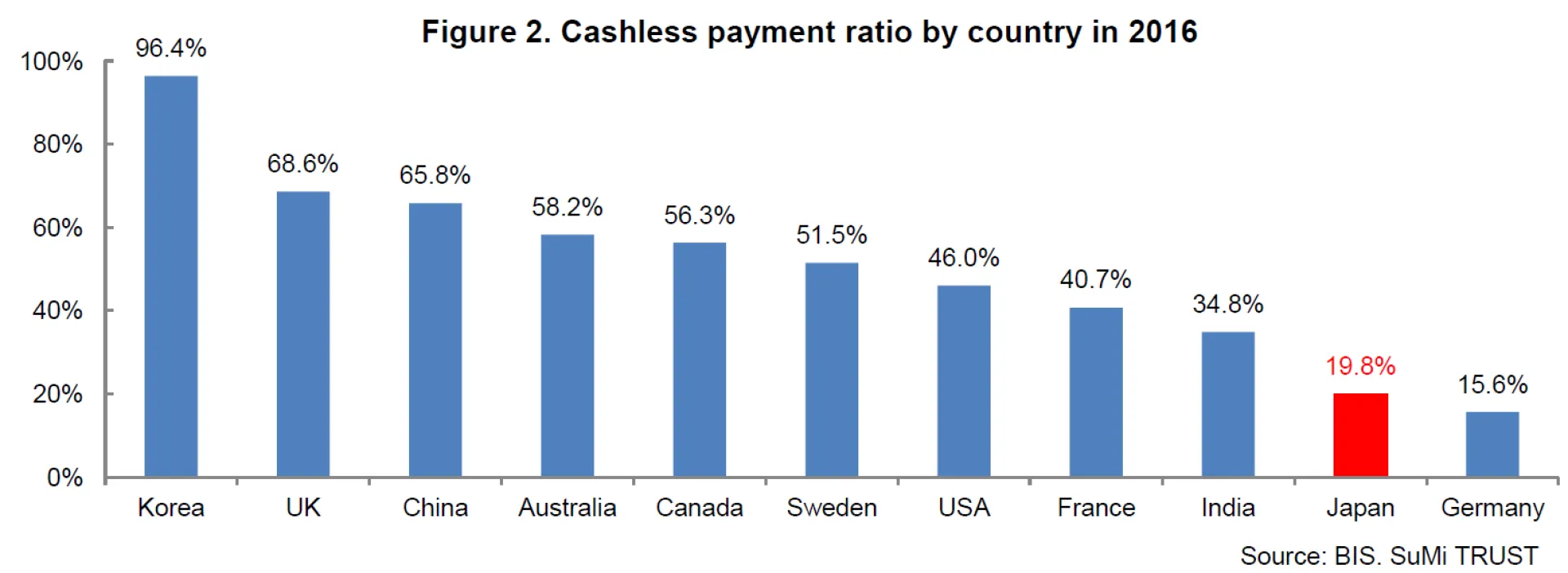

The reasons for this are the low rate of crime including counterfeit currencies and theft, and the low cost of holding cash as interest rates are at record lows. Next, if we calculate the 10% cashless payment ratio (or credit and debit card payment ratio) using “Non-cash payments (which include payments using credit and debit cards, and electronic money) divided by Final consumption expenditure by households”, Japan comes in second from the bottom at 19.8% ahead of Germany’s 15.6%. Korea has the highest ratio at 96.4%, whilst most other Western nations have a 40-60% ratio (See Figure 2).

On the other hand, most Japanese carry a large number of cards each used for different cashless payment purposes. The average Japanese held 8.2 cards (credit, debit and e-money) in 2016, just below Singapore (10.6 cards per person). In stark contrast, the citizens of Sweden and the Netherlands held less than 2 cards on average. In addition, according to a questionnaire conducted by the Japan Bankers Association entitled, “Report on the Payment Means and Services”, most respondents said they used electronic money and cash for purchases under JPY 3,000 and credit cards for amounts above JPY 3,000. For amounts in excess of JPY 10,000, credit cards, bank transfers and bank debits were used. And for payments in excess of JPY 50,000, the respondents used bank transfers. A Bank of Japan questionnaire supported the results of the Japan Bankers Association survey. It stated that respondents placed emphasis on "benefits including points and discounts received" and the "payment amount" when deciding on the method of non-cash payment. It also found that respondents preferred cash payment on a day to day basis as "it completes the payment on the spot" and as "it can be used widely".

When connecting these facts, we find that Japanese consumers, on average, use cashless payment methods based on benefits and convenience in addition to payment amount. But because there is no universal cashless payment method, cash payment still dominates. Thus the main drawback to Japan's cashless society is the lack of a universal cashless payment system that can replace cash payment. Network externalities (effects) exist in payment system infrastructures where the more people use it, the more convenient it becomes for its users. Therefore, a universal payment system would create a stress-free environment and raise the level of satisfaction among its users. This is a social requirement which must be addressed by both within and outside of the financial industry, and met through technological innovation, collaborative activities and other proactive initiatives.

In addition, there is another feature lacking in Japan's cashless society. And that is the active control of the use of cash for the purpose of crime prevention which includes tax evasion, theft and other underground economic activities in addition to counter-terrorism. For example, in Sweden, where cash in circulation as a percentage of GDP has declined to 1.3%, the move to a cashless society accelerated in the mid-2000’s as a means to prevent bank robberies. In 2012, the Swedish banking industry introduced “Swish”, a mobile payment system, and today, 60% of Swedish citizens use this mobile application. In late-2013, Sveriges Riksbank, the Swedish central bank, temporarily invalidated the 1,000 Swedish krona (approx. USD 104) note, the highest denominated banknote, for the purpose of crime prevention. There have been numerous additional cases, especially in Europe, where large cash transactions have been prohibited in order to prevent money laundering. In Belgium, for example, the maximum cash payment for ordinary goods in EUR 3,000, and cash settlement has been banned for real estate transactions. And in 2015, France lowered its maximum cash payment amount to EUR 1,000 after a series of terrorist attacks. Also, in 2016 the ECB suspended the printing of EUR 500 notes (approx. JPY 61,500) and by April of that year, all EU member countries stopped printing the note.

The high cashless payment ratio in advanced cashless societies was the result of an aggressively controlled use of cash. Japan is known as a nation with a low crime rate. Partly for that reason, the amount of JPY 10,000 notes in circulation has topped JPY 100 trillion at the end of 2018. In his book, "The Curse of Cash" published in 2017, the renowned Harvard professor Kenneth Rogoff calls for the elimination of the JPY 10,000 note, whilst protecting the economically disadvantaged and the privacy of citizens, as a means to tackle tax evasion and the underground economy. But without a viable substitute payment system in place, it would not make sense to abolish high denomination notes or to control the use of cash. Yet as part of a global trend, Japan will very likely be asked by the international community to collaborate in tackling money laundering and terrorism. As a nation that strives to reach the world's highest cashless payment ratio, Japan must formulate a policy and build a national consensus to decide on whether it wishes to enhance the convenience and economic efficiency of the payment user ("The promotion of cash substitute settlement"), or go a step further to promote the "Active control of cash use" for the purpose of legal compliance and crime prevention. What Japan lacks most today is a policy debate on creating a cashless society.

To overcome the situation, a group of cross industry-academia-government officials collaborated and called upon a cashless promotion conference in April entitled the "Cashless Roadmap 2019". The Roadmap calls to achieve the METI's goals set in its "Cashless Vision" of 2018, a cashless payment ratio of 40% by 2025 when the Osaka Expo takes place, and eventually an 80% cashless payment rate, the world's highest ratio. With October's consumption tax hike approaching, the government has taken steps by distributing premium gift certificates and granting point rewards for cashless payments at small to mid-sized retailers. Whilst these are temporary measures, the aim is to discourage restrained buying after the tax hike and, at the same time, to promote cashless payment ahead of next year's Tokyo Olympics and Paralympics; in effect killing two birds with one stone. Going cashless is a key issue for the new Reiwa Era.

2. Stock of the month

Here, we introduce cashless services related stocks in Japan that we focus on.

- GMO Payment Gateway (3769)

A subsidiary of GMO Internet, GMO Payment Gateway is a comprehensive payment and financial services company known for its strong sales force and systems development. It has amassed a wealth of know-how and is a top class payment service provider in Japan. The company provides comprehensive payment services in non-face-to- face sales for e-commerce, financial services and valued-added payment services (such as mobile payment and user authentication) to over 110,000 merchants including online shops, public organizations and financial institutions. This company is a prime beneficiary of Japan's transition to a cashless society and is expected to see its operating profits rise by more than 25% annually in the coming years. With the expansion of e-commerce and online payments, and the upcoming Tokyo Olympic Games, we anticipate face-to-face cashless payments to increase. In addition, "Bank pay", a cash-dispensing service application for regional banks, "GMO Payment After Delivery" and other financial services have been introduced. The company expects to see further growth from the overseas markets in addition to its joint venture with SMFG.

- Money Forward (3994)

The company provides "Money Forward ME", a household bookkeeping application that provides financial management service. It also provides companies and sole proprietorships with an accounting service software called, "MF Cloud Service". And together with domestic financial institutions, the company has developed "Money Forward for XXX" which promotes cashless payment and the transparency of money flows. The company aims to become a platform company in an era of FinTech. Together with the banks' move to API, the "Money Forward" application comprehensively manages personal assets and has preceded other services. In addition, the application introduces new financial products and seminars, both on and off line, to further encourage asset management. The company aims to raise cash consistently through "Money Forward", its household bookkeeping application, and to invest in training & education businesses such as MF Cloud Service and other new business areas in order to turn its EBITDA into the black during FY Nov. 2021.

- Rakuten (4755)

Japan's leading internet company and operator of the country's largest internet shopping mall, "Rakuten Ichiba". The company has 3 main pillars of business: internet business, FinTech business and mobile business through which it conducts a variety of businesses ranging from shopping and point awards, travel, entertainment, finance, SNS and information services. As Japan moves towards a cashless society, numerous payment service companies with the name, "XYZ Pay" have sprung up. Many have invested large amounts of money to promote their payment services. Among them, we believe that Rakuten stands out as the predominant player. This is because the company offers the "Rakuten Card", which has the highest penetration in Japan, has established a strong position in points service, and can reap the benefits of a cashless society without large scale promotion. Rakuten has established and expanded its own ecosystem called, "Rakuten Economic Zone" which includes an internet shopping mall called, "Rakuten Ichiba", financial services companies including "Rakuten Bank" and "Rakuten Securities", and in October this year, it will be entering the telecoms business. Thus Rakuten has already applied its payment services in a wide array of areas.