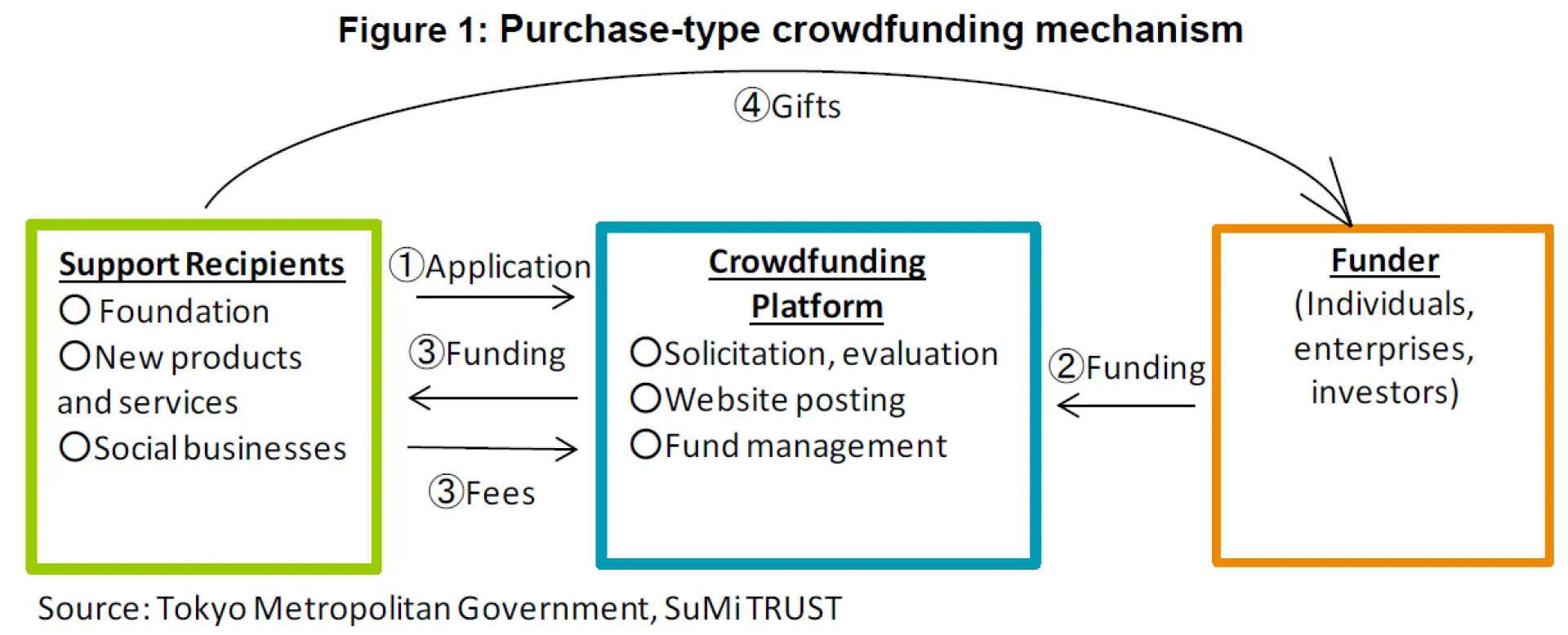

Another purpose of crowdfunding is to foster entrepreneur motivation. Completion of a project through crowdfunding will lead to social credibility of the project and recognition which will serve as a great motivator for entrepreneurs to continue with their business. It has the effect of stimulating the motivation of entrepreneurs to further challenge themselves in new businesses. Local governments are conducting educational activities aimed at promoting crowdfunding, such as briefing sessions and seminars, with the aim of promoting entrepreneurship, in anticipation of such effects brought by the success of crowdfunding. In addition, there are some municipalities that have a support system to subsidize fees for crowdfunding business operators.

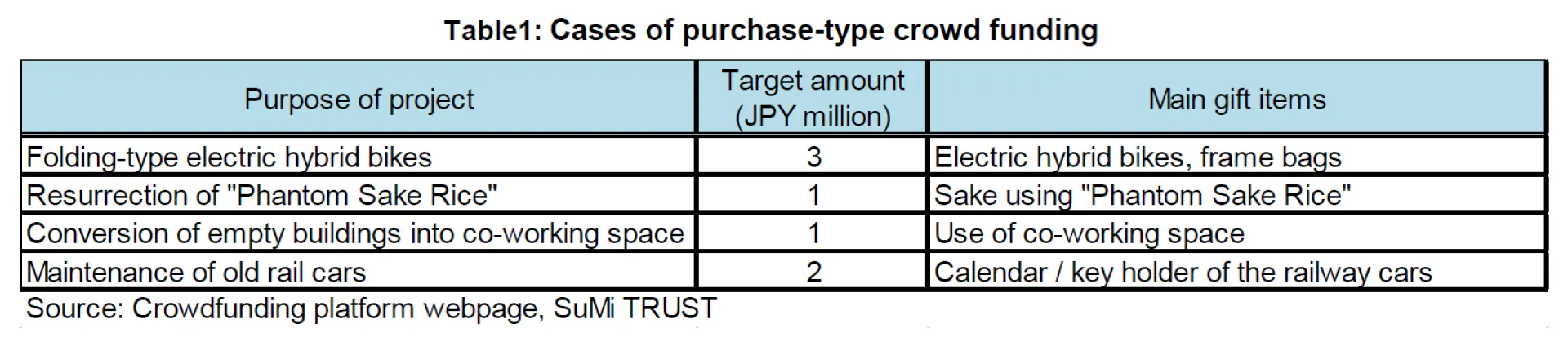

Unnan city, in Shimane prefecture, is a successful example of "local economy revitalization", a term used in Prime Minister Abe's speech. The city supports students and young people tackling regional problems using purchase-type crowdfunding. Under the city's project, about 250 young people have emigrated to abandoned areas in search of new ideas and to develop unique products from crops grown locally. Vacant houses are being used as share offices. As a result, nearly 50 ideas have been generated by entrepreneurs in the past four years.

II.Crowdworking : creating a flow of “work” from urban to rural areas

A remarkable example of another sharing service promoted by municipalities is crowdworking. This is a business which directly connects the company with the individual to the online platform of the sharing company and allows for the ordering and receiving of work. There are various kinds of work ranging from sophisticated programmimg to relatively simple things such as data entry.

Looking at the regions where new initiatives have started, we see that the focus has mainly been on relatively simple work, most of which come from companies in metropolitan areas. While crowdfunding has led to the flow of money from urban to rural areas, it has also created flow of work (employment) from urban to rural areas.

As an example of crowdworking, the city of Taku in Saga prefecture has declared itself as a Sharing City (※). Its purpose is to create income to those who have free time at home, mainly housewives raising children. However, it is difficult for inexperienced people to choose from thousands of tasks available on the platform. Therefore, the city has entrusted an external organization to match suitable jobs for housewives, meet delivery deadlines, and maintain quality control and management. The organization continues to devise measures to make it possible to receive high valued added work and match them with high quality workmanship. In doing so, housewives can make a smooth transition back to work after raising their children.

(※)Approved by the Sharing Economy Association, a local government actively engaged in sharing. It is also supported by the Cabinet Office. Initially five cities declared themselves as a Sharing City. Today there are 15 cities nationwide. Taku city in Saga prefecture is one of the first five cities to make the declaration.

III.How to spread the sharing economy

Sharing services which promote the flow of money and work via the internet, are expected to bring opportunities to the rural areas away from the city, and crowdfunding is gradually expanding its market size.

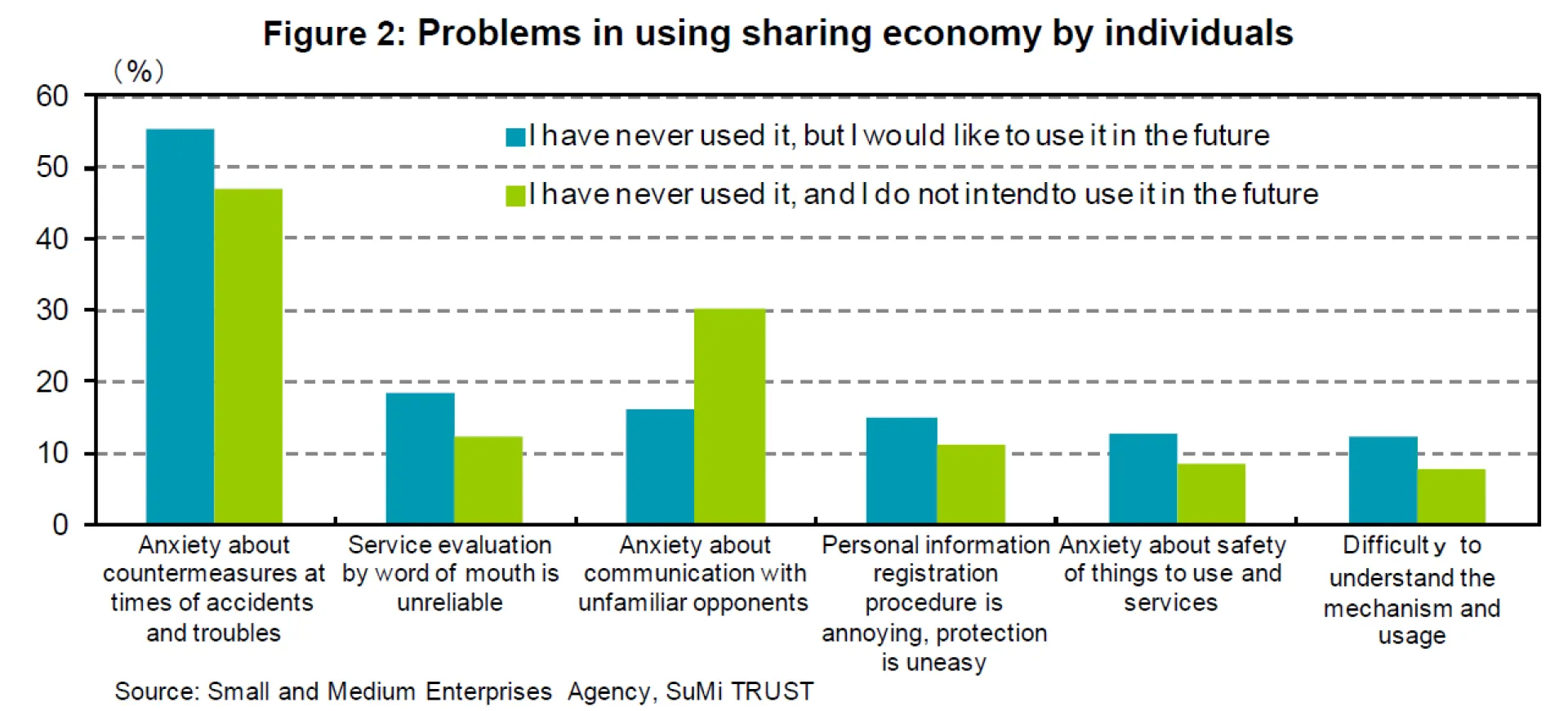

However, compared with the United States, it is still only half the size both in usage and users inclination. In addition, only 0.7% of small and medium-sized enterprises who want to actively use crowdfunding still face issues expanding their user base. The relatively low utilization rate is not only limited to crowdfunding, but is common to other sharing services. The reason is due to concerns over transaction security in C to C transactions, and in a survey conducted by the Small and Medium Enterprises Agency, "Anxiety about countermeasures at times of accidents and troubles" and "Anxiety about communication with unfamiliar opponents" account for the biggest reasons.(Figure2).

In the United States, sharing was not accepted from the beginning without resistance. By improving the service and safety mechanism, such as ridesharing and vacation rentals, it led to further expansion of users. The key to spreading the use of sharing is to establish safety mechanisms and rules in Japan, and to accumulate sharing opportunities by providing services in one’s immediate surroundings.

IV. Stock of the month

As mentioned above, the sharing economy provides an effective means to solve social problems.

In particular, in a modern society, which is said to consume excessively, a sharing economy that seeks to effectively use resources through sharing (without owning the assets) is indispensable in realizing a sustainable society.

There are not many companies directly related to crowdfunding or crowd working in Japan, but businesses incorporating the idea of s haring have already been established. Here we would like to introduce the companies that we are paying attention to and are expanding the sharing business among in Japan.

“Park24” “Park24”isaholdingcompanythatownstheTokyo-based“Times”,a24-hourunattendedparkinglotchain. The number of parking lots exceeds 17,000, making it the largest parking lot network in Japan.

Another business segment of Park 24 is car sharing. The market has expanded and its membership has exceeded onemillion.Park24isthedominantplayerinJapan. We believe that the number of people who do not own cars and wish to take part in car sharing will continue to rise, and we think that there is much room for expansion of the market.

The company is also active in expanding overseas. In January 2017, they created acquired, "Secure Parking", which develops parking lot business in the five countries of Australia, New Zealand, UK, Singapore, and Malaysia, in addition to Taiwan and Korea.

In August of the same year, they acquired the largest parking lot operator in the UK, the "National Car Parks", establishing a foundation to further strengthen the parking lot business in the UK and expanding business in Europe.

“Raksul”

As an internet printing sharing platform, “Raksul” also provides a logistics sharing platform called, “Hakobell Raksul’s inexpensive service is achieved by using printing machines owned by printing companies during non- operating hours. For “Hakobell”, it uses idle vehicles owned by transport companies. Particularly in ”Raksul“, by taking advantage of the seasonal fluctuations of the printing machine whose operating rate is about 40%, and by using non-working hours, it has not been necessary to own a printing factory. This makes cost reduction possible. There are approximately 660,000 users of which 45% account for corporations. In 2015, it was nominated for

the ”2015 Red Herring Top Global 100“ award. One hundred of the world’s most exciting technology/life science venture companies are selected for this award by Red Herring magazine. Its advertising services are expanding to not only leaflets, but also television commercials and traffic advertisements. “Raksul” will release a service in partnership with television stations to show on a computer application screen which times on the broadcast schedule have an open space for television commercials and allows companies to apply to purchase those times directly on the application.

2. Market Review

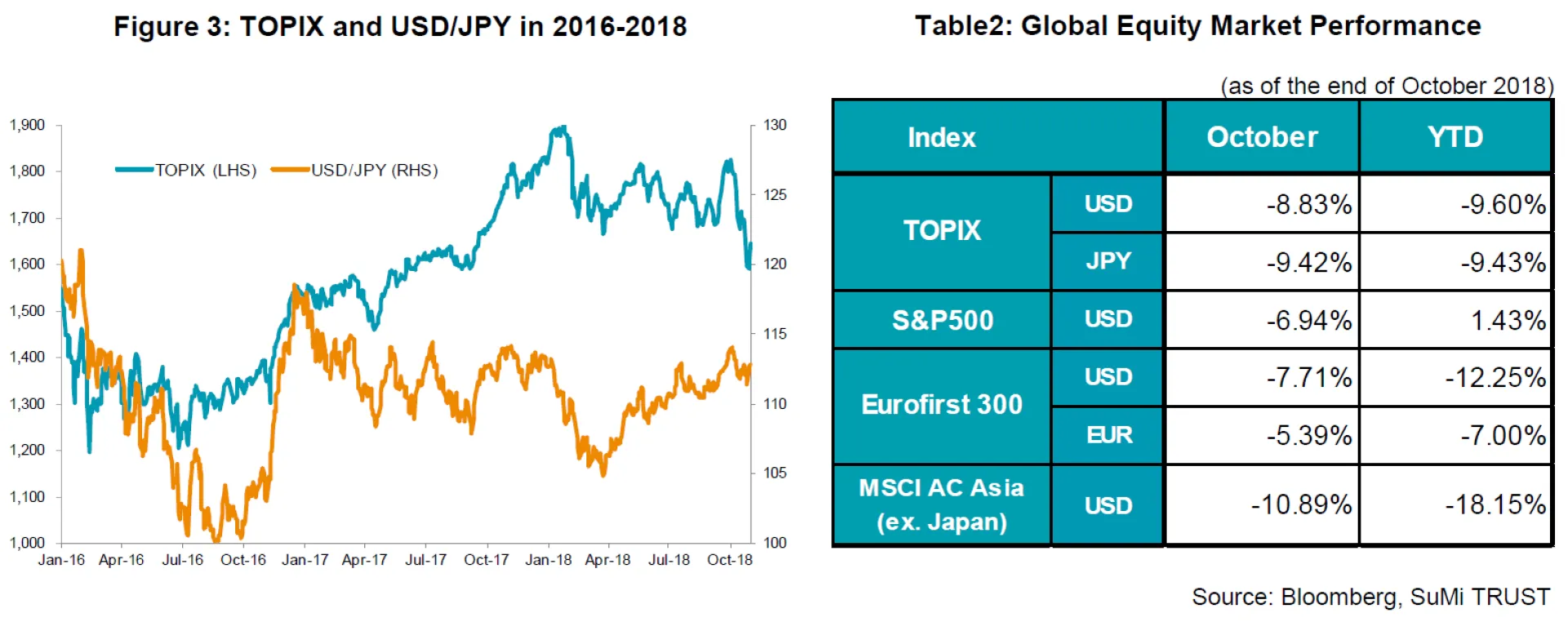

In October, the Japanese equity market plummeted, wiping out gains made in 2018. The TOPIX ended down 9.42% from September’s close. US rate hikes early in the month promoted risk aversion among investors, leading to the view that equities were overpriced. Renewed concerns over Sino-US trade friction and the general retreat seen in US and Chinese markets spilled over into the Japanese market. Month’s end saw a sharp rebound due to the weakening of the Yen, and global markets rebounding from improved sentiments. Sector wise, domestic utilities and real estate seen as less affected by trade, and financial services viewed as benefitting from rising interest rates, held their ground. A significant drop in IT and semiconductor stocks occurred due to trade concerns and a strong Yen.