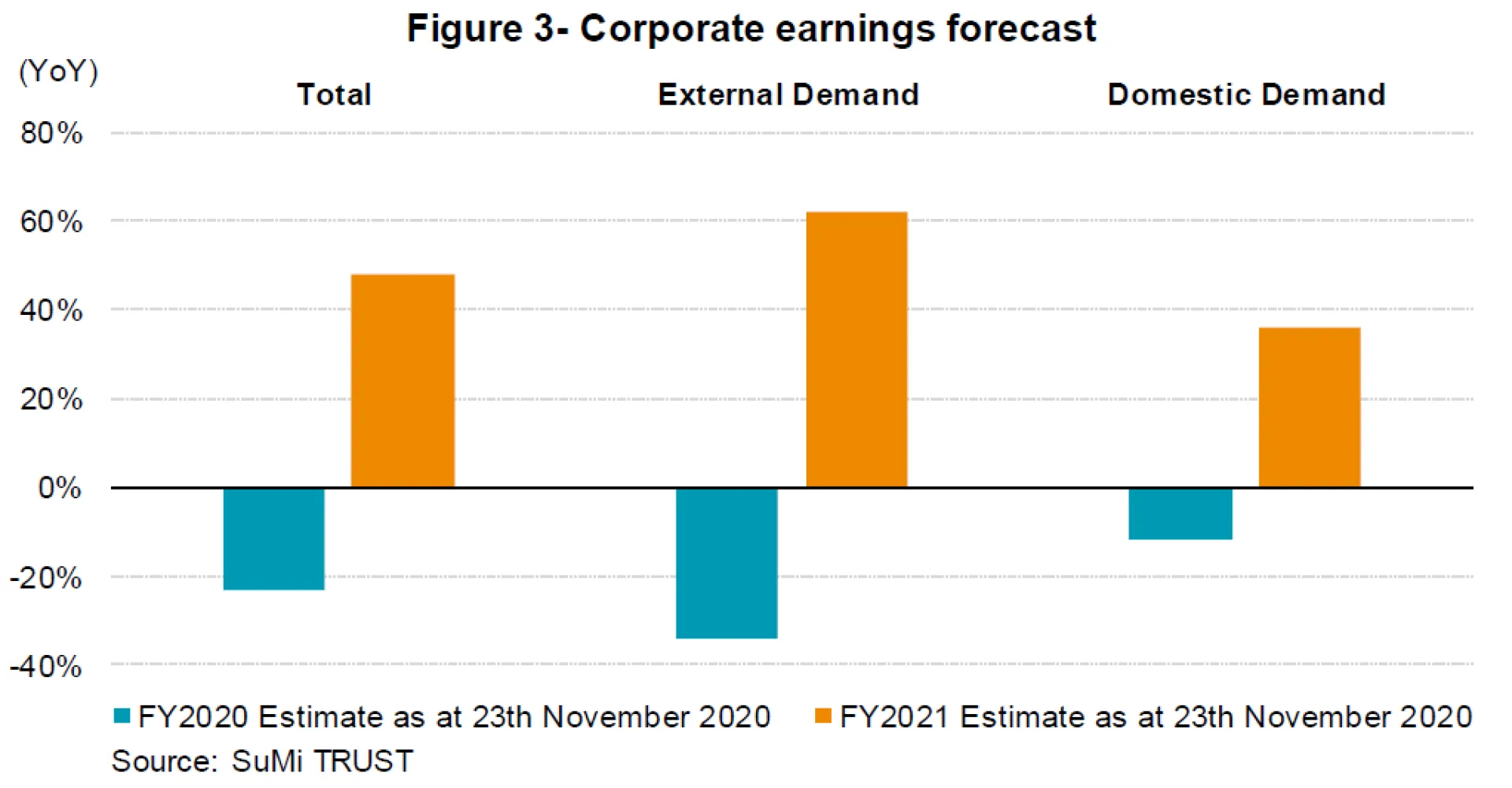

In 2021, we expect the Japanese stock market to remain firm as penetration of a vaccine against the virus, and continued accommodative monetary policy and expansionary fiscal policy on a global scale should gradually lead to a normalization of the economy. In the economic recovery phase, Japanese stocks, which are regarded as cyclical in nature by foreign investors, are likely to be subject to buying pressure led by foreign investors. Although corporate earnings estimation of the Nikkei 225 constituent stocks fell sharply by 23.3% in FY 2020, we expect a significant recovery of +47.8% in FY 2021 (Figure 3). As the low interest rate environment is expected to persist and corporate earnings recover, we should see a shift from bonds to stocks. By the end of next year, we expect the Nikkei 225 to rise to 29,000 and TOPIX to 1,900.

Risk scenarios for the stock market include: (i) ineffectiveness of the vaccine and the end of COVID-19 becomes unclear, (ii) US-China tensions will intensify, and (iii) the Tokyo Olympics Games will be cancelled. Although we are bullish on equities for 2021, we believe that we must be vigilant against these risk factors.

Regarding stock trends, although a short-term value reversal may be seen in the early stages of penetration by a new vaccine, ultra-low interest rates should remain over the course of 2021, and central banks around the world should continue to aggressively purchase assets. Growth will ultimately outperform in such an environment that supplies large amounts of liquidity to the market.

On an individual stock basis, in addition to 5G-related stocks, digitalization-related stocks will be the focus of investors. In particular, Suganomics will focus on areas where digitalization has fallen behind, namely government offices, health care facilities and schools. It is highly likely that related stocks will be sought after. They include NTT Data (9613), a company that should benefit from the digitalization of the government, M3 (2413), which should benefit from the digitalization of health care, and Benesse Holdings (9783) which should benefit from the digitalization of schools.

(5) Summary

While the world awaits a vaccine, it will take some time to penetrate the masses. Thus, we expect a modest recovery of global economy in 2021 at best even if the vaccine is successfully developed. The recovery will be led by China and other Asian countries including Japan where the damage of the pandemic has been limited. There are no choice for the central banks and the governments but to continue accommodative monetary policy and expansionary fiscal policy.

Based on an assumption that the vaccine is delivered to most Japanese people, its economy will gradually recover as personal consumption is expected to rebound. In addition to BOJ’s accommodative monetary policy and expansionary fiscal policy, exports to China and Asian countries, where its economy is expected to recover quicker than other regions, will also contribute positively.

We will see the Nikkei 225 testing 29,000 by end-2021, led by digitalization-related stocks under Suganomics with easy monetary policy and expansionary fiscal policies as well as recovery of corporate earnings. The risk factors are (i) the lack of an effective vaccine, (ii) further US-China tensions, and (iii) cancellation of the Olympic Games. Although we are bullish on equities for 2021, we believe that we must be vigilant against these risk factors.