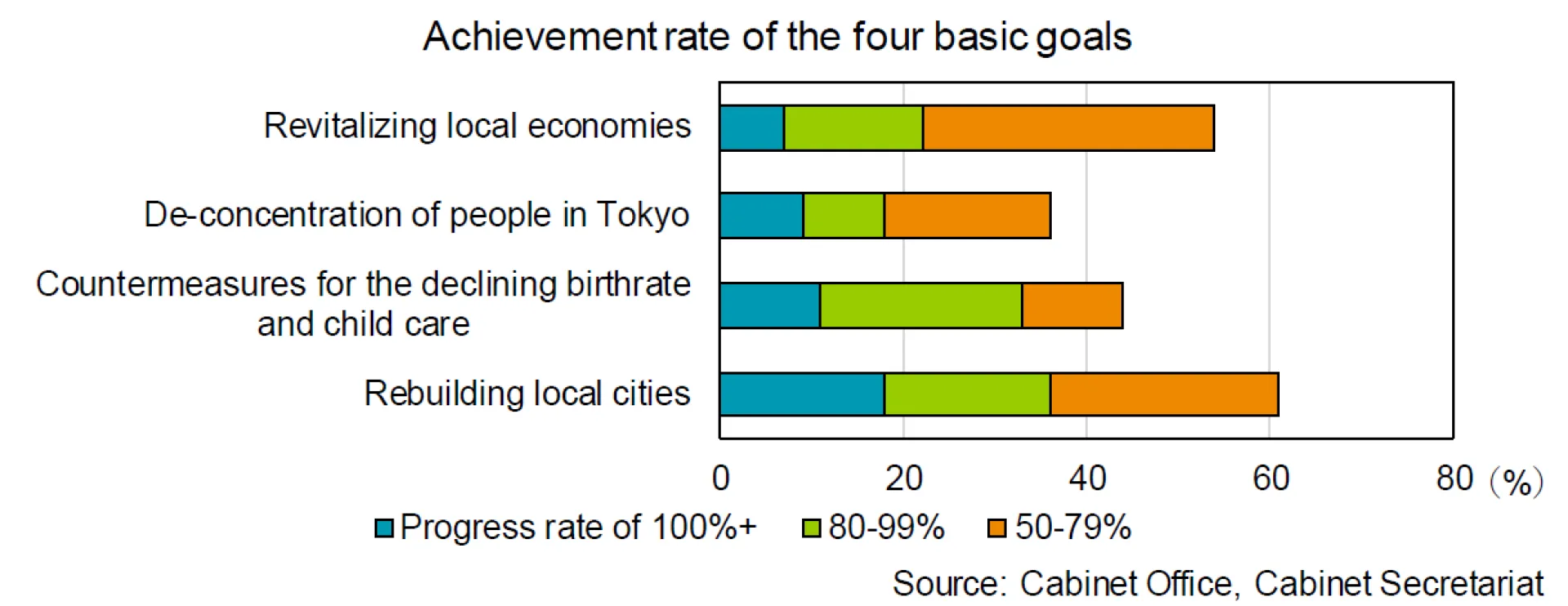

However, the rising concentration of people in Tokyo and the decline in the birth rate have not been stopped. Japanese migrants to the Tokyo metropolitan area (Tokyo, Kanagawa, Saitama, and Chiba prefectures) have been recording an excess inflow for 23 consecutive years to 2018. The excess inflow has expanded from 119,000 (in 2015) to 136,000 (in 2018). The “Total Fertility Rate”, which indicates the number of children a woman has in her lifetime, had bottomed out at 1.26 in 2005. However, after reaching 1.45 in 2015, it began to trend lower again, and in 2018 it receded to 1.42. Similarly, although there have been some successful cases of revitalizing the regional economy and rebuilding local cities, the situation has not been reversed.

This may be due in part to setting higher goals, but most municipalities should have tackled it as a top priority. In addition to the strong momentum of population decline, declining birthrate and aging population, there may have been problems in setting goals & issues in the first place. We would now like to look at ways to achieve "regional revitalization".

First of all, it is necessary to take the decline in population head on and minimize its negative effects; to transform the slogan of regional revitalization from, "regaining the vitality for regional growth and overcoming population decline", to "creating local townships with a feeling of affluence whilst assuming a population decline." In fact, according to an estimate by the National Institute of Population and Social Security Research, the annual population decline throughout the country will reach more than 880,000 up to the year 2040. Although it is a simple calculation, it is necessary to more than double the expected number of live births of 740,000 in 2040 to offset the population decline and maintain the population size. Also, for example, if the population shortfall is to be made up through an increase in foreign residents, it would be necessary to increase the net increase of 170,000 in 2018 by more than five times.

The number of foreign residents in 2040 would be about 18 million, more than six times the current level. None of these are realistic projections. Even if the pace of population decline, declining birthrate and aging can be eased, it is quite difficult to reverse or overcome the trend.

Secondly, it is necessary to make local cities “compact cities” and to promote “smart shrink” systematically. A “compact city" is a city that emphasizes mobility on foot and integrates the functions of houses, offices, and public facilities into a central area. Based on a law revision of 2014, municipalities will formulate a “location optimization plan” aimed for compact cities and establish areas which induce living and urban functions. As a result, this mechanism will suppress the “sponge phenomenon“ (perforation of urban areas), which causes declining population density and springs up vacant houses and buildings in unexpected places.

As of May 2019, 250 municipalities have prepared this plan and are working on it. Among the cities planned by FY 2016, 69.8% of the population in the residential induction area increased, and 63.0% of the facilities in the urban function induction area were maintained or increased. However, there has been only one case of recommendation for a development application outside the induction area. The development of suburban areas where land is cheap and easy to acquire, has continued, and “sprawling” has not been stopped.

In addition, compact cities may have had a negative impression due to the many failures in the construction of public buildings, such as redevelopment projects of train stations, and the difficulty to reach agreement on plans and relocation.

In this regard, the OECD’s “Compact City Policies” states that the benefits of compactification include: 1) contribution to economic growth, i.e. close proximity between work and housing, and improved business area density which should increase labor productivity and reduce the cost of maintaining and managing social capital, 2) contribution to community formation, i.e. the higher the population density, the greater the chance of citizen exchange and the promotion of culture and sports, and the synergistic effect of network and intellectual property accumulation, 3) the promotion of a green economy, i.e. reduced dependence on cars and shorter travel time will improve the environmental burden, and can be expected to turn vacant lands into green spaces. These are the forward-thinking ideas of "creating a city where you can feel the affluence.“

Success cases are also mounting, such as Toyama city's approach to using public transportation and relocation subsidies, and efforts at Marugame-machi shopping street (in Takamatsu city) centered on separating land ownership and tenant use rights. Emergency disaster prevention measures should be given top priority, and other issues need to be steadily promoted over time as long-term issues.

Thirdly, what is needed is the wide-area cooperation of local governments and digitization of administrative services. Compactification increases the sustainability of local finances by reducing the costs of services for inhabitants and the renewal of infrastructure. However, there is a limit to making each municipality more compact while maintaining the existing full equipment and infrastructure. Complementarity with neighboring municipalities and overall optimization at the prefectural level are essential. In addition, town management requires expertise, and there is the risk that qualified human resources cannot be secured. In that case, cooperation within a wider area may be an option.

With the development of information and communication technology, the digitization of local government administrative procedures and counter services is also important. In fact, according to the OECD, Japan has the lowest internet access rate of individuals to public institutions, including rural areas, out of 34 countries. As cities become more compact, municipal operations will need to aim for greater convenience through digitization and the use of the internet.

These issues, which are related to regional city reconstruction, are also included in the basic policy. However, the basic policy itself has been expanded every year, and the latest version has seen the number of pages and examples of specific cases increase by 30% since inception. In order to ensure that priority issues are not buried, it is necessary to narrow down basic policies and comprehensive strategies and to make them more compact.

Below, we list “regional revitalization” and “digitization of government administrative services” related stocks that we are following closely:

KATITAS (8919 JP)

KATITAS is a leading company in the refurbishment and resale of second-hand homes located mainly in the regions. The company excels in the procurement of properties based on its relationships with local communities. It also has

a unique renovation methodology which it has accumulated over the years. As vacant homes increase in regional cities due to the declining and aging population, and with local governments encouraging existing home distribution to revitalize the region, the company can expect growth in the medium term.

NTT DATA (9613 JP)

NTT DATA is part of the NTT Group and is the largest domestic IT service provider with an edge in IT solutions for government administrative services. The company is involved in digitization of government administrative procedures and the construction of an IT infrastructure for cashless payments platform. It has played a key role in promoting the digitization of social life. The Japanese government has announced the implementation of a new point awards redemption system using the My Number Card (the Japanese social security and tax ID number) this fall, and it is expected that government administrative services will be digitized as the use of the My Number Card is promoted. IT infrastructure building should contribute to the company's performance.