1. Corporate Governance in Japan today

In 2015, as part of Prime Minister Abe’s growth strategy, the government promoted self-directed efforts by companies toward sustainable growth and profitability, which in turn would lead to higher wages and investment returns, further enhancing corporate earnings. The Corporate Governance Code was formulated and published for the first time in history with the aim of creating such a virtuous cycle. Since then, it has been reviewed every three years, and this is the second revision.

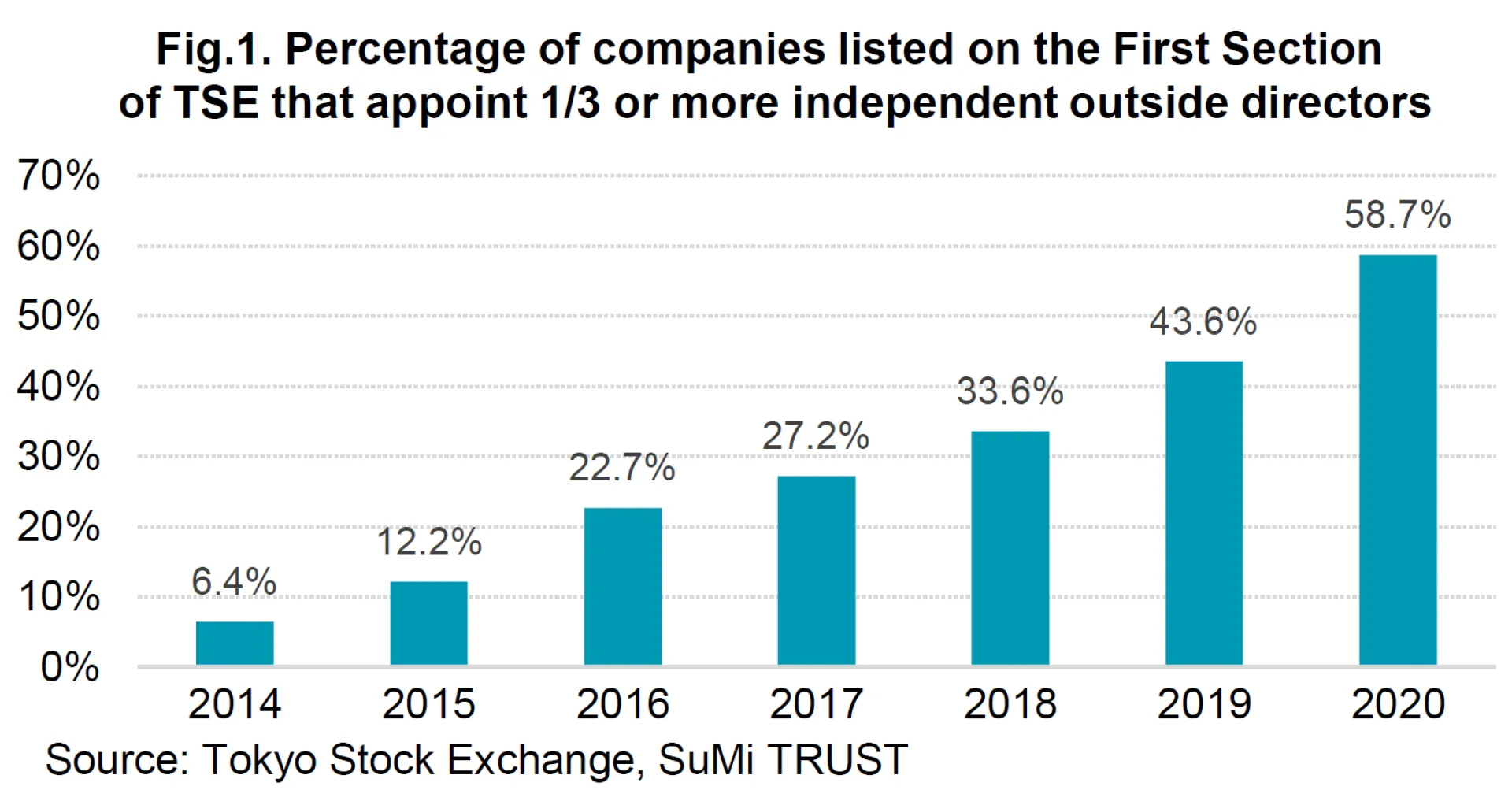

With the introduction of the Corporate Governance Code, Japanese companies are required to place emphasis on ROE while collaborating with stakeholders including shareholders, and appoint external directors. About six years have passed since the introduction of the Governance Code, and Japanese companies are gradually undergoing transformation. The percentage of companies listed on the First Section of the TSE that have appointed independent external directors constituting over one third of the Board, increased from 6.4% in 2014 to 58.7% in 2020 (Figure 1).

SMC (6273) is a typical example of a company that is undergoing change. SMC, which has the world's top market share in pneumatic control equipment, has had a governance and management structure reflecting a very traditional founder-led company. However, since the founder retired from his position as representative director in 2019, the company’s governance structure has changed rapidly. SMC has been a cash-rich company with poor capital efficiency in the past. But it has been aggressively buying back shares, increasing dividends, and announcing dividend forecasts. Today, management is more conscious of the cost of capital. In addition, from the diversification of the board point of view, SMC was far lagged behind even from Japanese standard. It was one of twelve companies in the TOPIX 100, the top hundred companies in TOPIX by market cap, that did not have female directors. But finally one female external director is expected to be appointed after this year's AGM and the ratio of external directors is also expected to rise from 20% to 40%, rapidly diversifying the board structure.

2. Key features of the Corporate Governance Code revision

Let's take a look at the features of the Code revision.

First, measures were taken to improve the effectiveness of the Board of Directors. Specifically, regarding the number of independent external directors, it was stated that "Prime Market-listed companies should appoint at least one-third of their board directors externally (and a minimum of two external directors for listed companies in other markets)" from the previous requirement of a minimum two external directors. In addition, in order to improve the quality of the Board of Directors, "disclosure of a so-called skills matrix that lists the knowledge, experience and abilities of each director" was introduced. We expect the independence and quality of the board members will improve as result of these measures.

Secondly, listed companies with controlling shareholders are required to establish a new governance system to protect the interests of minority shareholders. Specifically, "a listed company with a controlling shareholder is required to appoint at least one-third (or a majority for Prime Market-listed companies) of its directors externally who retain independence from the controlling shareholder on the Board of Directors. Also, a special committee consisting of independent persons, including independent external directors, shall be established to deliberate and consider key business transactions and actions in which the interests of controlling shareholders and minority shareholders are seen to be in conflict".

The third point is the requirement to proactively respond to sustainability issues such as climate change. Specifically, "The Board of Directors shall give its consideration to global environmental issues such as climate change, human rights, the health and working environment of employees, and fair and appropriate treatment of employees and business partners. The Board shall give its utmost consideration to proactively tackle issues related to sustainability, such as business transactions and crisis management for natural disasters, in order to improve corporate value over the medium to long term."

In addition, the revision encourages disclosure, stating that "publicly listed companies shall properly disclose their sustainability efforts". In particular, Prime Market-listed companies are expected to improve both quality and quantity of disclosure on matters regarding TCFD (Task Force on Climate-related Financial Disclosures). Companies are asked to make specific efforts to collect data and conduct analysis on the data with regards to the impact of climate change on corporate earnings and business activities.

Companies are also requested to promote diversity by employing women, foreigners and mid-career hires. Prime Market-listed companies should disclose and provide required information in English.

3. Key features of the reform of Japanese stock market

Let's take a look at the features of the reform, which is closely related to the revision of the Corporate Governance Code.

The reform is expected to scrap the current 4 markets (TSE 1st Section, TSE 2nd Section, JASDAQ, Mothers) and to create 3 new markets (Prime, Standard, Growth) on April 4th, 2022. The listed companies will select the market from September to December of this year, and the listed companies of each new market will be published in January next year.

The listing criteria for the Prime Market, the top-tier, includes to provide an electronic voting platform for at least institutional investors, to have independent external directors constituting over one third of the Board, and to have a market capitalization of JPY 10 billion, which is roughly equivalent to USD 100 million, or more. Quantitative criteria such as a tradable share ratio of over 35% have been established. In addition, stocks held by domestic banks, insurance companies and corporations (excluding shares held for investment purposes) will be excluded from tradable shares. In addition to high governance standards, liquidity of shares is required. As the Prime Market listing standards become stricter, it will be interesting to see which market the listed companies will choose. (It is worth to note that if companies listed on the First Section of the TSE do not meet the Prime Market standards in April 2022, they can, in principle, still make the transition if desired. The TSE will apply a provisional standard called transitional measures to companies which fall short of the requirements. The deadline for transitional measures is not specified, but such companies must formulate an improvement plan and report on the progress after a certain period of time after the transition).

In addition, the TSE announced that TOPIX will be revamped to include companies that meet a certain standard in order to improve quality, instead of incorporating all the stocks listed on the market as with the current index. Specifically, companies whose tradable stock capitalization is less than 10 billion yen at the end of June 2021 (first stage) and at the end of the next fiscal year (second stage) will be designated as "stocks with reduced weightings". The TOPIX weighting will be gradually reduced from October 2022, and the company will be completely excluded from the index at the end of January 2025 unless improved. According to TSE estimates, about 600 stocks, which is equivalent to a weighting of 1% of the market or 30% in terms of number of listed company on the TSE First Section, may eventually be excluded. This will no doubt become a mechanism that reflects the efforts by listed companies to improve the market capitalization of stocks in circulation.

4. Implications

Following the revision of the Corporate Governance Code and the reform of the Japanese stock market, many companies will choose to be listed on the Prime Market in order to maintain their reputation. In the Prime Market, a market capitalization of JPY 10 billion or more and a tradable stock ratio of 35% or more are required, and cross share holdings will be excluded from shares in circulation. In order to improve liquidity, we believe that the cross share holdings will be reduced. In fact, in May this year, Sumitomo Mitsui Trust Holdings announced its goal of reducing its cross share holdings of about JPY 1.4 trillion to zero. We expect that such movements will accelerate in the future.

The Prime Market will also promote diversity by requiring more than one third of the Board of Directors to have been selected externally, disclosing a skill matrix of directors, and promoting women and foreigners to managerial positions. This will lead to the diversification of company management. As in the case of SMC, mentioned above, some companies have already taken steps to diversify their management team prior to the revision of the Corporate Governance Code, and we expect such moves to accelerate in the future.

Furthermore, based on strict standards for parent-child listings, it is possible that parent companies may reconsider whether to maintain listed subsidiaries (the “children”) given the low ratio of independent external directors and the illiquidity of shares in circulation. As such, we believe the elimination of parent-child listings will proceed. Specifically, we can envision parent companies acquiring 100% of the subsidiary’s shares through a TOB, or the subsidiary could delist itself through an MBO. Thus, the number of TOBs and MBOs in the Japan should rise further. Recently, we have seen an increasing number of such buyouts such as NTT's TOB of NTT DoCoMo, Sony's TOB of Sony Financial Holdings, and Hitachi's TOB for Hitachi High-Tech, and we expect to see more in the future.

Given that the hurdles for listing on the Prime Market are quite high, corporations will need to make the effort that meets the conscious eyes of investors. As a result, we believe that improvement of corporate governance at Japanese companies will ultimately increase the number of attractive companies. As global investors are getting more keen on the governance of companies, the strictest governance standards will be applied in the Prime Market, which will have a positive effect on the share prices listed on the Market. We believe that this revision of the Corporate Governance Code and the reform of the Japanese stock market will bring positive effects to the capital market in Japan.