2. Current Status

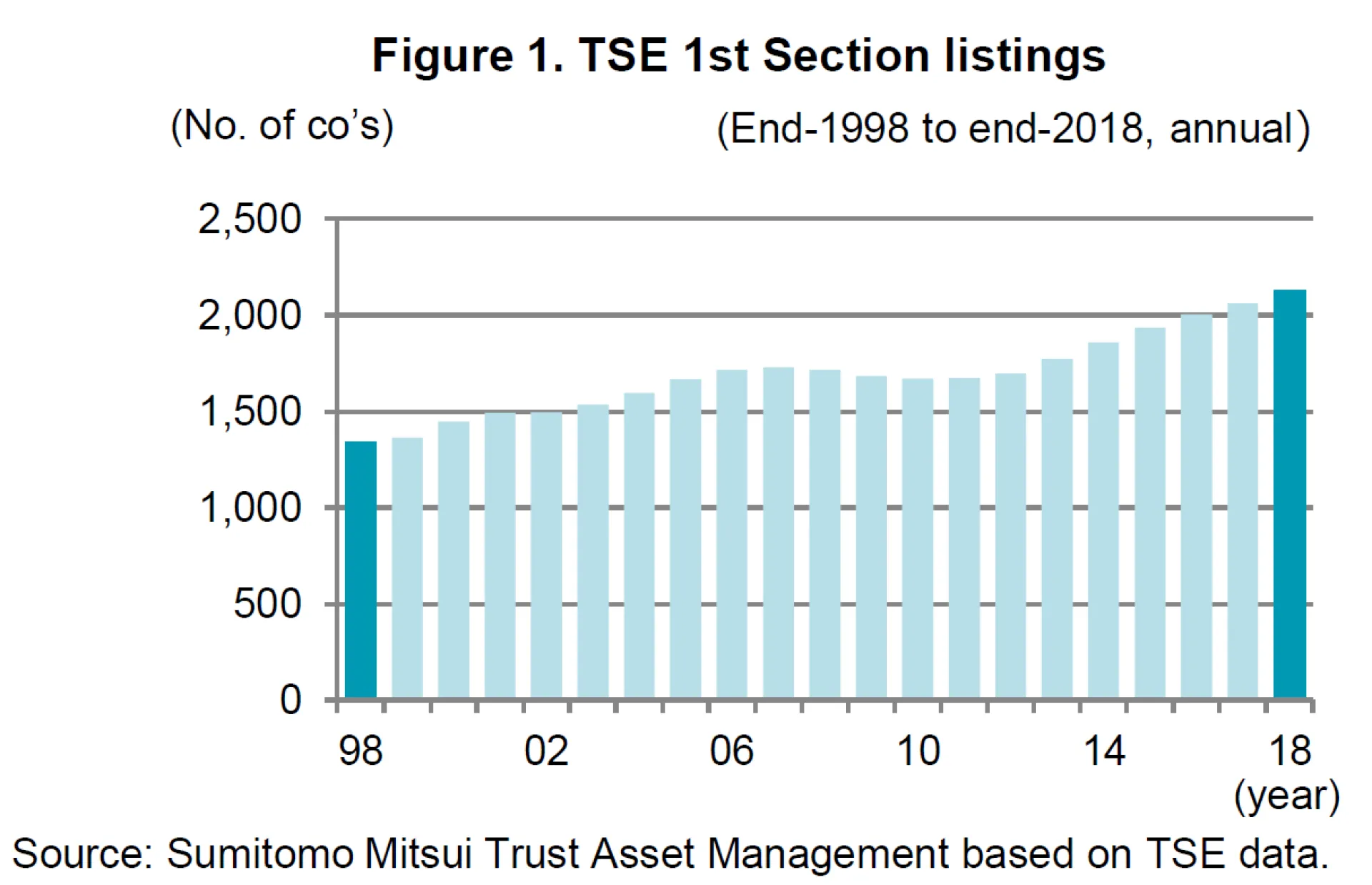

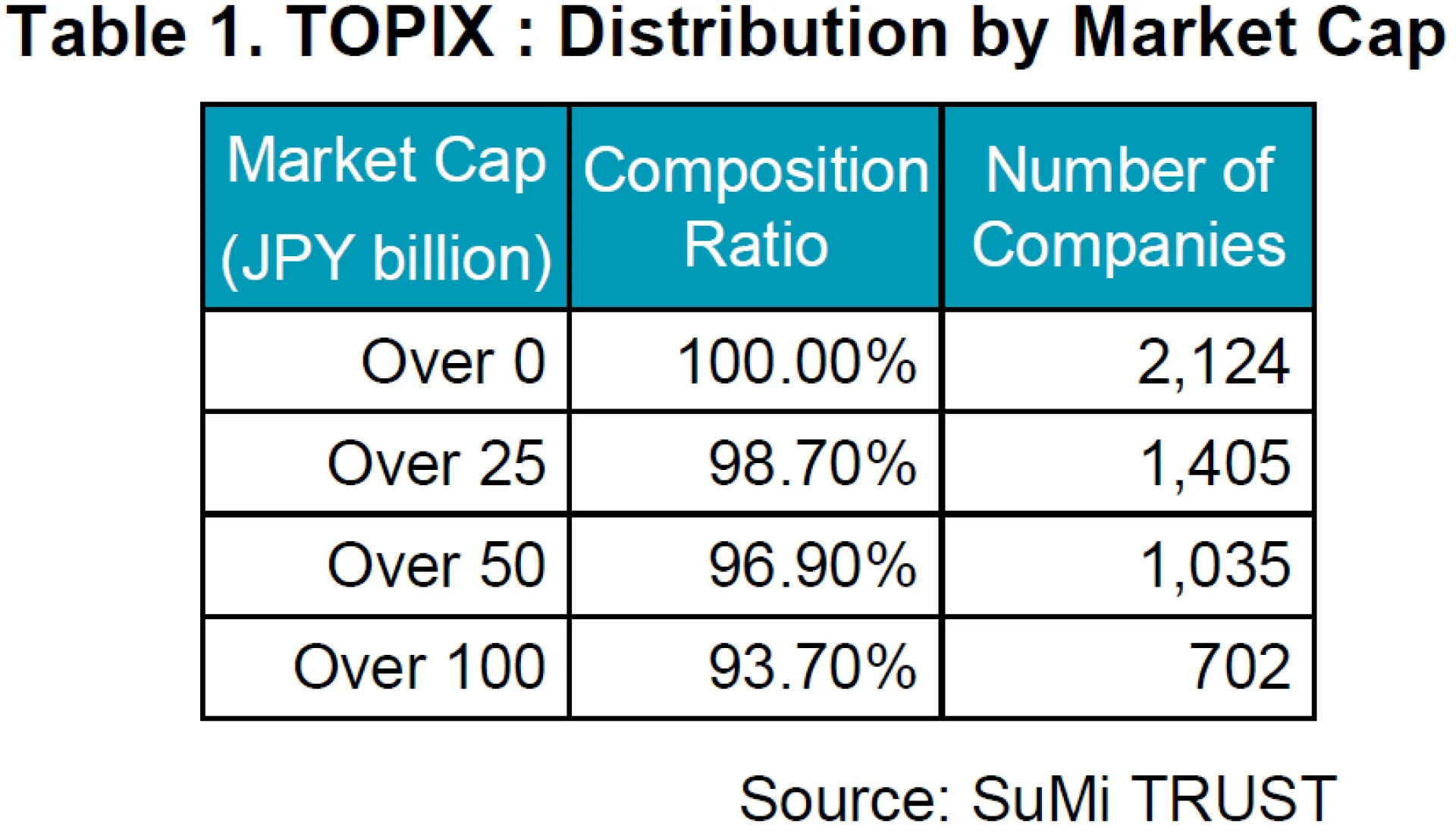

In late-2018, the media reported on discussions of raising the market capitalization hurdle from the current JPY2 billion to JPY50 billion - JPY100 billion ($18 million to $450 million - $900 million*). However, it appears that it has since been lowered to “JPY25 billion” ($230 million*), which is less strict. Should the hurdle be raised to JPY50 billion ($450 million*), 1,100 companies would be demoted from the 1st Section. And if it is relaxed to JPY25 billion ($230 million*), 720 companies would be purged. Currently, the matter is being discussed at the TSE. Thereafter, it will be deliberated at the Financial System Council, an advisory body to the Ministry of Finance.

3. Impact on the Stock Market

Most of domestic corporate pensions and public pensions invest in TOPIX (Tokyo Stock Price Index) index linked products whose constituents are TSE 1st Section listed stocks. In addition, some of the ETFs held by the Bank of Japan are TOPIX index funds. These products, which are estimated at around 60 trillion yen, will need to be rebalanced and sell stocks that have been demoted from the 1st Section, and make additional purchases of stocks which remain in the 1st Section. The amount sold would be about JPY 960 billion.

Demoted stocks should comprise of only a small percentage of the total TSE 1st Section market cap (1.3% of the total market cap when the threshold set at JPY 25 billion, See Table 1) thereby only minimally impacting the level of TOPIX. On the other hand, it would create a sell-off and impact small-medium cap stocks that are being purged as it triggers a sell-off in these stocks at as much as 10% of their market cap. Also, it is widely believed that the valuation of these index constituents is inflated to some extent supported by passive investments.

There has reportedly been discussion around having a 3 year grace period before the change, to mitigate the impact. However, once the new 1st Section standards are announced, we believe that index-based investors will rebalance their holdings ahead of the change even if there is a grace period.

We believe the impact would be largest in the first year after the announcement and will get smaller towards the end of the grace period. We anticipate that the review will push some borderline companies to conduct mergers and acquisitions in order to expand their market cap to meet the new market capitalization requirements for being a TOPIX constituent. Whilst we are unaware of the details at this stage, we believe that there is a good possibility that stocks with a market cap of under the JPY 25 billion threshold may be excluded from the TOPIX 1st Section. This could impact share prices of small caps albeit temporarily. However, we do not intend to change our focus ahead of the change. We invest in stocks which offer medium to long term growth potential and believe these shares offer upside potential regardless of such events.

4. Outlook for Japanese Market

We see the Nikkei 225 index heading towards 24,000 by year end as the effects of China’s public investments become apparent, and concerns over its economy subside. A considerable amount China’s budget has been apportioned to railroad construction and infrastructure spending. By the National Day of the People’s Republic of China (in October), we should see signs of full economic recovery.

Many forecast weaker growth in the US towards year end. But with 2020 being a Presidential election year, we believe there will be some economic stimulus measures which should calm fears of a recession. We like IT stocks including electronic parts manufacturers which stand to benefit from the spread of the next generation 5G communication standards.

Although it already surpassed the 22,000 level, we consider the back and forth still continues until May because the Chinese and Americans won’t come to terms easily. Overseas investors have not been buying Japanese equities and much of the flow is short-term money. Japanese companies are likely to announce a conservative guidance in May. Thus it is hard to imagine long-term funds coming into the market until companies announce upward revisions during the interim results season.

5. Stock of the month

Here, we introduce 5G related stocks in Japan that we focus on.

- Itochu Techno-Solutions Corporation (4739)

Itochu Techno-Solution Corporation is a major systems integrator and affiliate of the Itochu group.

Its main areas of focus are 5G, cloud service, systems application operation and managed security services. The company's strength lies in system and network build-out expertise by using information systems and software by global IT firms. It is expected to receive increased orders from telecoms companies for telecoms network build-up and the spread of 5G. In fact, it has already received 5G-related orders from a major telecoms carrier which proves the company's level of competitiveness in 5G investments. As 5G spreads, the company will introduce 5G technology to a wide variety of industries. This will underscore the importance of the company’s technological expertise, and we see mid-longer term business expansion from here.

- Comsys Holdings (1721)

A major telecoms construction company, Comsys Holdings' primary area of business is social systems business which includes cable and wireless network construction primarily for NTT facilities, NCC facilities and ICT Solution. Its main client is the NTT Group. Comsys’ expertise lies in telecoms facility and base station construction and is in a position to gain from 5G investments. We expect Comsys to receive orders from companies other than the NTT Group as 5G spreads and we see rising 5G-related telecoms construction and network orders. We also expect to see 4G-related construction orders in addition to orders from Rakuten, a new comer in the mobile business. In short, we see earnings rising for Comsys.