2. From Heisei to Reiwa - assuming the challenges and the legacy

May 2019 marks the start of a new era, Reiwa (“beautiful harmony” in English). Yet Reiwa is a mere extension of Heisei (the previous era; 1989-2019) and neither the society nor the economy will change abruptly as result of the turn to a new era. Looking back at the Heisei era, we recall the negative undertones as exemplified by the phrase, “the lost two decades”. This stems from Japan’s failure to adapt and respond to the 4 mega trends during the Heisei era - population onus, globalization, digitalization and “financialization”. The Japanese were shaken and stirred with strong feelings of remorse, regret and failure. The 30 years of Heisei left Japan with heavy tasks and issues both in economic and corporate management. But looking back, it has not been all about the “lost” and “strayed”. The Heisei era displayed Japan’s economic endurance, tenacity and flexibility. It also made “new gains” and “held its own” during the era.

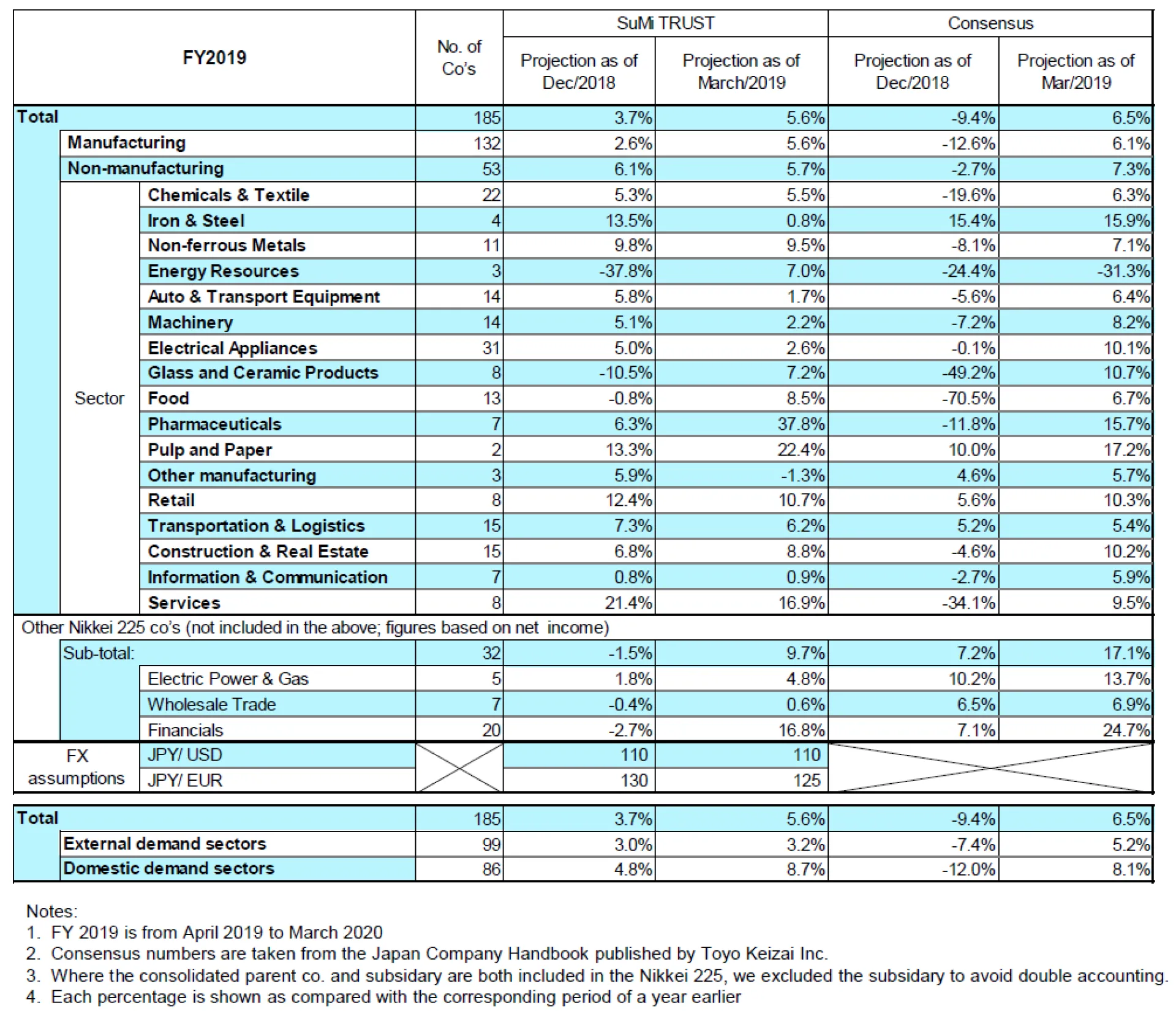

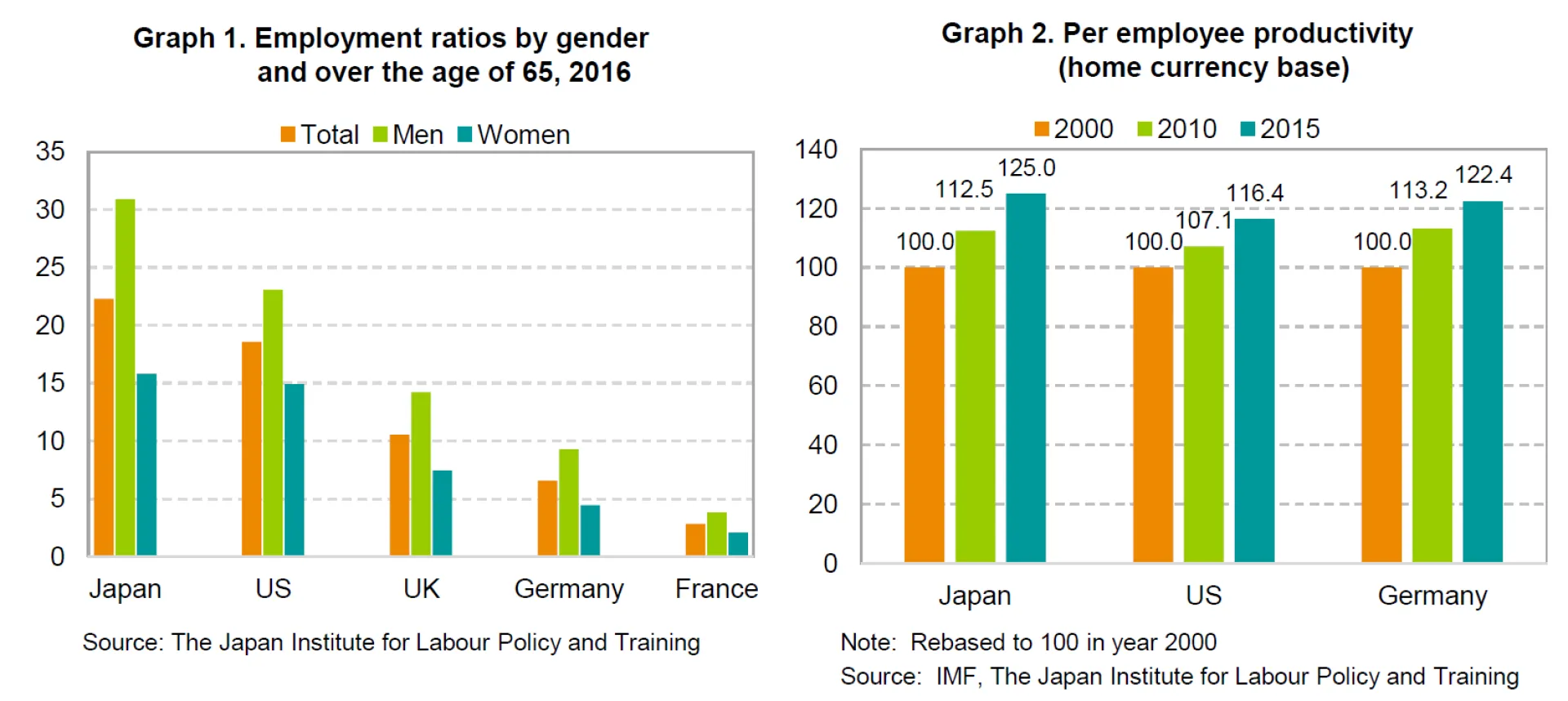

Whilst its working age population has diminished, the increase of seniors and women in the labor force has helped raise Japan’s working population since 2013. The percentage of those over the age of 65 in the workforce (in 2016) was 22% for Japan which was higher than that of the US (19%), Germany (7%) and France (3%) (see Graph 1). There is no other country like Japan where the elderly continue to work with so much energy. Japan’s low productivity has been repeatedly mentioned and its per capita real GDP (USD base) has fallen in rank. However, its per employee productivity (home currency base) ranks higher than that of the US and Germany (see Graph 2). Japan’s labor force remains diligent and industrious, and its productivity level is not inferior by any means. According to the Global Competitiveness rankings (which is determined by the level of productivity of a country by quantifying and synthesizing various factors and drivers) released annually at the World Economic Forum, Japan has been ranked in the top 10 over the past 10 years. Last year, Japan ranked 1st in health, 3rd in ICT adoption, 5th in infrastructure, and 6th in innovation capability. It ranked 5th overall (The US ranked 1st overall, Germany was 3rd, Korea 15th and China 28th.) Whilst Japan lacks the GAFA type companies, it has positioned itself accordingly towards the goal of realizing Society 5.0.

Globalization has created new sources of revenue for the Japanese economy. Two such areas are tourism and foreign investments and loans. The annual number of tourists to Japan now exceeds 30 million and has created a surplus in tourism receipts (It was deep in the red until 10 years ago.) Income from investments and loans have also grown. Tourism contributes to GDP (i.e. export of goods & services) and investment income has boosted GNI (i.e. incomes from abroad).

What is more notable is the stability of Japanese society. In a survey by NHK, Japan‘s national broadcasting company, on the attitudes of Japanese people, the respondents were asked about the level of satisfaction on life in general. A record 92% of respondents answered “satisfied” of “somewhat satisfied”. The income gap has also been held in check in stark contrast to other Western nations where society has become divided and populism is rising. Japan has maintained a high level of social capital (trust and coordination among its citizens which in turn affects productivity and efficiency) The origins of the name, “Reiwa” comes from the Manyoshu, a collection of classic Japanese poetry. It is described by Otomo-no- tabito, a poet, who hosted a banquet at his home, when he wrote the preface of his 32nd poem on the joys of greeting early spring after a harsh winter.

The new era has come after numerous natural disasters, the bursting of the bubble, and the 2008 financial crisis. The start of Reiwa will coincide with, and feature large international events including the Rugby World Cup in 2019 (Reiwa 1), the Tokyo Summer Olympics and Paralympics in 2020 (Reiwa 2), the World Master Games in 2021 (Reiwa 3) and the Osaka & Kansai World Expo in 2025 (Reiwa 7) which should raise the spirit of the nation over the coming years. At the same time, Japan must grapple squarely with, and confront the tasks and issues left from the Heisei era, but also refine the "achievements" and "legacies" from the past and create a peaceful, rich and vibrant society.