1. CBDC today

Preparations for the issuance of a CBDC have begun in earnest. China, which is at the forefront, has started a public experiment of a "Digital Yuan" in which citizens have participated since October last year, and is gradually expanding its scale. According to officials, it is aiming for practical use by the Beijing Winter Olympics in February 2022. In Europe, Sweden's central bank, the Riksbank, has announced that it will proceed with a demo test of the "e-Krona" until February 2021, and the European Central Bank (ECB) will also decide on the start date for its "digital Euro" project by the middle of this year. In addition, CBDCs have been officially introduced in smaller emerging countries. The Bahamas announced the "Sand Dollar" and Cambodia issued the "Bakong". After a series of trials, they were launched nationwide in October last year.

In response to this situation, the Bank for International Settlements (BIS) became the coordinator, and a study group in which the central banks of seven major countries including the Bank of Japan and the Federal Reserve Board (FRB), published the report, "Central bank digital currencies: foundational principles and core features” in October last year. Although there is a disclaimer in the report which states that participating countries have yet to decide on issuing a CBDC, the discussion is in maturing stages and there has been mutual recognition that work needs to progress quickly given the speed of private sector innovation.

2. CBDC – background and why it is being considered

CBDC is generally defined as "digitised central bank money (bank notes and central bank current accounts) issued by the central bank in fiat currency form." There are two main types of CBDC’s: One is a "wholesale type CBDC" that is used for large-scale fund settlements for select users such as financial institutions, and the other is a “general use CBDC” for small-lot settlements without restriction on users which may include individuals and companies. Currently, the "general use CBDC", which digitises real and physical banknotes, is being urgently considered.

What changed the cautious position of major central banks were Facebook's impending launch of its private digital currency, Libra, announced in June 2019, and the Chinese government's development of a digital yuan.

In particular, Libra (now called Diem) was initially proposed as a universal currency linked to a basket of currencies, which would be used by about 2.7 billion Facebook users worldwide. Major central banks felt threatened that it could compromise the sustainability of their currency system, and give rise to misuse and money laundering. It was thought that the Chinese government would halt the expansion of private digital payment methods, which have become widespread in China, and aimed to expand the digital yuan overseas (As the US and China vie for global dominance, the digital yuan can potentially become a powerful means of payment that threatens the status of the US dollar.)

In fact, according to a BIS research report, major central bank officials who had been negative or skeptical on the CBDC concept until around 2018, had changed their views dramatically from the end of 2019.

3. The purpose of a CBDC

So what is the purpose of these leading central banks trying to issue a CBDC?

The first is the adaptation to the digital environment and to provide a digitised currency that complements physical cash in response to the permeation of e-commerce and the spread of digital payments. In fact, in Sweden, where a cashless society has evolved, it has become necessary to secure alternative payment methods for those who have difficulty obtaining cash.

The second is the development of an efficient payment infrastructure. In addition to reducing cash distribution costs, it is an attempt to popularise digital payments using smartphones by introducing CBDC in emerging countries where payment systems have not yet been developed. This is the main reason for countries such as Cambodia and the Bahamas to introduce CBDC ahead of the rest of the world.

Third is the promotion of financial inclusion. There are many people who do not have a bank account in emerging countries and those who cannot use digital technology even in developed countries. Providing these people with a safe and convenient means of payment at extremely low cost is also an important policy objective.

Fourth is the reinforcement of anti-money laundering and anti-crime measures. Because cash is completely anonymous, it can easily become a hotbed of fraud. The intention is that CBDC will be able to capture information on distribution and possession, and will have a deterrent effect. China cites it as one of the purposes of introducing CBDC, but compatibility with privacy protection is still an issue.

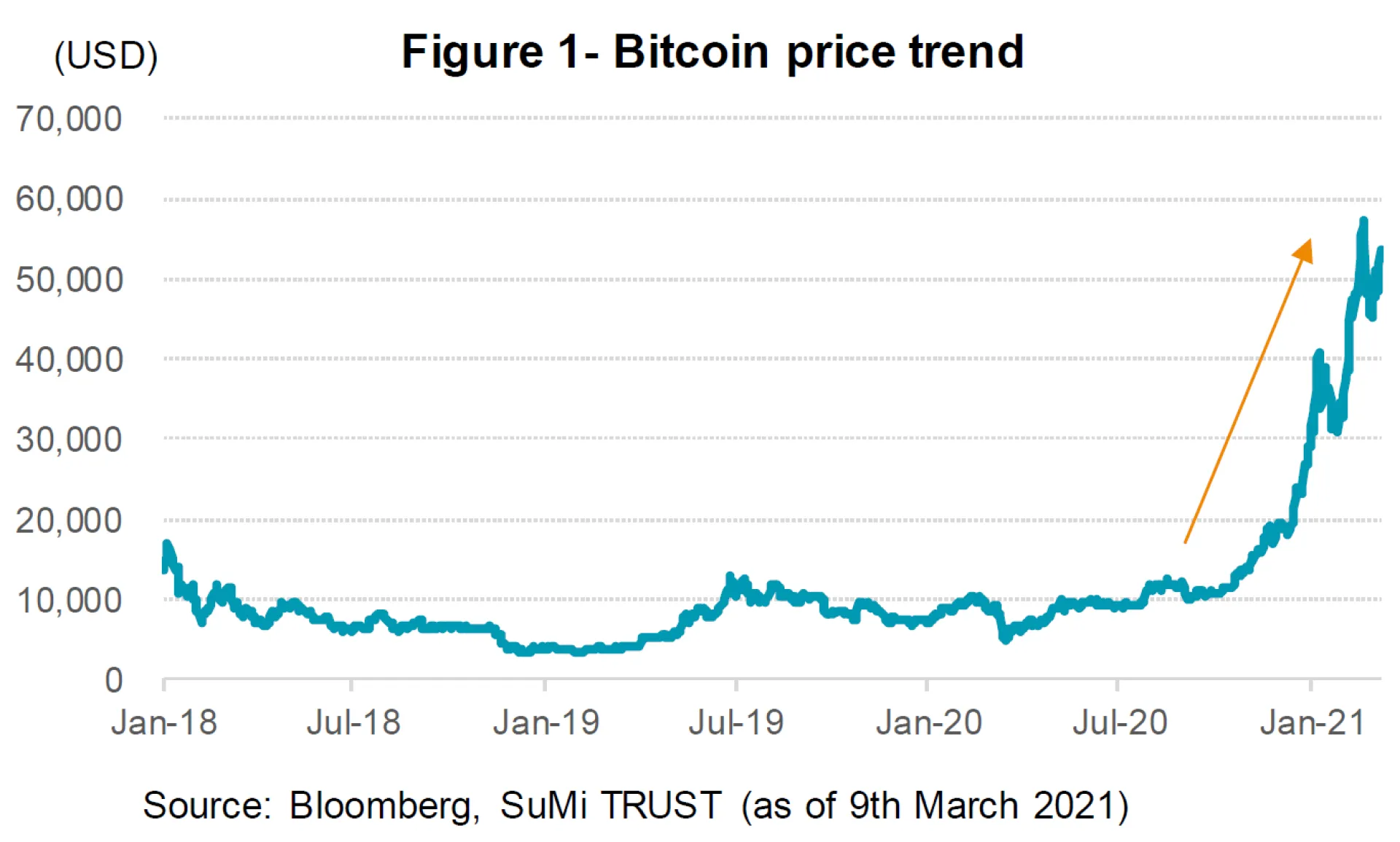

Fifth is to secure currency sovereignty. If private digital currencies such as "Libra", crypto currencies such as "Bitcoin", or CBDCs of other countries become widespread in the home country, the use of domestic currencies will decrease, and the central bank will lose currency control, and the effectiveness of its monetary policy may be compromised. Bitcoin, the largest cryptocurrency, once a rare means of financial transactions, is now being actively accepted by large investors, businesses, and even some local governments. Even this year, the inflow of funds has been quite notable, such that the price of "Bitcoin" has hit record highs. The momentum has not stopped as electric vehicle maker, Tesla, announced a huge investment in Bitcoin (Figure 1). The battle for currency sovereignty has already begun.

4. Issues surrounding the CBDC

On the other hand, the BIS report mentioned above also points out many issues related to CBDC.

The first is the erosion of the financial intermediary function. If the risk-free CBDC replaces not only cash but also bank deposits, there is the possibility that deposit and lending operations by banks will shrink and the credit creation mechanism will be impaired.

The second is the risk of "a run on digital currencies". Although a run on banks can still occur, the velocity will be much faster and the scale of any chain reaction would be much larger for the digitised CBDC.

Third is the impact on monetary policy and the financial system. While there is an opinion that interest rates on the CBDC can enhance the policy effect, there is also a view that a large-scale shift in funds will occur if interest rates are set incorrectly. Discussions are on-going.

Fourth, achieving both protection of personal information and prevention of fraudulent activities simultaneously. A balance between "safety" of privacy protection and "security" against counterfeiting and crime prevention is indispensable for the introduction of CBDC. The effective use of payment information cannot be ignored as well.

Fifth is the prevention of cyberattacks and the use of CBDC in the event of a disaster. It is necessary to consider offline functions in case the operating system stops due to a disaster, as well as countermeasures against cyberattacks.

To solve these issues, the BIS emphasises the importance of innovation through "public-private partnership" involving banks and businesses, in addition to information sharing and collaborative work among major central banks.

5. CBDC in Japan and issues

The Bank of Japan has also begun to accelerate its preparation for a CBDC. The BOJ established the FinTech Center in 2016 within its Payment and Settlement Systems Department to proceed with a basic examination of a CBDC from various aspects. In 2016, it launched a joint research project (Project Stella) on distribution ledger technology with the ECB, and in 2019 it released a summary of the debate by a study group of outside experts analysing a CBDC’s legal issues. In January last year, it participated in the group that was jointly established by the BIS and major central banks to assess CBDCs. The "Digital Currency Group" was launched in July of last year, and the "CBDC Initiative Policy" was announced in October. Although Japan sees no urgency to issue a CBDC, there are two reasons for Japan to start the full-scale preparation and examination of CBDCs.

The first reason is its role to connect among private payment services. In Japan, we are facing overabundance of payment services and it is not convenient for users due to lack of their mutual compatibility. The BOJ’s CBDC is expected to play the role of a bridge among the payment services so that practicality of the CBDC will increase.

Also, the government’s support can be expected for now as the Basic Policy 2020 (for Economic and Fiscal Management and Reform) gives the BOJ a big push to examine CBDCs. In this regard, the government and the ruling Liberal Democratic Party have called for the need for a CBDC to counter the “China threat”. Although their objective is different from that of the BOJ, it is still a positive factor for the Bank to start a full-scale examination.

On the other hand, there are several challenges for BOJ to tackle in issuing a CBDC.

Establishing an efficient and secure system is the most fundamental problem. As banknotes will surely continue to exist, developing and operating a CBDC will incur additional costs for the BOJ. These costs will need to be approved by the government and public support will become necessary in the implementation stage.

In addition, there are concern whether the need for a CBDC will truly grow in Japan. Although the COVID-19 pandemic has highlighted the necessity of a digital currency in Japan, it is unclear whether people will shift further to cashless payments. Even if cashless payments become more popular, people would not like to share their payment and settlement records even with the BOJ or public institutions as the Japanese are highly sensitive about their privacy.

Possible negative impact on the banking sector is another agenda to consider to issue CBDC. The digital currency will enable individuals to transfer money at almost zero cost which lead to reduction in the remittance fees charged by banks. As the issuance of a CBDC will take one of banks’ revenue sources away, mitigating measures such as the introduction of account maintenance fees may become necessary to convince the banking sector.

Japanese yen cash is clean and trustworthy, and there are only few cases of counterfeit currencies. The amount in distribution continues to rise, and technological development in pursuit of convenience is progressing. Most people in Japan have a bank account. Undoubtedly, Japan's cash distribution and payment systems are the most advanced in the world. On the other hand, however, e-commerce and digital transformation will continue to expand and accelerate in the future. As a result, it is not difficult to imagine that there will be a strong need for currencies and payment systems that are suitable for a digital economy and society. Japan must not be complacent and continue to innovate. It must not let the yen be left behind by the rest of the world and avoid falling into a Galápagos syndrome.