You are visiting the Rest Of World site, but it looks like you're visiting from United States. Please click here to go to the correct site for your country, or select the correct country from the list below:

You are currently visiting the Rest Of World site. Select a country below to change location or click here to stay on this site.

Please review the terms and conditions below and press 'Accept' to proceed to the site.

These website terms and conditions (the “Terms”) govern your use of this website.

The information on this website is approved for publication by Sumitomo Mitsui Trust International Limited ("SMTIL", "we", "us" or "our"). This website is owned and operated by SMTIL. SMTIL is a company registered in England and Wales (Company No. 02007985) whose registered office is located at 155 Bishopsgate, London, EC2M 3XU. SMTIL is authorised and regulated by the Financial Conduct Authority ("FCA") (whose address is 12 Endeavour Square, London, E20 1JN) and entered on the FCA Financial Services Register under Firm Reference Number 124546.

When using this website, your browser may be directed to or may access local web pages ("Local Pages") which are operated by SMTIL on behalf of other companies in the Sumitomo Mitsui Trust Group ("SuMi TRUST"). At the time of publication of these Terms those Local Pages are:

Countries | Domain |

Japan | www.sumitrust-am.com |

Luxembourg and other EU and EEA member states | eu.sumitrust-am.com |

Hong Kong | hk.sumitrust-am.com |

Singapore | sg.sumitrust-am.com |

United States of America | us.sumitrust-am.com |

United Kingdom and jurisdictions in which SMTIL promotes its products and services other than as listed above | www.smtil.com and uk.sumitrust-am.com |

Rest of the World | row.sumitrust-am.com |

You are only entitled to access this website via the Local Pages applicable to the country in which you are located as identified in the table above. There are additional local terms and conditions relevant to access in your jurisdiction which apply in addition to these Terms and are set out below. The additional local terms and conditions identifying the appropriate SuMi TRUST group company with which you have a relationship and any local terms and conditions which apply including additional legal and regulatory information. Such additional local terms and conditions shall be deemed to form part of the Terms and shall apply to your use of the website for the protection of SMTIL and any SuMi TRUST group company. Reference in these Terms to the website include any of the pages or any information contained in any of the domains listed above.

Any information accessed via this website is protected under copyright © 2022 Sumitomo Mitsui Trust International Limited. All rights reserved.

Terms for access

By continuing to access and use the website, you are deemed to have understood and consented to the Terms. Please read them carefully and confirm that you agree to the Terms. If you do not agree to these Terms, you must not use the website. You are responsible for ensuring that all persons who access the website through your internet connection are aware of these Terms and any other applicable local terms and conditions, and that they comply with them.

The website is primarily directed towards and intended for institutional investors, as professional clients, SMTIL only provides services to persons it classifies as professional investors and eligible counterparties. (SMTIL provides no services to retail investors.)

This website is solely directed towards such investors in the countries listed in the table above where SMTIL decides to promote its services and products from time to time but may be accessed by citizens or residents of or located in any country or jurisdiction provided that the Terms are complied with and where local law in that jurisdiction does not preclude such access or impose additional obligations on either a SuMi TRUST group company or on you. All persons must satisfy themselves that they are not subject to any local requirements which would restrict or prohibit them from accessing this website. SMTIL does not give any assurance that this website complies with the regulatory requirements in any particular jurisdiction. However, additional local terms and conditions set out below may apply in those jurisdictions listed in the table above.

Information basis only

All information, text, disclaimers, data, databases, charts, tables, tools, press releases, software, graphics, names, logos, trademarks, service marks and other material on the website (the "content"), and your subsequent use of it, may from time to time be subject to certain statutory or other external regulations, conditions and restrictions. All use of information by you must comply with such regulations, conditions or restrictions.

The content provided may include reference to specific investments but none of the content provided is intended to constitute, and nor shall it be regarded as constituting as giving advice or, an offer to sell or the solicitation to buy any investments or services or recommendation with respect to such investments that may be referenced on or through this website. Specifically, this content does not constitute an offer or invitation to anyone in any jurisdiction to invest in any of our products, or use any of our services where such offer or invitation would not be lawful or in any jurisdiction in which the person making such offer or invitation is not qualified, permitted, licensed or approved to do so, or to anyone to whom it is unlawful to make such offer or invitation and this content has not been prepared and is not intended to be read, considered or relied upon in connection with any such offer or invitation.

In relation to provision of services for a client, they would be governed solely by the terms of the agreement we enter into with the client. In relation to an investment in investment funds mentioned, any subscription to such an investment fund would be governed solely by the terms of the subscription documentation and the prospectus for the relevant investment fund.

The content on the website is for general information only and does not purport to provide, nor does it constitute investment, legal, tax or other financial advice (or any services). No comment or observation is given by SMTIL in connection with any of the investments or services discussed on, or accessible through, this website. You acknowledge that the provision of any content through this website shall not constitute or be considered investment advice.

Investment information

Past performance of an investment is not a guide to future returns. The value of investments can fall as well as rise. As a result an investor may not receive back the amount invested.

Investments which take place in currencies other than the investor's own currency will be subject to movements in foreign exchange rates.

SMTIL does not provide any tax advice to its clients in relation to its services. Any comment on the tax position or proposed tax position which may apply to a particular product is for indicative use only and prevailing at the time of an investment may subsequently change. Investors must rely on their own tax adviser in their own jurisdiction as to the tax implications for them of any service offered or investment they make.

Accuracy of information

The website and content on it is provided "as is" and on an "as available" basis.

Unless otherwise specified, SMTIL is the source of all information. SMTIL does not guarantee the accuracy, timeliness, completeness, performance or fitness for a particular purpose of the website or any of the content.

SMTIL endeavours to ensure that all content provided on the website is correct as at the date of its publication. However errors or omissions in the content may occur. SMTIL will not necessarily keep all content up to date as there is often a time lag in updating information. On this basis, no responsibility for the accuracy of any content is accepted by SMTIL and SMTIL does not warrant, represent or undertake that the content will be uncorrupted or error free. Nor does SMTIL give or make any warranty, representation or undertaking of any kind in relation to the content and all implied warranties are excluded from the Terms to the extent that they may be excluded as a matter of law.

SMTIL is not obligated to update, or to continue to offer information accessible through this website.

SMTIL accepts no liability for the results of any action taken on the basis of the content contained on this website. Further, we do not warrant that the website will be uninterrupted or error free or that any defects will be corrected. We will not be liable in contract, tort or otherwise for any cost, claim, loss or damage arising out of or in connection with access or use of the website. Nothing however in this paragraph nor elsewhere in the Terms excludes or limits any liability which may not be lawfully excluded or limited by applicable law.

Use of content

The content and all rights in it belong to us or have been duly licensed to us.

You may not copy, reproduce, duplicate, adopt or lend, sell, disseminate or otherwise transfer, in whole or in part, any of the content, except for the purpose of accessing the website.

Solely for the purposes of informing yourself about SMTIL and its services, you may retrieve, display on a computer screen, copy, print, make photocopies of printed material, store in electronic form or on disk, download and republish content.

You may not adapt, alter, modify, add content, create derivative works or otherwise change any part of the content.

Intellectual property rights

All copyright, trademarks, database rights and other intellectual property rights that may exist in this website and the content shall remain at all times our intellectual property. Except as expressly permitted by these Terms, nothing in this website shall be construed as granting, by implication or otherwise, any licence or right to use the content without our prior written permission. If you become aware of anything which appears to infringe these Terms, you agree to contact us promptly by emailing info@smtil.com.

Liability

Access to, and use of, this website is at your own risk. In no event will SMTIL be liable in contract, tort or otherwise for any loss, damages, claims or expenses which may be suffered or incurred by you or any other person which are caused directly or indirectly by accessing this website including, but not limited to, loss, damages, claims or expenses caused by any failure, delayed or defective operation or unavailability of any pages of this website or any computer virus arising from the use of or in connection with this website.

You will indemnify SuMi TRUST (including each of its affiliated or associated companies) and their officers, directors, employees and agents in respect of any third-party claim for any injury, loss, damage or expense occasioned by or arising directly or indirectly from the operation, use or supply of information to a third party provided in breach of any of your obligations under these Terms.

Unlawful use

You agree to use this website only for lawful purposes and in a manner that does not infringe the rights of or restrict or inhibit the use and enjoyment of the website by any third party.

Privacy policy

Our Privacy Policy details the type of personal information that we may collect from you when you visit the website and how we store and use your personal information. Your use of the website is taken as your acceptance of the terms of our Privacy Policy.

Cookie Policy

SMTIL maintains and operates a Cookie Policy to monitor use of its website.

Computer viruses, worms and Trojan horses

We do not warrant that the website is free from computer viruses, worms, and Trojan horses and we accept no liability whatsoever for damage that may result from the transmission of any computer viruses, worms, or Trojan horses via the website.

Third party information

Through this website, you may have access to information which SMTIL obtains from third parties who are independent of SMTIL. Even though the sources of the information are believed to be reliable, SMTIL is not responsible for, and makes no warranty with respect to, the contents, accuracy, completeness, timeliness, suitability, or reliability of the third party content within such information.

Linking and framing

The website may contain hyperlinks to websites owned and operated by third parties. We do not accept any responsibility for the content of third party websites or web pages, nor do we accept responsibility for any losses or penalties incurred as a result of your use of any links or reliance on the content of any website to which the website is linked.

Creating links to our website is freely permitted so long as this is done in a manner that is not misleading and does not imply endorsement by or affiliation with SMTIL. You are prohibited from framing this website.

File download

Certain files of content may be available for download from the website. These files of content are subject to these Terms.

SMTIL has discretion to change content within the website, or the Terms, and to withdraw access to the website.

We reserve the right, at our discretion, to make changes to the content of this website or these Terms at any time and to withdraw access without notice to users. You must check these Terms periodically for changes and so as to ensure that you refer to, and comply with, the up to date Terms. Any changes, modifications, or additions to, or deletions from these Terms shall be effective upon posting on this website. If you access this website after we post changes to the Terms, you accept the Terms as changed.

We also reserve the right to grant or evoke the authority to use this website at our absolute discretion.

Your use of the products and services on this website may be monitored by SMTIL, and the resultant information may be used by SMTIL for its internal business purposes and/or in accordance with applicable laws and regulations.

Recommended Environment

We recommend that this website be viewed using the most recent release of Microsoft Edge, Google Chrome or Apple Safari. Please be reminded that some content may not be displayed correctly if you are viewing this website in any other environment or, even in a recommended environment, depending on your browser settings.

This website uses JavaScript to control the display. If JavaScript is disabled in your browser settings, this website may not work properly. Please enable JavaScript when viewing this website.

Governing law and jurisdiction

The governing law of these Terms shall be the law of the country ("Home Country") in the table above which corresponds to the domain through which you initially access this website (the "Local Law"). These Terms shall be governed by and interpreted in accordance with the Local Law. Any additional local terms and conditions below relating to the Local Pages or access by you in the jurisdiction from which you access this website will also be governed and interpreted by Local Law.

Any dispute, action or claim (whether contractual or non-contractual) arising under or in connection with these Terms shall be subject to the exclusive jurisdiction of the Home Country.

Contacting us about this Website

If you have any queries concerning this website or the Information contained on this website, please contact Sumitomo Mitsui Trust International Limited on 020 7562 8400. Calls may be monitored or recorded to maintain and improve our services.

Local Terms and Conditions

Japan

Sumitomo Mitsui Trust Asset Management Co., Ltd.

Sumitomo Fudosan Onarimon Tower

1-1-1 Shibakoen, Minato-ku, Tokyo 105-0011 Japan

Notes Concerning Investment Trusts

The term, "investment trusts", used in this website means any fund products regulated under the Law Concerning Investment Trusts and Investment Companies of Japan. No such investment trusts shall be offered or sold to any person in any jurisdiction in which such offer or solicitation would be unlawful under the securities regulation of such jurisdictions.

Investment trusts invest in securities and other instruments such as shares and public corporation bonds whose prices are subject to change (when investments are made in assets denominated in foreign currencies, there are also risks associated with changes in currency exchange rates), and therefore, net asset values are subject to change. Consequently, unlike deposits with financial institutions, investment principals are not guaranteed.

Gains and losses resulting from investment in an investment trust shall be imputed to the customers who purchased the investment trust.

Investment trusts are not subject to deposit insurance.

Unlike amounts guaranteed under deposit insurance, funds received from investment in investment trusts are not guaranteed.

Investment trusts are not insurance and are not subject to the Non-life Insurance Policy-holders Protection Corporation of Japan.

Unlike securities companies, registered financial institutions are not members of the Japan Investor Protection Fund.

When making investments, be sure to read the investment trust prospectus provided to you.

Luxembourg

Local website terms and conditions

Company details

Sumitomo Mitsui Trust Bank (Luxembourg) S.A. is a Luxembourg public limited liability company (société anonyme), incorporated under Luxembourg law and listed with the Luxembourg Trade and Companies Register under reference B22765, whose head office is located at 2, Rue Peternelchen, L-2370 Hesperange, Grand-Duchy of Luxembourg. VAT number is LU12915516.

Sumitomo Mitsui Trust Bank (Luxembourg) S.A. is a Luxembourg credit institution authorised by the Luxembourg Minister of Finances and supervised under reference B0000146 by the Luxembourg financial sector regulator, the Commission de Surveillance du Secteur Financier (CSSF), located at 283 route d’Arlon, L-1150 Luxembourg (www.cssf.lu).

Investment warnings

Personal data

Cookies

Complaint Management Procedure

Hong Kong

Sumitomo Mitsui Trust (Hong Kong) Limited., (三井住友信託(香港)有限公司, SMTHK)

三井住友信託(香港)有限公司

25/F, AIA Central, 1 Connaught Road, Central, Hong Kong

No additional local terms and conditions.

United States of America

Sumitomo Mitsui Trust Asset Management Americas, Inc.

1251 Avenue of the Americas, New York, NY 10020, U.S.A.

No additional terms and conditions.

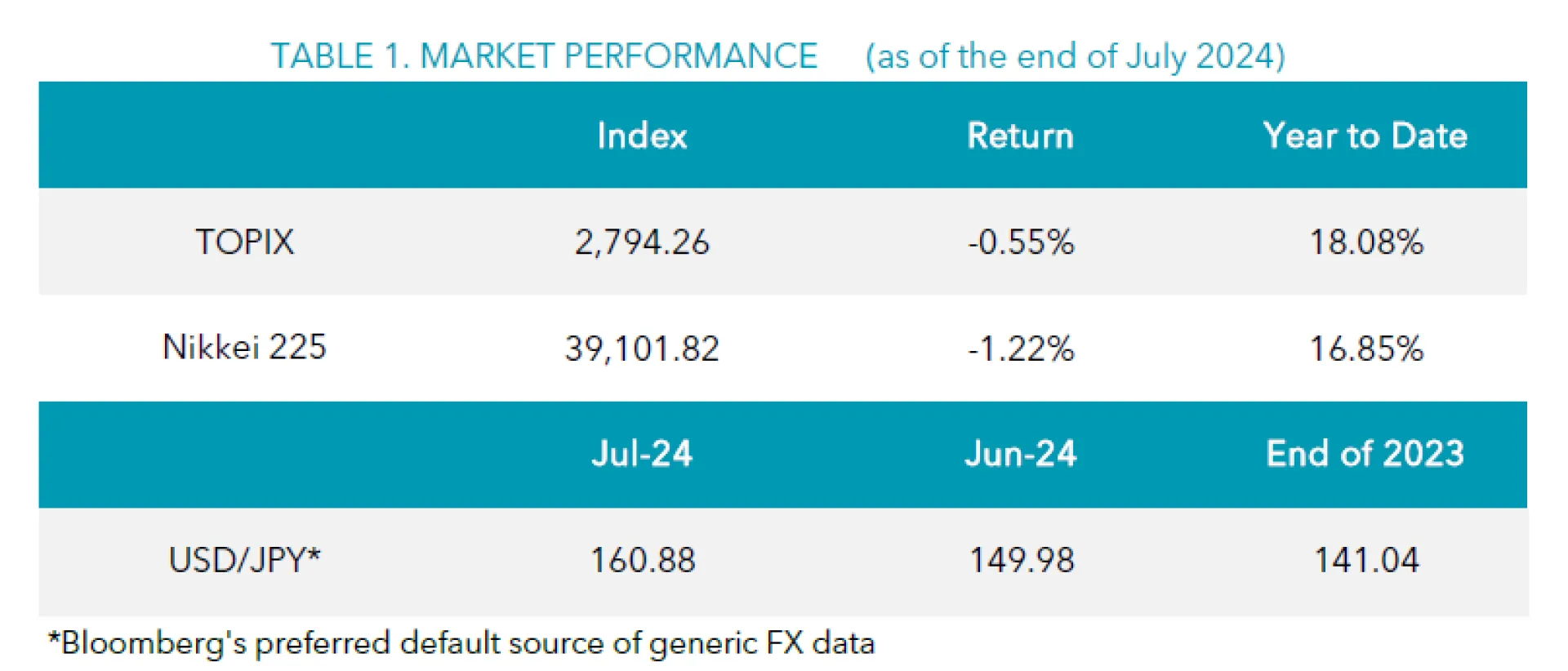

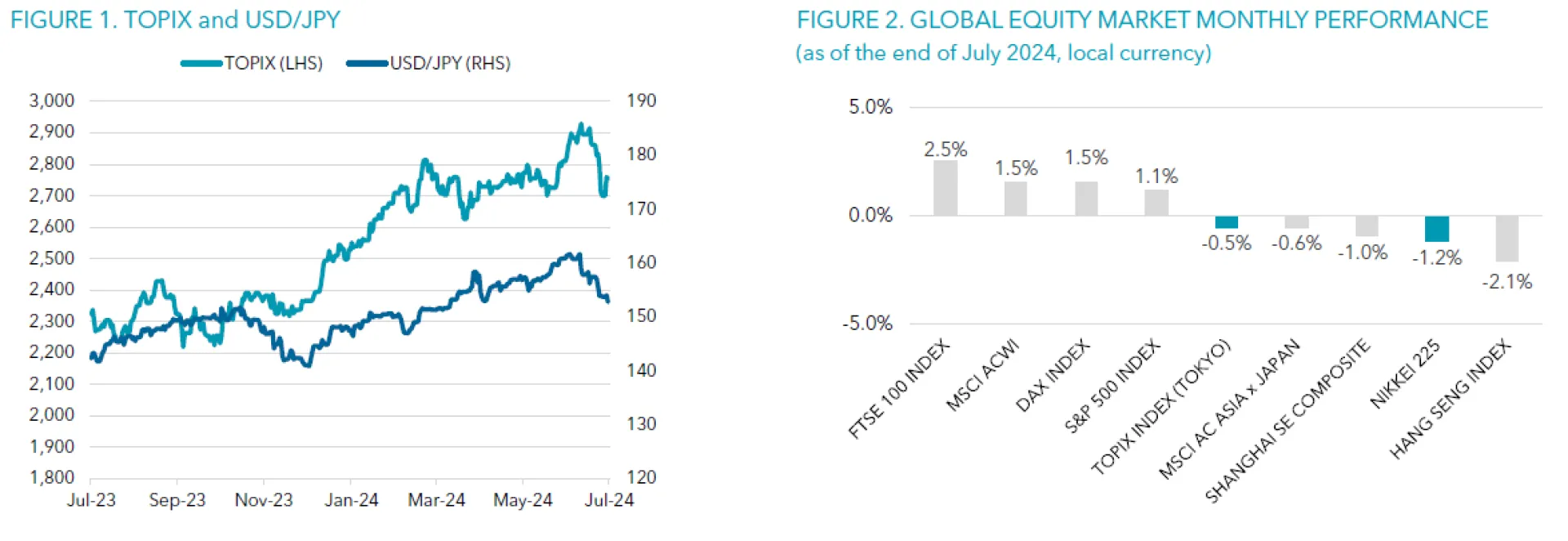

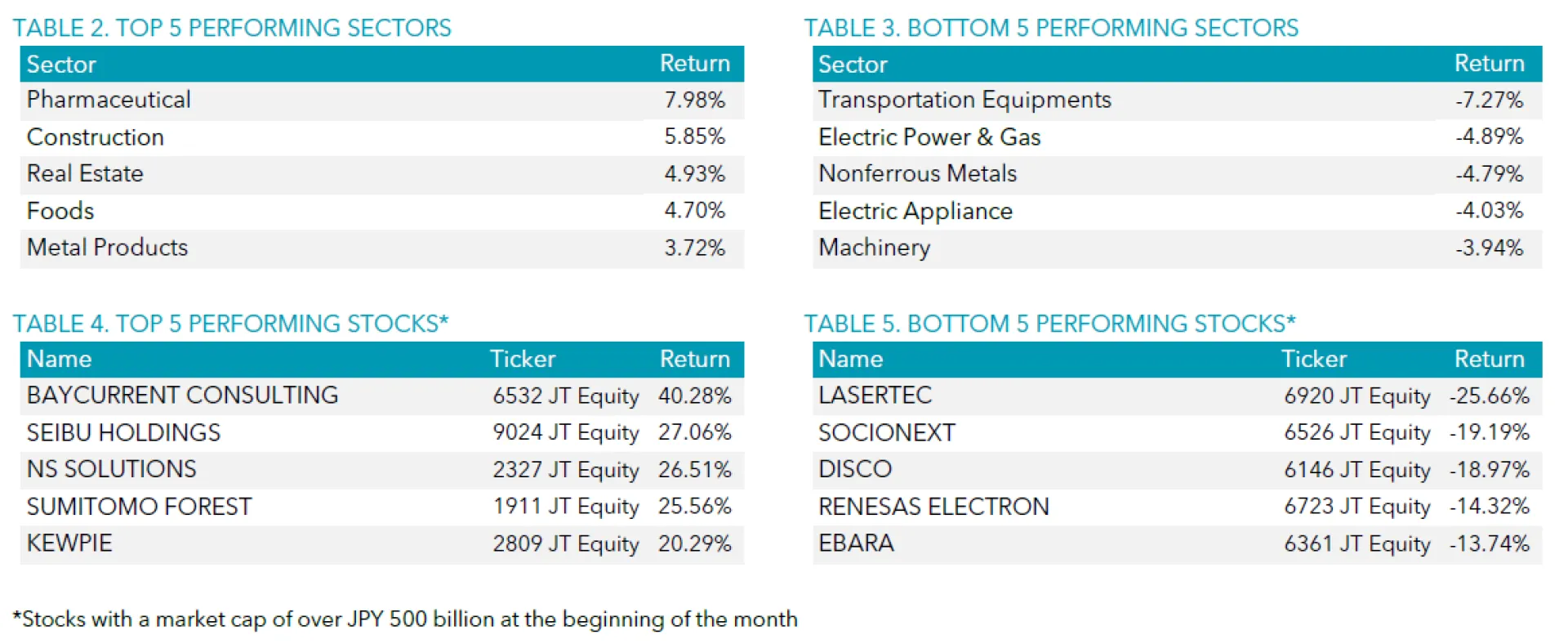

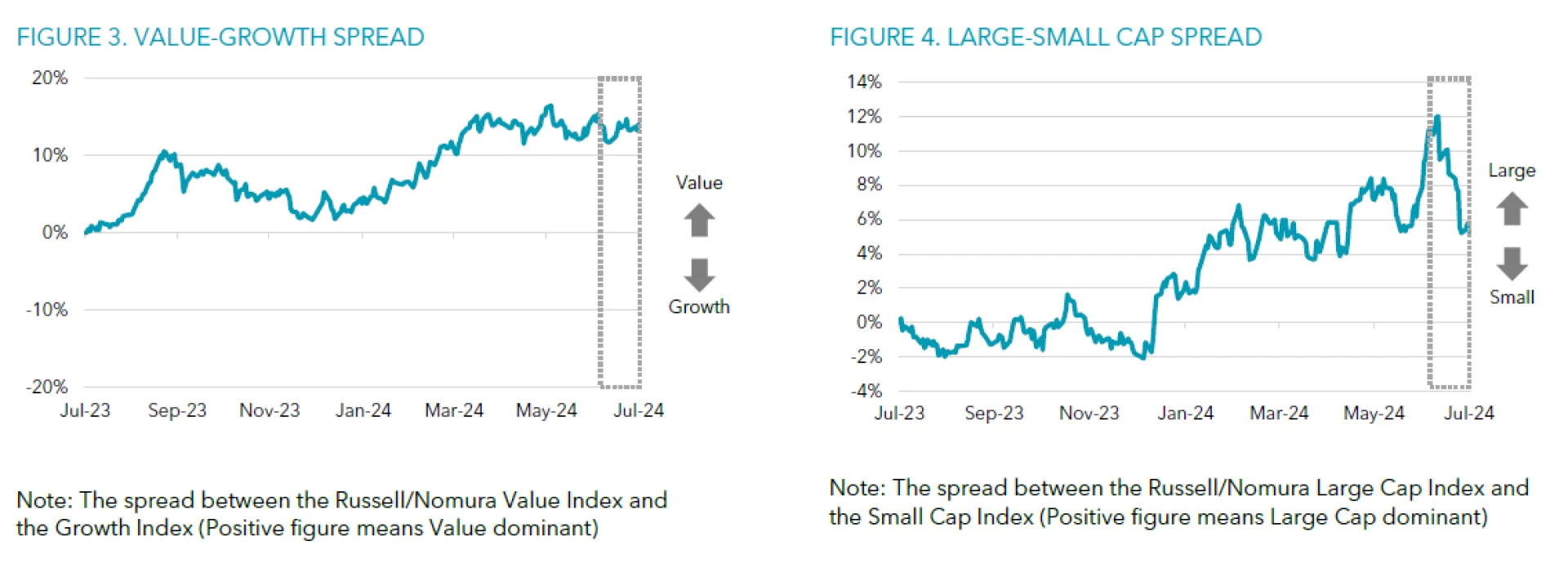

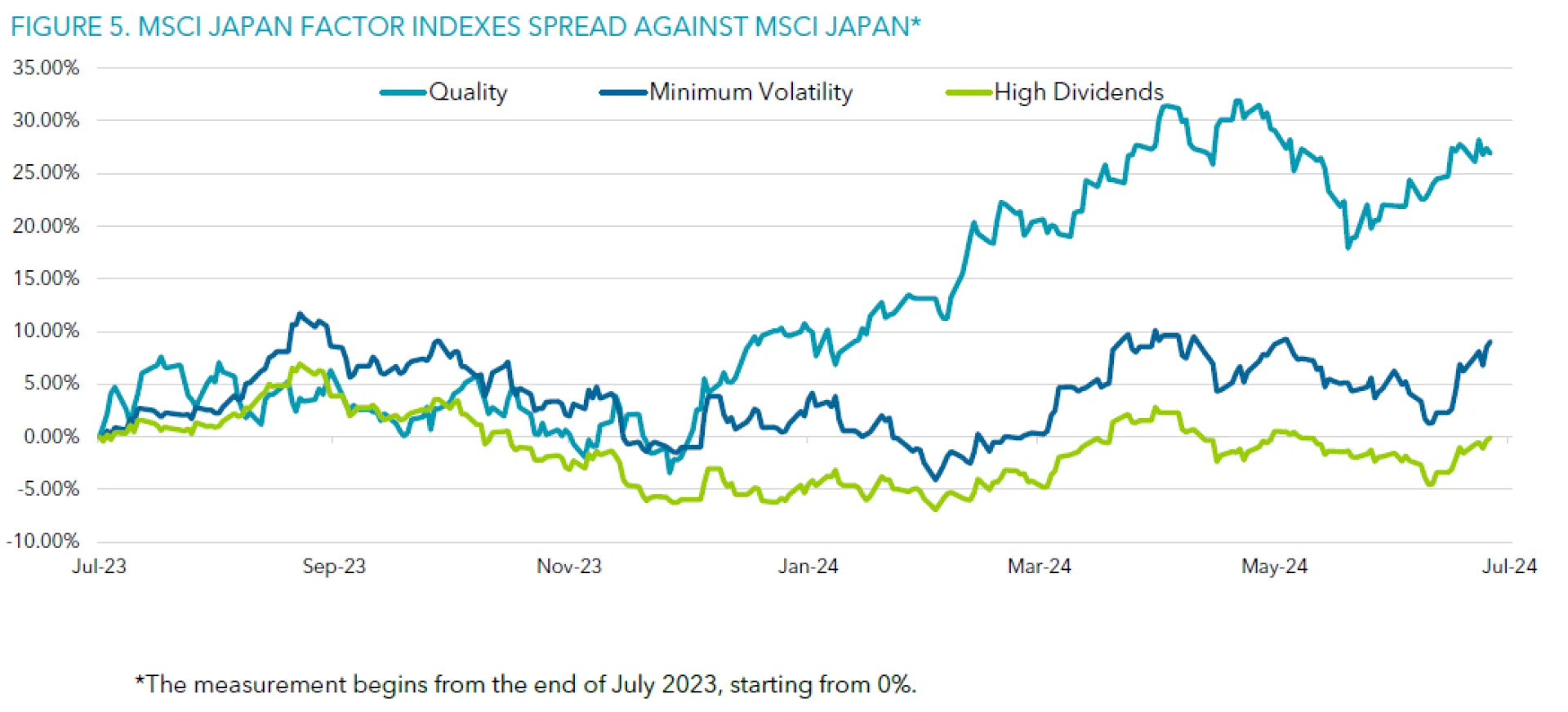

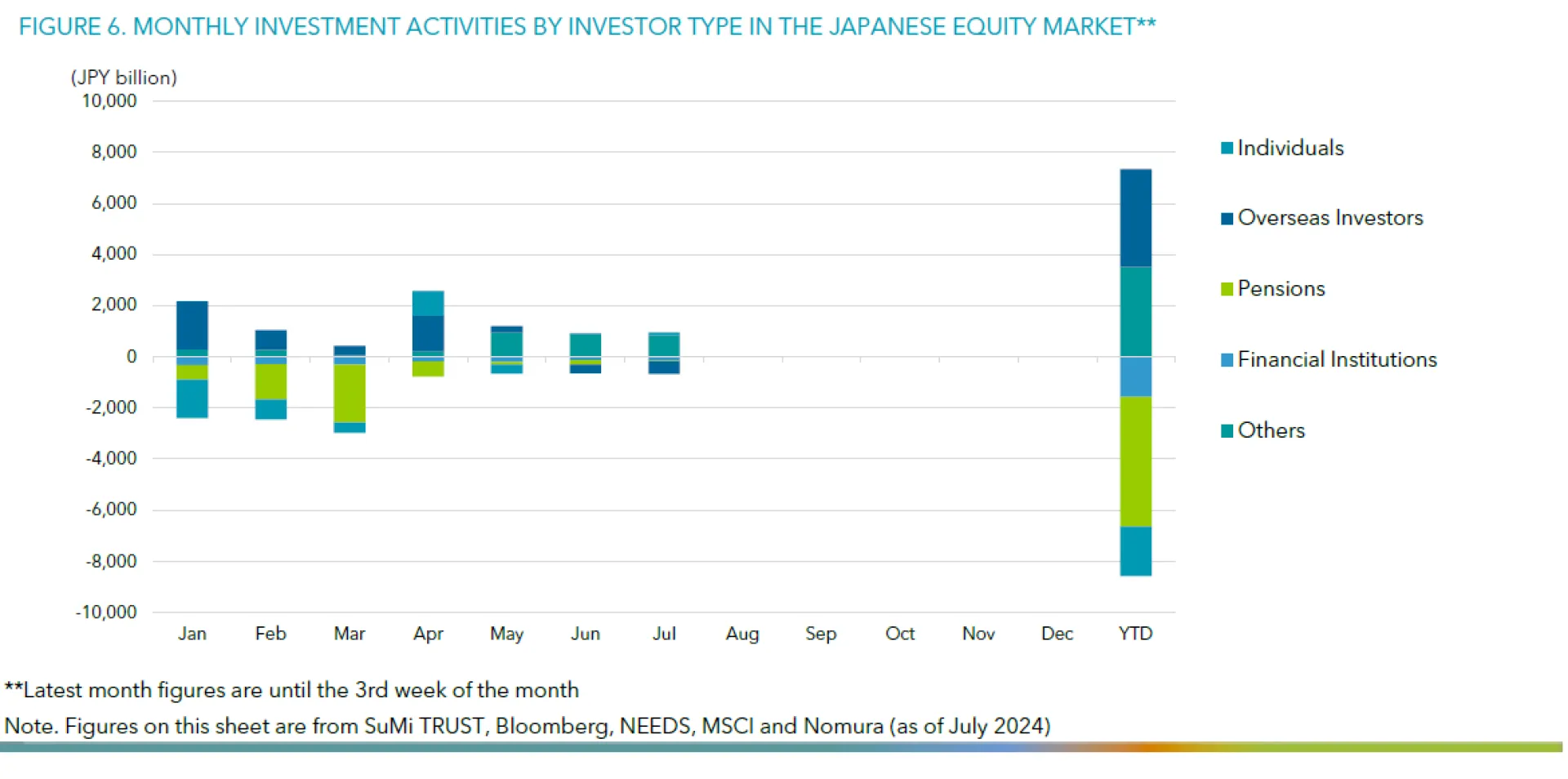

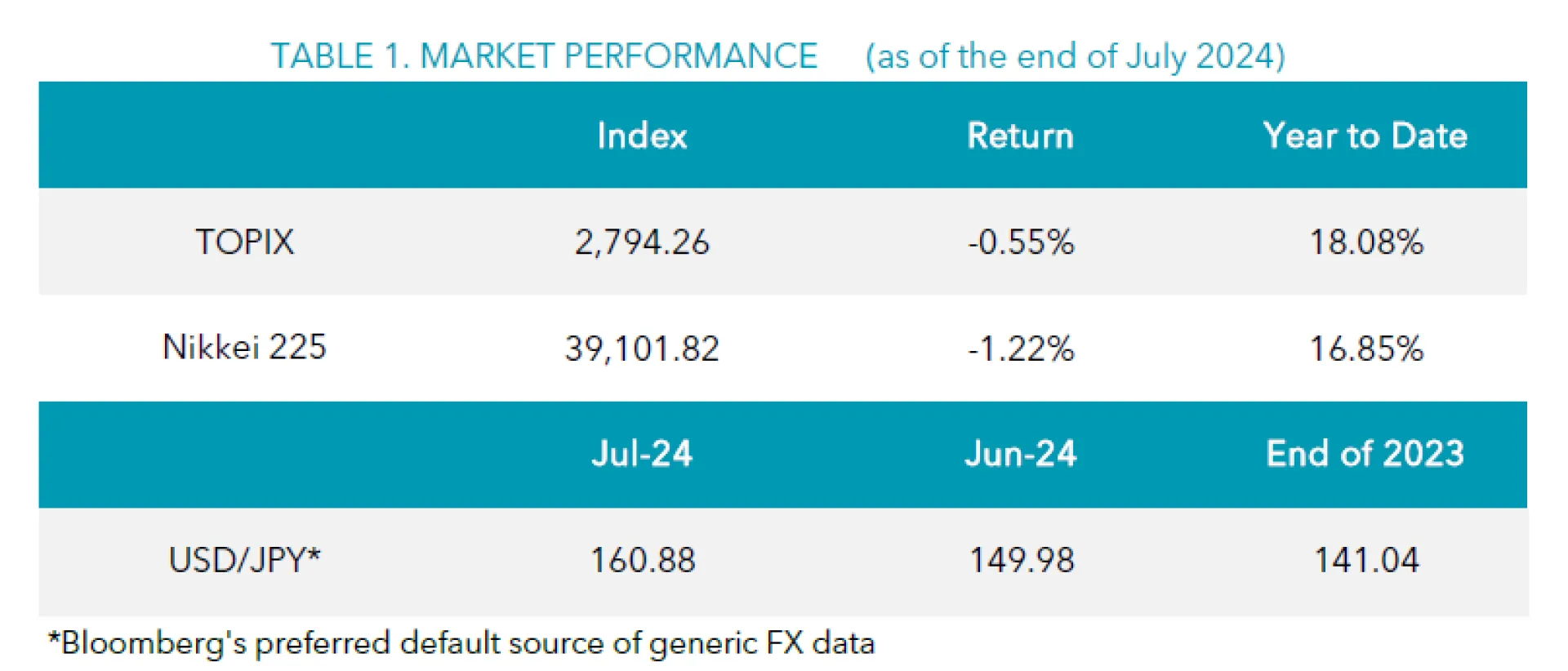

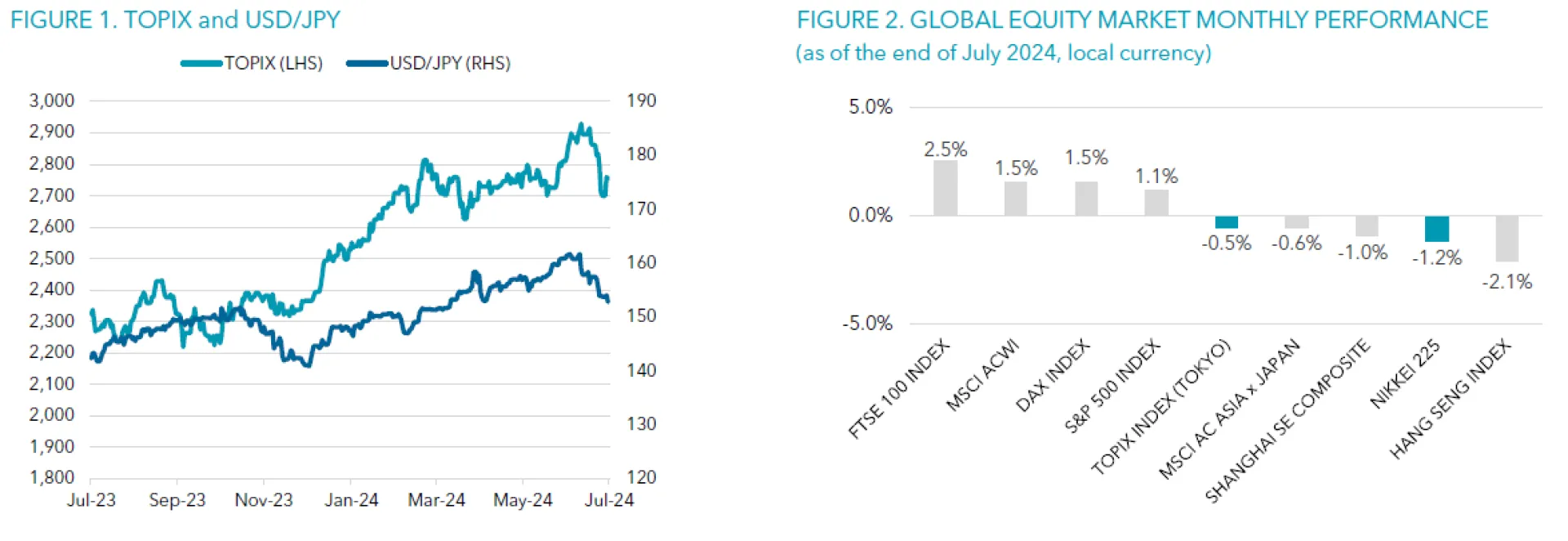

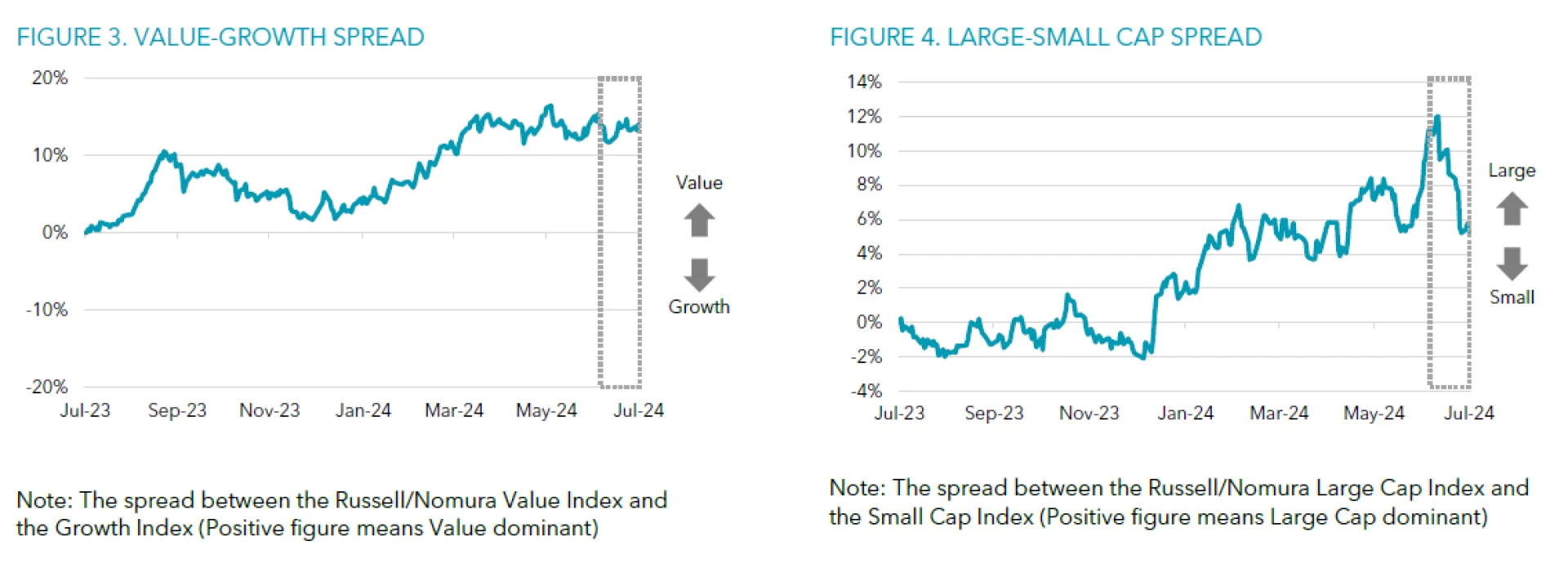

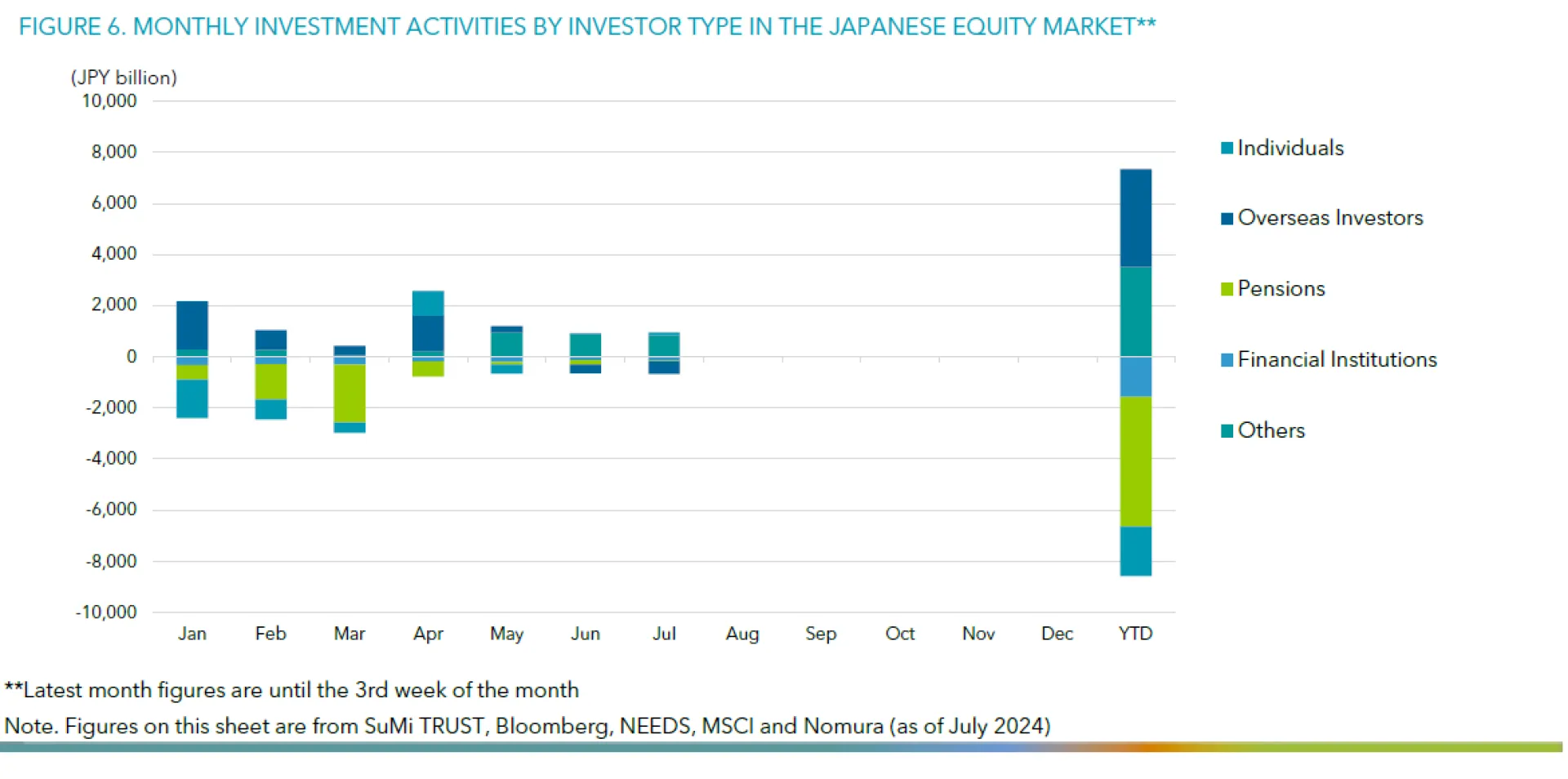

In July, the Japanese equity market saw significant fluctuations. At the start of the month the Nikkei 225 and TOPIX indices reached new historic highs riding the wave of the weak yen and strong US markets but ultimately ended the month in negative territory, dropping by 1.2% and 0.5% respectively. In terms of the TOPIX, downward movement was driven by a drop in the TOPIX 100 large cap index while small caps in the TOPIX Small remained flat and mid caps in the TOPIX Mid400 saw gains. Alongside a tumultuous political and economic environment in the US as the election hots up and US stock indices falling back from historic highs earlier in the month there have also been significant movements in the Japanese economic sphere. The 31st of July saw the Bank of Japan raise its policy rate from 0-0.1% to 0.25%. Following this, the yen surged to the 149 yen to the dollar level, a sharp increase from the 38 year low of 161.7 yen/dollar that was seen at the start of the month.

This marketing communication is issued by Sumitomo Mitsui Trust International Limited (“SMTI”). SMTI is authorised and regulated by the United Kingdom’s Financial Conduct Authority (the “FCA”), whose address is 12 Endeavour Square, London, E20 1JN, United Kingdom.

This marketing communication has been made available to you only because SMTI has classified you as a professional client in accordance with the FCA’s rules. If you have received this marketing communication from a source other than SMTI, you should contact SMTI before using it or relying on it. You must not send this marketing communication to any other person without first having received written approval from SMTI.

The information contained in this marketing communication (the “Material”) is being made available for information purposes only and is designed to provide information on the investment services which SMTI may offer to clients. Nothing in the Material amounts to or should be construed as an actual offer by SMTI to provide any investment services to any person. If SMTI agrees to provide any investment services to any person, those services will be the subject of a separate written agreement between SMTI and that person. Furthermore, the Material has not been prepared with any consideration of the individual circumstances of any person to whom it is communicated. Accordingly, it is not intended to, and does not, constitute a personnel recommendation in relation to the purchase or sale of, or exercise of any rights in relation to, any financial instruments or advice in relation to any investment policy or strategy to be followed. The Material also does not contain the results of any investment research carried out by SMTI and is not intended to amount to a financial promotion of any particular financial instrument which may be referred to in it.

While SMTI uses all reasonable endeavours to ensure the Material is accurate, it has not been prepared with a view to any person relying on it. Accordingly, SMTI accepts no responsibility for any loss caused to any recipient of this document as a result of any error, inaccuracy or incompleteness in the Material, nor for any error in the transmission or receipt of this communication.

Any enquiries regarding the products should be made to:

Hirofumi Hayashi

Head of Investment Management Department

Sumitomo Mitsui Trust International Limited

155 Bishopsgate, London EC2M 3XU, United Kingdom

Direct: +44 20 7562 8405

Email: imd@smtil.com

Sumitomo Mitsui Trust International Limited is authorised and regulated by the

Financial Conduct Authority

© Sumitomo Mitsui Trust International Limited 2025