2. Fears of a Stronger Yen will be dispelled

There are fears that the yen will strengthen as the US lowers its interest rates and the rate differential between the

two currencies expands. However, we believe that any yen strength will be short-lived for the following reasons:

(i) USD-JPY has traded in a narrow range around the 110 mark for the past 2-3 years as speculators have left the

market, (ii) Short and long term rates in the US have been the highest among advanced nations. Even should the Fed lower the Fed funds by 0.5%, US rates will stay above Canada's policy rate of 1.75%, the second highest among advanced nations, (iii) JPY 60 trillion of high coupon (1% of more) JGB 10 year notes will be maturing over the next 3 years. This may exacerbate Japanese investor purchases of US fixed income securities, (iv) We expect the US economy to remain strong, (v) Receding geopolitical risks as seen in the June 30th US-N. Korea talks to resume denuclearization talks.

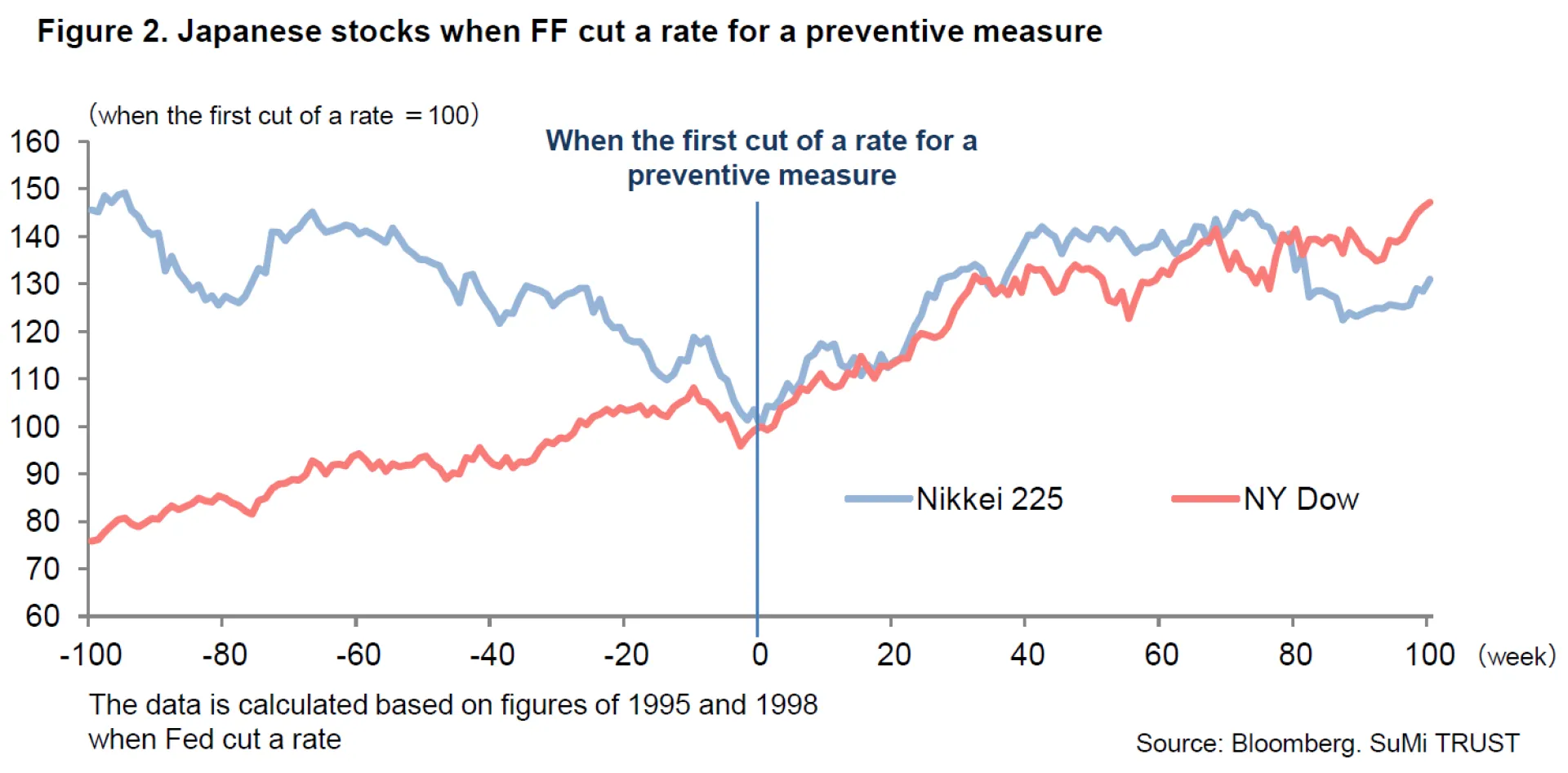

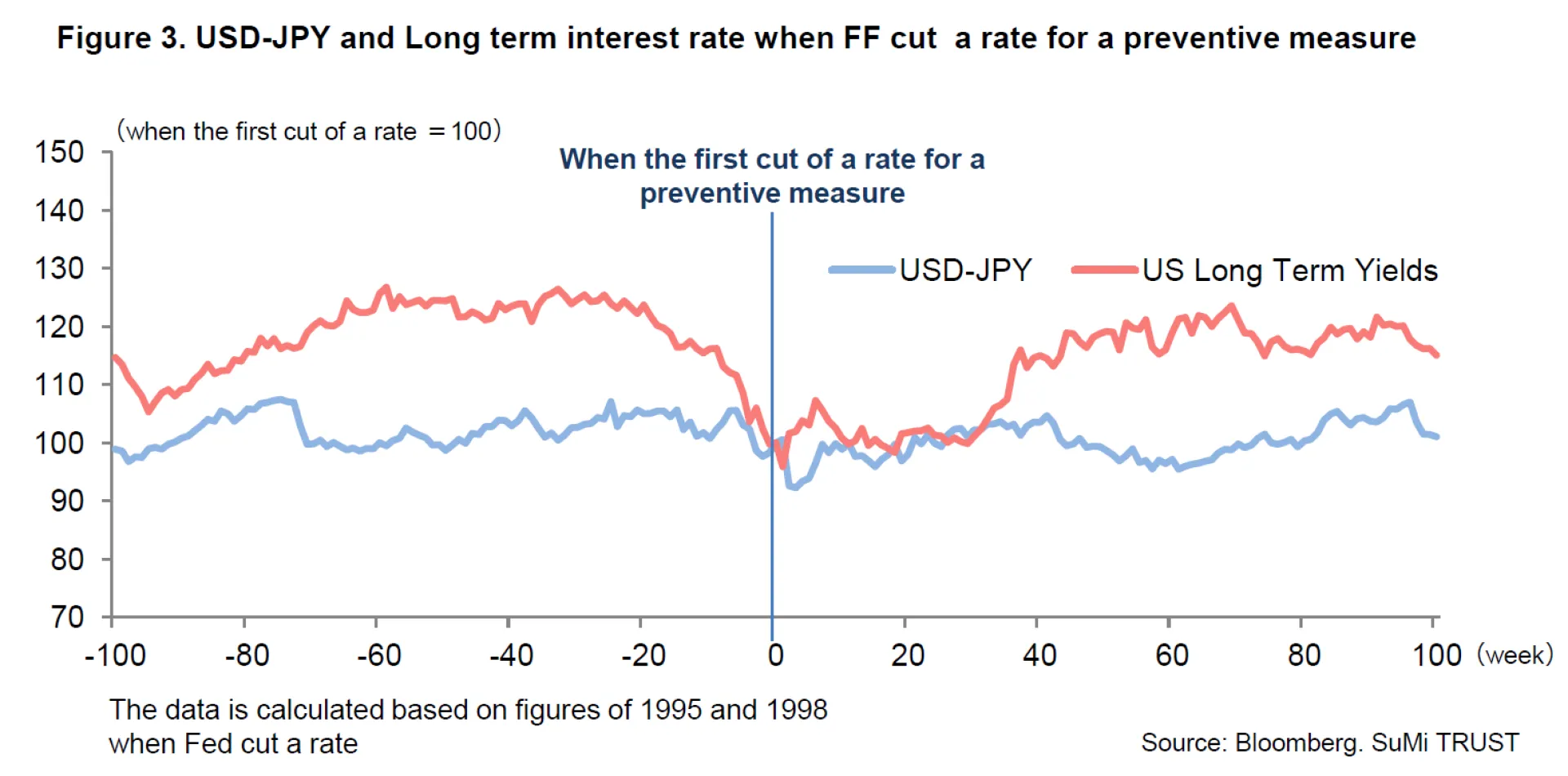

In reality, US (and Japanese) equities have rallied after previous preventive US rate cuts. US long term yields tend to be at their lowest before the first rate cut as the USD-JPY is left directionless. We believe that a preventive rate cut will limit the downside of long term rates and that global equities should rally as a result. Thus we believe that a sharp move upward in the yen against the dollar is highly unlikely.

3. Japan - a large-scale supplementary budget

Japan's export sector and production have been sluggish of late. Moreover, consumer sentiment has also been

experiencing a downturn. In the midst of this, the consumption tax will be raised in October. Prime Minister Abe has

expressed the need for measures such as a supplementary budget to offset a recession as result of higher taxes. We believe there is a strong possibility that there will be a large-scale supplementary budget announced in late-2019.

4. Japanese equities – attractive valuations and strong technicals

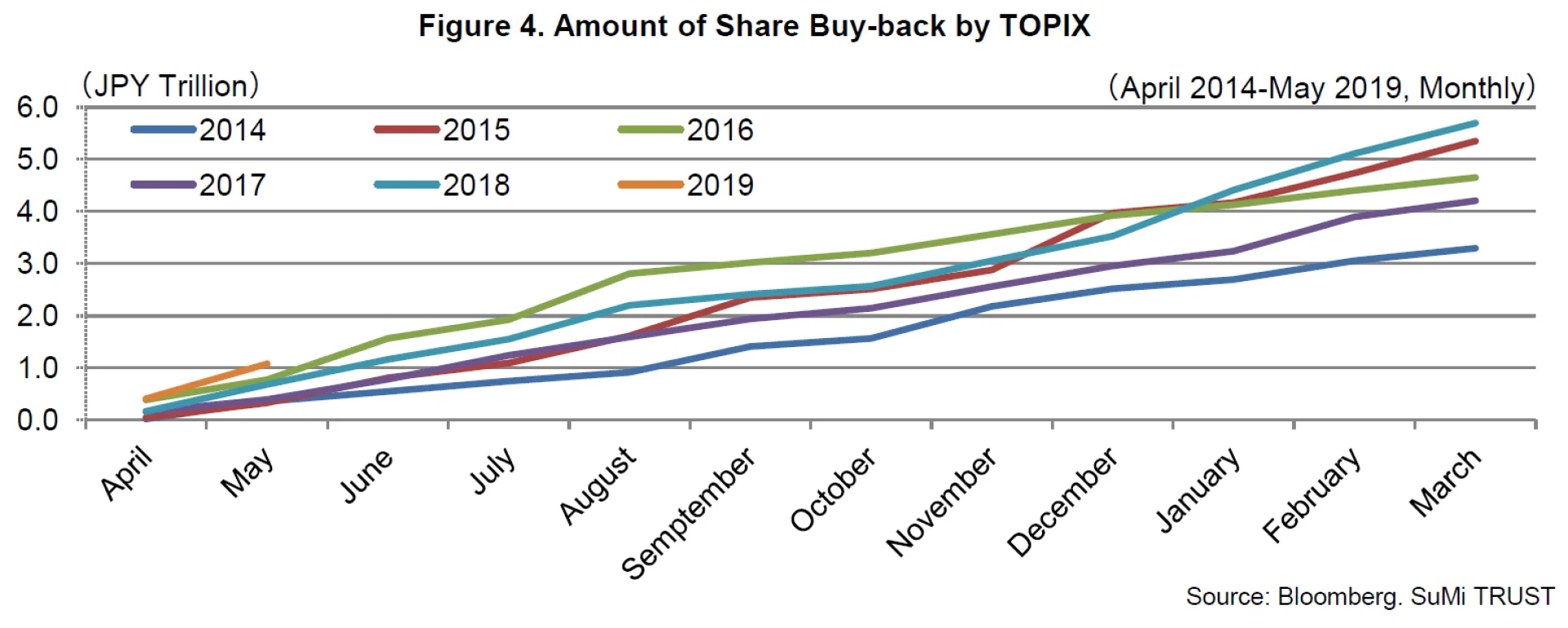

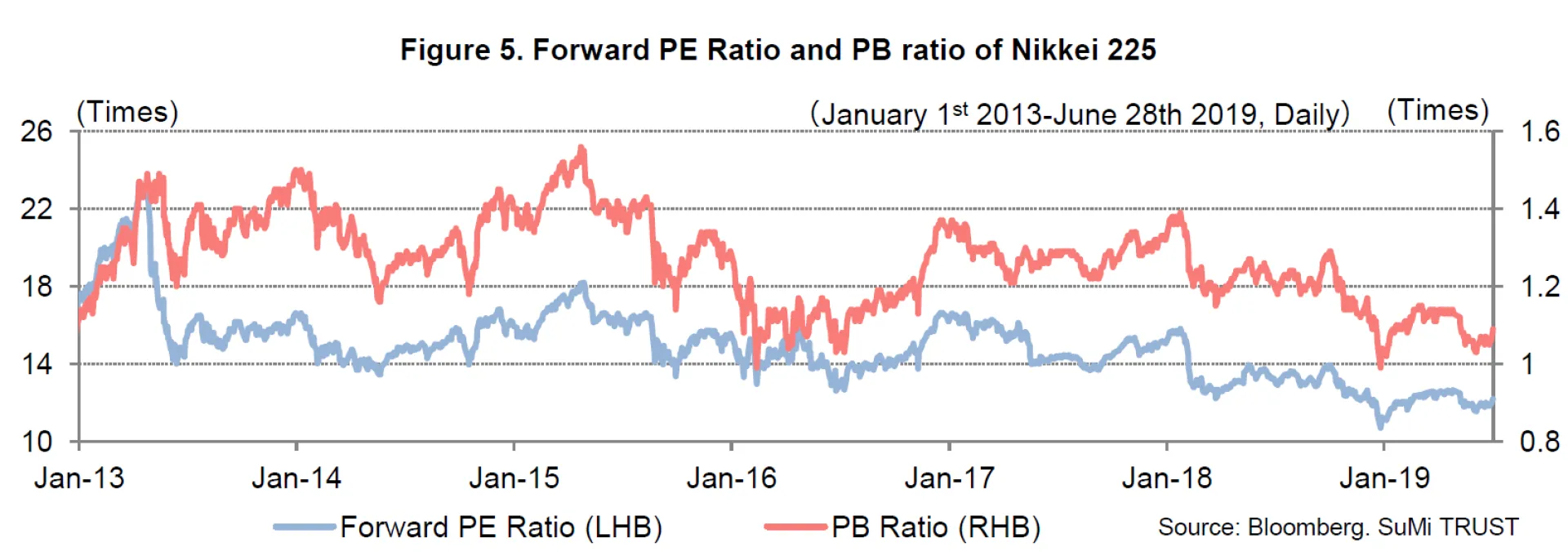

In the midst of governance reform, share buybacks by Japanese corporations have reached record levels. In addition, the Bank of Japan continues to purchase JPY 6 trillion of ETF's annually and may purchase more if needed. As such, the technical (supply-demand) environment for Japanese equities has been favorable. From a valuation standpoint,Japanese equities are very attractive with the forward PE trading at just 11.9 times and price-to-book at 1.06 times (as of 28th June).

Under the above scenario, we believe that USD-JPY will trade around the 110 level (a range of 105-112) and for the

Nikkei 225 to rise to 24,000 (a range of 20,500-24,500) in the second half of 2019. We like the cyclical sectors such as Electric Appliances, Semiconductors, Precision Instruments. Whilst these sectors were looked upon with caution during the Sino-US trade spat, we believe that they will be favored towards year end as valuations are attractive and the global economy, led by the US, recovers. Conversely, we would avoid Banks. As global central banks ease, Japanese banks (especially regional banks) will bear the brunt of a prolonged period of ultra low interest rates.